How to Trade on Yes-No Market: A Practical Guide to Binary Prediction Trading

How to Trade on Yes-No Market starts with one simple idea: you are trading binary event contracts priced between $0 and $1, where the price reflects the market’s implied probability. A “Yes” contract pays $1 if the event happens and $0 if it doesn’t—making success a matter of correctly interpreting probability, timing, and risk.

These markets are gaining mainstream attention because they turn real-world events into tradeable prices, often reacting faster than polls or expert commentary. In this article, you’ll learn everything from how pricing works to how to manage risk using practical, beginner-friendly frameworks—along with how to use Bitget Wallet as a safer self-custody workflow when accessing third-party prediction market platforms.

Key Takeaways

- How to Trade on Yes-No Market: price = probability; Yes pays $1 if correct, $0 if wrong.

- Buying Yes vs selling No is often equivalent exposure—choose the view that fits your trading style.

- Yes-No market risk and payout are unforgiving: deadlines, liquidity, and resolution rules can wipe you out.

What is a Yes-No prediction market?

A Yes–No prediction market is a type of event-based market where participants trade contracts tied to a binary outcome—an event either happens or it doesn’t. Each contract is typically priced between $0 and $1, with the market price representing the implied probability of the event occurring.

Unlike open-ended assets such as tokens or stocks, Yes–No markets resolve to a clear, verifiable outcome once the event concludes, and contracts settle accordingly. However, despite this structured resolution, these markets can still resemble gambling behavior when factors such as thin liquidity, coordinated manipulation, or poorly defined resolution rules distort price signals and reduce their informational value.

Source: readon.substack.com

What makes Yes-No markets “event contracts” instead of open-ended asset bets?

Yes-No markets are called event contracts because they settle on a verifiable outcome by a fixed date, rather than trying to price something forever.

- Traditional markets (stocks): price tries to answer “What should this be worth?” and never fully resolves.

- Yes-No prediction market: price tries to answer “What will happen?” and resolves on a date with a yes/no settlement.

That “resolution” element is why Yes-No markets are fundamentally event contracts rather than open-ended valuation debates.

Why do people claim prediction markets aggregate information better than polls?

Supporters argue prediction market trading can compress dispersed information into one number faster than surveys. The logic is simple:

- Information is dispersed across many people (different knowledge, incentives, and signals).

- Prices aggregate beliefs into a single number (implied probability).

- Money at risk pushes participants to express what they truly believe—not what sounds good.

That’s the optimistic thesis behind prediction market trading as an information tool.

When are prediction markets not better than polls or experts?

Prediction markets can fail as forecasting tools when structure, incentives, or data quality breaks down. Use this risk framework:

- Thin participation → weak signal quality and noisy pricing

- Whales dominate → odds can reflect capital strength, not information accuracy

- Ambiguous definitions → disputes at settlement; “truth” becomes an oracle/legal argument

- Reflexive incentives → markets can encourage the outcome they’re betting on

This is why prediction markets vs gambling is a legitimate distinction: in well-designed, liquid markets with clear resolution rules, the price can be informative. In thin or poorly defined markets, the same mechanism can behave like a casino with a probability label.

How Do Yes-No Market Mechanics Work in Practice?

Yes-No market mechanics are built on two tradable sides—Yes and No—priced between $0 and $1. Prices move as traders buy opposing outcomes, and the equilibrium idea “Yes + No equals $1” helps explain why the market can translate trading flow into implied probability before contracts resolve to $1 or $0.

What is the simplest way to understand Yes-No market mechanics?

The simplest way is to separate Yes-No market mechanics into payoff (what you get at the end) and pricing (what the market thinks today). If you understand these two layers, you can trade without confusing “probability” with “certainty.”

Layer 1: Payoff (resolution is binary)

- If the event happens, the Yes side settles at $1 and No settles at $0.

- If the event doesn’t happen, the No side settles at $1 and Yes settles at $0.

Layer 2: Price as probability (before resolution)

- A $0.60 Yes price implies the market is pricing about a 60% chance of the event happening.

- That is not a forecast guarantee—it’s a tradable estimate that can change quickly.

This is the core of binary prediction trading: you’re trading probabilities, not guaranteed outcomes.

Source: financemagnates.com

Why does “Yes + No equals $1” matter for equilibrium?

“Yes + No equals $1” is a useful equilibrium shortcut that explains why the two sides move together. When traders push Yes higher, No generally falls—and vice versa—because they represent opposite claims about the same event.

| Side | If priced at… | Implied view |

| Yes | $0.65 | Market leans “happens” |

| No | $0.35 | Market leans “doesn’t happen” |

| Total | $1.00 | Equilibrium intuition |

The point isn’t perfection—it’s a mental model for how the market balances the two sides.

What can break the “clean” mechanics in real markets?

In real markets, the neat theory can break down because prices are not produced by perfect information—they’re produced by liquidity, incentives, and rule systems. The same Yes-No market mechanics can behave very differently depending on the venue and the specific contract.

- Liquidity: thin markets can have bad spreads and slippage

- Incentives: whales can distort probability signals

- Resolution: unclear definitions can create disputes at settlement

How are Yes-No contracts priced and how should you interpret probability?

Prices in a Yes-No market are a crowd-based probability signal. If a “Yes” contract trades at $0.60, the market is pricing roughly a 60% chance the event happens. Understanding how Yes-No contracts are priced helps you avoid emotional trades and manage exits before resolution.

How Yes-No contracts are priced between $0 and $1?

Yes-No contracts are typically priced from $0.00 to $1.00, where the price represents the market’s implied probability that the outcome will occur by a specific deadline. The closer the price is to $1, the more confident the market is; the closer to $0, the less confident it is.

Example:

- Buy “Yes” at $0.40 → if correct, it settles at $1.00

- Gross upside per contract = $1.00 − $0.40 = $0.60 (minus fees)

- If incorrect, it can settle at $0.00 → gross loss = $0.40 (plus fees)

This is the heart of how probability is priced in Yes-No markets: the price compresses uncertainty into a tradable number. You’re not buying “truth”—you’re buying exposure to an outcome at a given probability level.

Source: barrons.com

How does news flow move prices before the market closes?

In prediction market trading, prices move when traders collectively update beliefs—often faster than polls, analysts, or mainstream headlines. That’s why you’ll see sharp price jumps around rumors, leaks, official statements, and “confirmation” moments.

- Market opens: early prices reflect initial consensus

- New info arrives: prices adjust quickly (and sometimes overreact)

- Liquidity reacts: spreads widen if uncertainty spikes

- Close approaches: timing matters more; mistakes become costly

- Resolution: contract settles to $1 or $0

You can often buy or sell anytime before the market closes, which means managing exits is a core part of prediction market trading.

How do you buy, sell, and exit positions in binary prediction trading?

A beginner-friendly execution plan for binary prediction trading is: pick a market, interpret the price as probability, size your risk, enter a Yes/No position, and decide in advance whether you’ll hold to settlement or exit early. This structure helps reduce impulse trades and deadline mistakes.

What are the key steps to trade in Yes-No markets from start to finish?

Use this step-by-step execution checklist as your standard operating procedure (SOP). It’s built to keep prediction market trading simple, repeatable, and less emotional:

- Select a platform and market with clear rules and decent liquidity

- Read the resolution criteria (what counts as proof?)

- Interpret price as probability (don’t treat it as a guarantee)

- Choose your side: Yes if you think it happens; No if not

- Size your risk: assume you can lose the full premium

- Plan your exit: hold to settlement or sell early

- Track fees/spreads and avoid chasing sudden spikes

When should you hold to settlement vs sell early?

The main decision is whether you want to capture the full payout or trade changing probabilities. Here’s a practical comparison:

| Approach | When it fits | Trade-off |

| Hold to settlement | High conviction + clear resolution criteria + you can tolerate all-or-nothing payout | You can still lose 100% if timing is wrong; capital is tied up until resolution |

| Sell early | You want to lock gains, reduce downside, or the market’s probability moved in your favor before the deadline | May cap upside; spreads/fees can reduce returns; timing exits becomes a skill |

This is not financial advice—just execution hygiene for How to Trade on Yes-No Market safely.

Is buying Yes vs selling No the same trade in a Yes-No market?

In many Yes-No markets, buying a “Yes” contract and selling a “No” contract create the same directional exposure—both positions profit if the event happens and lose if it doesn’t. The difference is typically user preference or platform conventions, not the fundamental payoff direction.

What’s the clearest way to compare buying Yes vs selling No?

Here’s the simplest comparison of buying Yes vs selling No when you want exposure to “the event will happen”:

| Aspect | Buying “Yes” | Selling “No” |

| Market view | Event will happen | Event will happen |

| Exposure | Long the outcome | Short the opposite outcome |

| If correct | Settles to $1 (profit vs entry) | Equivalent payoff direction |

| If wrong | Can lose full premium | Can lose full premium |

| Market effect | Pushes Yes up | Pushes No down |

| Economic result | Equivalent exposure | Equivalent exposure |

From a market-mechanics perspective, buying Yes and selling No are economically equivalent trades—the difference lies in trader preference, not in expected outcome.

When might a trader prefer one side operationally?

The choice between buying Yes vs selling No often comes down to how you think and how you manage positions, not which side is “better.” Use these operational reasons:

- Some traders think in “probability I believe” → prefer buy Yes

- Others think in “I’m fading the opposite” → prefer sell No

- Position management and UI conventions can differ across platforms

Use this section to naturally include the long-tail phrase buying Yes vs selling No multiple times without stuffing.

How do you calculate profit in prediction markets with real examples?

Profit in Yes-No markets comes from the difference between your entry price and your exit price (or settlement), minus fees. If you hold to settlement and you’re right, the contract pays $1; if you’re wrong, it can expire at $0. This section shows how to calculate profit in prediction markets with clean math.

How to calculate profit in prediction markets if you hold to settlement?

If you hold to settlement, the contract resolves to $1.00 if correct or $0.00 if wrong. That makes the payoff binary and the math clean.

- Gross profit (correct) = $1.00 − entry price

- Gross loss (incorrect) = entry price (since it settles at $0)

- Net result = gross result − fees

Example: buy Yes at $0.40 → settles at $1.00 → gross $0.60 (minus fees).

Source: research.auditless.com

How to calculate profit in prediction markets if you exit early?

Exiting early means you close your position before resolution by selling at the current market price. This is common in short-term prediction market trading when probability shifts, volatility spikes, or you simply want to lock in gains.

- Entry: buy at $0.40

- Exit: sell at $0.70

- Gross profit: $0.30

- Net: $0.30 − fees

This is the core mechanic behind short-term prediction market trading.

What are the biggest risks in Yes-No market risk?

Yes-No market risk and payout are harsh because contracts can expire worthless, deadlines are rigid, liquidity can be thin, and resolution rules can surprise traders. On top of that, insider trading risk can appear when a concentrated group knows the outcome before the public does—so odds may move ahead of confirmation. Even being “directionally right” can still end in a 100% loss if timing or settlement rules don’t go your way.

| Risks | Matters |

| Timing / Deadline Risk | You can be “right later” but still settle at $0 if the event happens after the cutoff. |

| All-or-Nothing Downside | Wrong side can expire worthless; maximum loss is often close to your entry price (plus fees). |

| Liquidity & Slippage Risk | Thin markets can have wide spreads; entering/exiting can move price against you and reduce returns. |

| Resolution / Oracle Risk | Settlement depends on exact wording and accepted sources; “obvious” outcomes can still be disputed. |

| Manipulation / Reflexivity Risk | Whales can distort odds; some markets can incentivize people to influence the outcome. |

| Insider Trading Risk | When insiders know outcomes early (e.g., corporate decisions), odds can shift before public confirmation. |

To manage Yes-No market risk, traders should keep execution discipline basic and repeatable:

- Trade markets with clear definitions, credible evidence sources, and realistic deadlines.

- Check liquidity/spreads before entering and plan exits in advance.

- Size positions assuming total loss is possible.

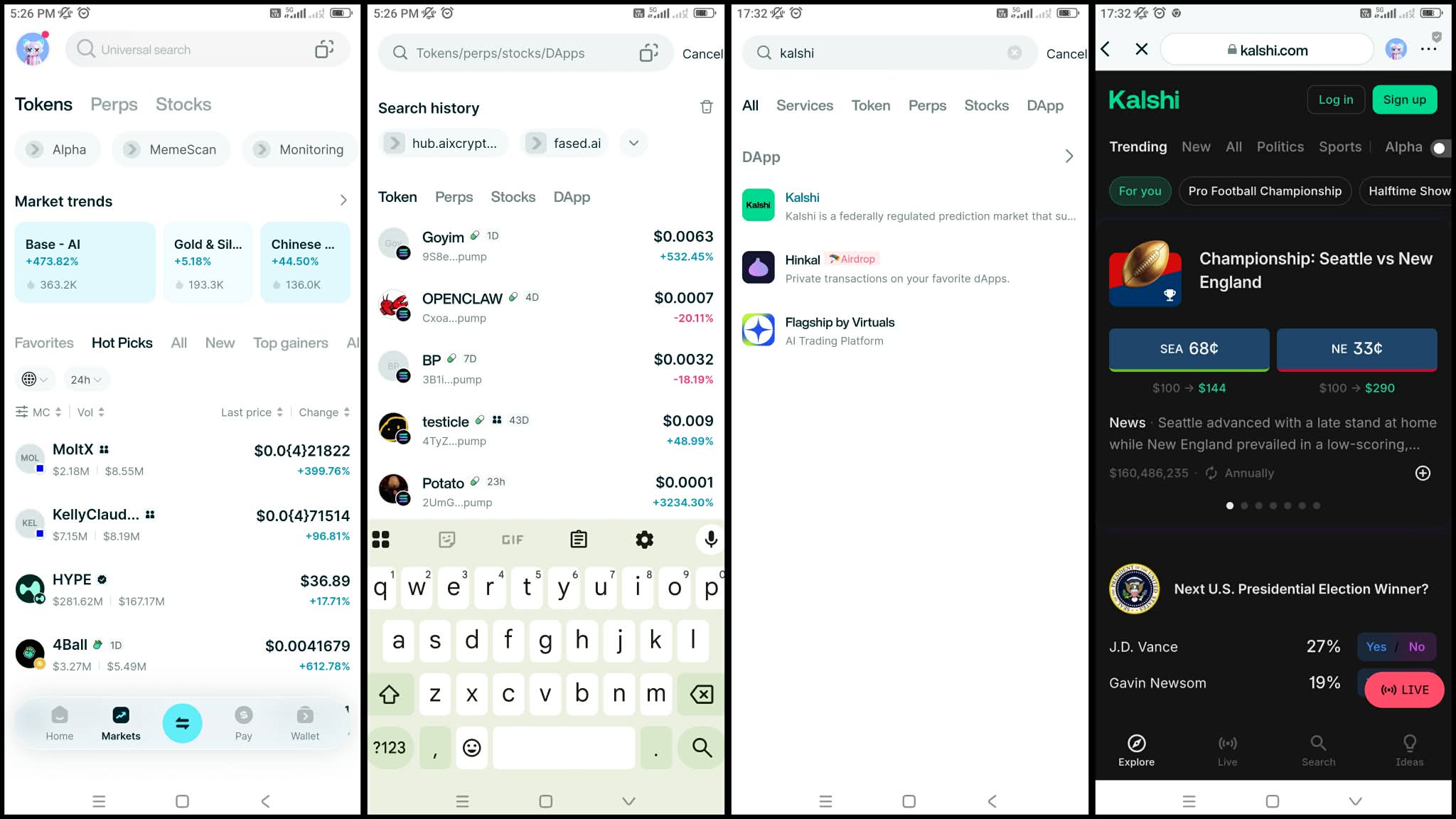

How to Trade on Yes-No Market With Bitget Wallet?

Bitget Wallet does not operate a Yes-No prediction market or create Yes–No contracts. Instead, Bitget Wallet is a non-custodial Web3 wallet with an in-app browser, allowing users to access third-party prediction markets while retaining full control of their assets.

This setup supports safer participation in Yes-No markets, where strict deadlines and binary payouts make execution discipline critical. By separating asset custody from trade execution, traders can better manage risk during volatile periods.

To support a more disciplined workflow, Bitget Wallet provides complementary features that fit naturally into Yes-No market participation:

- Stablecoin Earn Plus (up to 10% APY): allows traders to park idle capital between trades instead of leaving funds unused on external platforms.

- Zero-fee trading on memecoins and RWA U.S. stock tokens: useful for users who actively rotate between speculative strategies and want flexibility without extra cost friction.

- Crypto card (Mastercard & Visa): enables global spending directly from crypto balances, supporting liquidity management outside trading sessions.

Use Bitget Wallet to manage stablecoins, monitor positions, and keep execution disciplined across chains while learning how to trade on Yes-No markets.

Related Reading on Prediction Market:

If you want to explore prediction market further, you may find the following articles helpful:

- What Is a Yes No Market: How Investors Trade Probabilities Using Yes-or-No Contracts

- How to Trade on Yes-No Market: A Practical Guide to Binary Prediction Trading

- Yes-No Market vs Polls: What Investors Should Know About Signal Quality and Bias

- What Is a Prediction Market?

- How Do Sports Prediction Markets Work?

- What You Need to Know About Prediction Markets Before You Bet

Conclusion

How to Trade on Yes-No Market ultimately comes down to disciplined probability trading. Traders need to understand $0–$1 pricing as a reflection of market-implied probability, respect strict settlement deadlines, and recognize that contracts always resolve to $1 or $0—with no partial credit for being “almost right.” Grasping core mechanics, especially the intuition that Yes + No equals $1, helps avoid emotional decisions and unrealistic expectations.

If you want a more controlled workflow, Bitget Wallet provides a practical foundation for participating in Yes-No markets with better risk discipline. By keeping assets under self-custody, managing stablecoins efficiently, and accessing prediction platforms through an integrated Web3 browser, traders can stay flexible across chains while reducing overexposure to any single venue.

Download Bitget Wallet now to participate in Yes-No Market trading with greater execution discipline!

FAQs

1. How to Trade on Yes-No Market?

Start by choosing a clear market, interpret price as probability, size risk assuming total loss, and plan whether to exit early or hold to settlement.

2. Is buying Yes vs selling No actually the same trade?

Often, yes. Buying Yes and selling No typically create the same directional exposure; the difference is preference and platform convention, not the payoff direction.

3. How to calculate profit in prediction markets after fees?

Profit equals your exit price (or $1 at settlement) minus entry price, minus fees. If the contract settles at $0, you generally lose the entry premium plus fees.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.