Is Prediction Market Gambling: Sports Betting or Financial Forecasting?

Is Prediction Market Gambling a form of sports betting, or does it function more like financial forecasting? As prediction markets expand beyond politics into sports, crypto, and macroeconomic events, this question has moved from a niche debate to mainstream scrutiny. In 2025, regulators, media, and financial institutions are paying closer attention as supporters argue these platforms aggregate information efficiently, while critics warn they blur the line between data-driven forecasting and gambling behavior.

In this article, we examine whether prediction markets should be classified as gambling, how regulators view their legal and regulatory status, and what risks participants should understand. As prediction markets increasingly intersect with crypto assets, many users track exposure using on-chain tools and self-custody wallets such as Bitget Wallet, which provide greater asset control and visibility without relying on centralized platforms.

Key Takeaways

-

Prediction markets sit between gambling and financial forecasting models.

They resemble betting on outcomes but rely on market pricing to express probabilities rather than fixed odds.

-

Regulators treat prediction markets differently from sportsbooks in many jurisdictions.

Oversight often comes from financial authorities, not gambling regulators, which affects how these markets operate.

-

Risks include insider trading, manipulation, and behavioral bias.

Information asymmetry and emotional trading can quickly turn forecasting into gambling-like behavior for retail users.

Is Prediction Market Gambling or a Legitimate Forecasting Tool?

Prediction markets allow participants to trade contracts tied to real-world outcomes, with prices reflecting collective expectations rather than bookmaker odds. This structure is why the question Is Prediction Market Gambling remains disputed, as these markets resemble financial forecasting systems more than traditional games of chance.

What are prediction markets and how do they work?

Prediction markets allow participants to trade contracts tied to real-world outcomes, such as election results, sports championships, or economic indicators. Each contract’s price reflects the market’s collective estimate of probability.

Unlike traditional betting, where odds are fixed by a bookmaker, prediction markets rely on continuous trading. Prices fluctuate based on new information, analysis, and sentiment. This is why supporters argue prediction markets function as forecasting tools rather than games of chance.

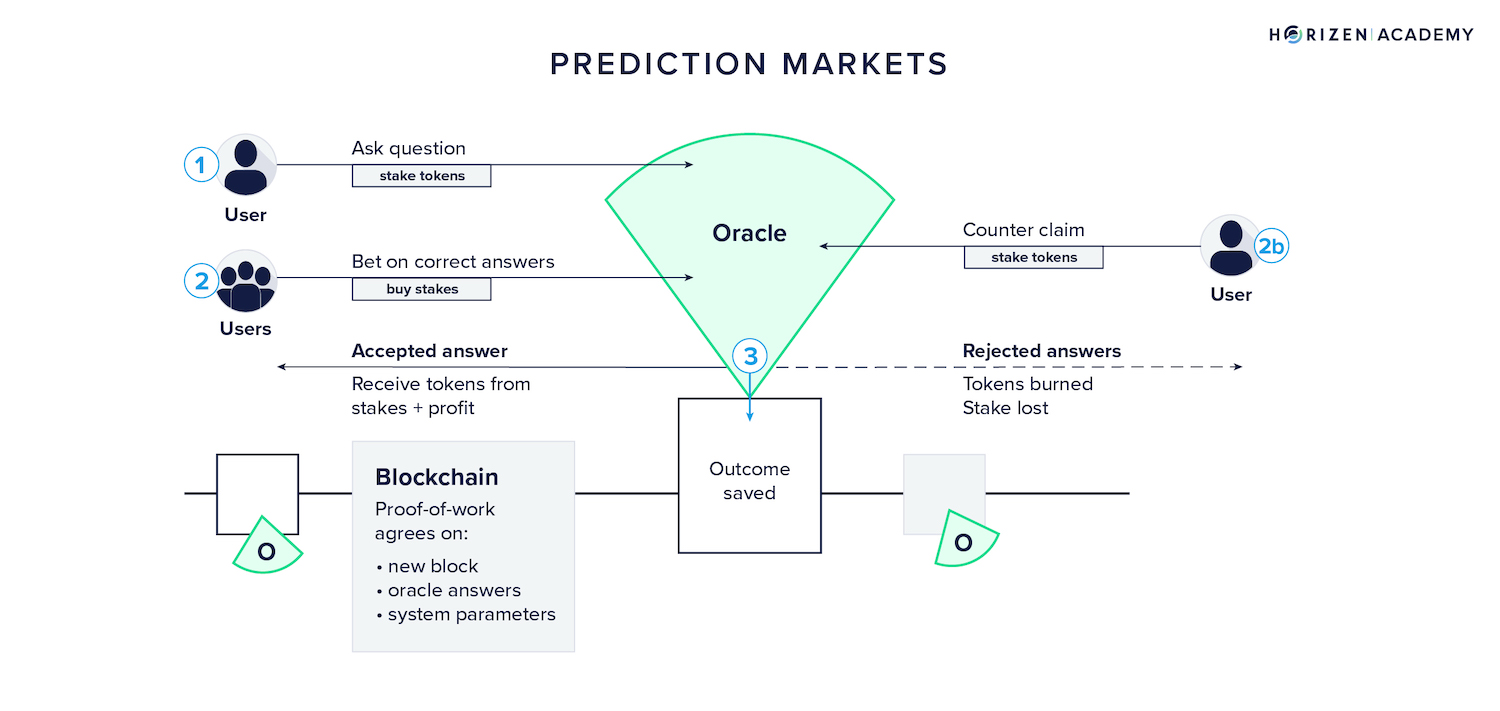

Source: Horizen

Are Prediction Markets Considered Gambling by Regulators?

Whether prediction markets are considered gambling depends largely on how regulators classify them under existing legal frameworks. In many jurisdictions, prediction markets are reviewed through financial or derivatives regulations rather than traditional gambling laws, which explains why their legal status often differs from sportsbooks and betting platforms.

Are prediction markets legal in the United States?

In the U.S., prediction markets fall under the oversight of the Commodity Futures Trading Commission rather than state gambling authorities. This distinction matters: legality does not automatically mean regulators view prediction markets as gambling.

The CFTC evaluates whether contracts serve a legitimate economic purpose and whether they pose risks to market integrity. As a result, some event contracts are permitted while others face restrictions.

How prediction markets regulation differs from gambling laws?

Traditional gambling laws are designed to manage consumer risk and regulate entertainment-based wagering. Prediction markets regulation, by contrast, focuses on market integrity and the economic impact of outcome-based trading.

Key regulatory differences include:

- Gambling laws: Emphasize player protection, odds disclosure, and responsible betting controls

- Prediction markets regulation: Prioritize transparency, manipulation prevention, and systemic risk oversight

- Enforcement scope: Financial regulators assess market structure, while gaming authorities oversee operator behavior

This regulatory divide explains why debates around are prediction markets legal remain unresolved in many regions.

Prediction Markets vs Gambling vs Sports Betting — What’s the Difference?

Understanding the difference between prediction markets and gambling requires comparing how prediction markets operate versus how sports betting is structured. While all involve financial risk tied to outcomes, prediction markets rely on market-driven pricing and trading activity, whereas gambling and sports betting are built around fixed odds and entertainment-focused wagering.

Prediction markets vs sports betting — key structural differences

Although both involve placing money on uncertain outcomes, prediction markets and sports betting are built on fundamentally different mechanisms and objectives.

- Pricing: Market-driven probabilities vs bookmaker-set odds

- Participation: Active trading vs passive wagering

- Purpose: Information discovery vs entertainment

- Regulation: Financial oversight vs gaming commissions

These differences explain why prediction markets vs sports betting is not a simple equivalence, even though both involve outcomes and money at risk.

Source: ESPN

Comparison Table: Prediction Markets vs Gambling vs Sports Betting

| Aspect | Prediction Markets | Gambling | Sports Betting |

| Purpose | Information discovery and forecasting based on collective expectations | Entertainment and chance-based wagering | Betting on sports outcomes for profit or entertainment |

| Pricing Mechanism | Market-driven prices that reflect probability and change through trading | Fixed payouts or odds set by the operator | Fixed odds set by bookmakers |

| Risk Exposure | High risk due to volatility, information asymmetry, and thin liquidity | Loss based on chance and house advantage | Loss based on odds, vigorish, and event uncertainty |

| Regulatory Framing | Often reviewed under financial or derivatives regulation | Regulated as gaming or gambling activity | Regulated under sports betting and gaming laws |

Why Are Prediction Markets Controversial?

Prediction markets are controversial because they raise ethical, political, and societal concerns beyond individual financial risk. Critics argue that trading on sensitive outcomes may encourage speculation on serious events, while supporters believe these markets provide valuable insight into collective expectations.

Why prediction markets are controversial in politics and sports?

Prediction markets tied to elections or sporting events raise concerns about manipulation, perception bias, and conflicts of interest. Because prices are often interpreted as probabilities, critics worry that market signals can influence public opinion rather than simply reflect it.

In sports, integrity risks are a major issue. When financial incentives are attached to outcomes, even the perception of insider knowledge or coordinated trading can undermine trust in fair competition, which is why regulators and leagues closely scrutinize these markets.

Are prediction markets ethical or socially harmful?

Some analysts question whether prediction markets normalize betting on tragedy, uncertainty, or sensitive public events. This concern becomes more pronounced when contracts involve disasters, conflicts, or public health outcomes that affect real lives.

These debates sit at the center of discussions around are prediction markets ethical, as critics argue that profit-driven speculation may cross moral boundaries. Supporters counter that ethical risk depends on market design and oversight rather than the forecasting mechanism itself.

What Are the Real Risks of Prediction Markets?

The risks of prediction markets go beyond simple financial loss and should not be treated casually. These markets can expose participants to manipulation, insider advantages, and behavioral biases, especially when liquidity is thin or regulatory oversight is limited, making risk management essential for retail users.

Prediction markets insider trading and manipulation risks

Because prices react directly to information, participants with early or privileged access can exploit thin liquidity. These prediction markets insider trading risks are especially pronounced in smaller or lightly regulated markets.

Common manipulation risks include:

- Trading ahead of public information releases

- Coordinated buying or selling to move prices artificially

- Exploiting low liquidity to exaggerate probability signals

Financial and behavioral risks for retail users

Retail participants often underestimate volatility and overestimate their ability to predict outcomes. As a result, normal forecasting activity can quickly resemble gambling behavior.

Typical behavioral pitfalls include:

- Loss chasing after incorrect predictions

- Confirmation bias that reinforces flawed assumptions

- Misunderstanding probability as certainty rather than estimation

Prediction Markets Social Impact — Do They Cross a Line?

Beyond individual financial risk, prediction markets can influence public perception, media narratives, and collective behavior. This broader prediction markets social impact is why critics argue these platforms should be evaluated not only as markets, but also for their societal and informational consequences.

Do prediction markets influence real-world behavior?

Market prices from prediction markets are often cited by media outlets as indicators of likely outcomes. When these probabilities are repeated and amplified, they can shape public narratives rather than merely reflect them.

Key social impact concerns include:

- Feedback loops where market prices influence opinion and behavior

- Media framing that treats probabilities as forecasts or facts

- Heightened sensitivity during elections or major sporting events

Should prediction markets be treated like financial instruments?

Supporters argue that treating prediction markets as financial instruments allows regulators to preserve their informational value while imposing transparency and manipulation controls. Under this view, structured oversight reduces harm without banning outcome-based trading.

Critics counter that some markets remain inherently speculative, regardless of regulation. They argue that when participation is driven by profit rather than analysis, prediction markets can resemble gambling even under financial oversight.

How Can Users Participate More Safely in Prediction Markets?

Participating safely in prediction markets depends more on risk management than on how these platforms are classified. Because prediction markets combine financial exposure with uncertainty and limited regulation, users must focus on capital discipline, information quality, and operational security.

What users should understand before trading prediction markets?

Before participating, users should recognize that prediction markets are high-risk environments where losses are common and advantages are unevenly distributed.

Key principles to keep in mind include:

- Only risk capital you can afford to lose without affecting financial stability

- Expect regulatory uncertainty, including sudden rule changes or market closures

- Understand that no strategy consistently outperforms the market over time

Why self-custody tools matter when tracking prediction markets?

On-chain prediction markets introduce wallet-level and transaction-level risks that do not exist in traditional betting platforms. Managing assets securely becomes a core part of participation rather than a secondary concern.

Practical safety considerations include:

- Using secure self-custody wallets to retain control of assets

- Monitoring transactions carefully to avoid approval or signing mistakes

- Separating trading funds from long-term holdings to limit exposure

How Bitget Wallet Helps Users Navigate High-Risk Markets?

For users engaging with high-risk markets such as prediction markets, operational security and asset control matter as much as market insight. Tools like Bitget Wallet are designed to help users manage on-chain exposure more safely by combining self-custody, cross-chain visibility, and simple portfolio monitoring in one interface.

How Bitget Wallet supports informed participation?

Rather than reducing risk at the market level, Bitget Wallet focuses on helping users manage how they participate by improving asset control and transaction awareness.

- Non-custodial asset control: Users retain full control of private keys, reducing counterparty and platform risk

- Cross-chain tracking: Monitor tokens and assets connected to prediction markets across multiple blockchains

- Secure stablecoin management: Use stable assets to manage volatility and isolate speculative exposure

- Beginner-friendly interface: Clear transaction flows and portfolio views help reduce operational mistakes

Manage assets securely and explore Web3 markets with Bitget Wallet — built for beginners and cross-chain users.

Conclusion

Whether the question “Is Prediction Market Gambling” applies ultimately depends on how these platforms are structured, regulated, and used. While prediction markets share surface similarities with sports betting, their mechanics and regulatory treatment often align more closely with financial forecasting.

For retail users, however, the risks are real. Regulatory uncertainty, manipulation potential, and behavioral bias mean prediction markets should be approached with caution. Using secure self-custody tools like Bitget Wallet can help users manage exposure responsibly and engage with these markets using discipline rather than speculation.

Manage your assets securely and explore Web3 markets with Bitget Wallet — built for beginners and designed for safe, cross-chain participation.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. Is Prediction Market Gambling by definition?

Not necessarily. Classification depends on market structure, intent, and regulation rather than the presence of monetary risk alone.

2. Are prediction markets legal in all countries?

No. Legal status varies by jurisdiction, with some regions treating them as financial instruments and others as gambling.

3. How are prediction markets different from sports betting?

Prediction markets use market-driven pricing and continuous trading, while sports betting relies on fixed odds set by bookmakers.

4. What are the biggest risks of prediction markets?

Key risks include manipulation, insider trading, volatility, and behavioral bias. In thin or lightly regulated markets, these factors can cause prediction markets to function more like gambling than forecasting.

5. Can Bitget Wallet be used to manage assets linked to prediction markets?

Yes. Bitget Wallet supports secure, non-custodial management of crypto assets connected to prediction market activity.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Polymarket Trading Strategies: How to Make Money on Polymarket?2026-02-27 | 5mins