How to Buy CLAWD in 2026: A Beginner’s Step-by-Step Guide to clawdbot

How to buy CLAWD in 2026 is a common question among users exploring fast-moving, community-driven tokens on the Solana network. CLAWD (often referred to as clawdbot) has attracted attention due to sharp price movements, on-chain liquidity activity, and rapid rotations typical of meme-style assets.

Unlike traditional utility tokens, buying CLAWD requires understanding on-chain execution, wallet custody, and liquidity conditions. In this article, we’ll walk through how to buy CLAWD step by step, where it trades, what risks to watch for, and how to approach it safely using Bitget Wallet.

Unlock cross-chain DeFi and stablecoin savings easily in Bitget Wallet.

Key Takeaways

- CLAWD is a Solana-based, high-risk narrative token, where price action is driven by liquidity flow and market sentiment rather than long-term fundamentals

- Buying CLAWD safely is primarily about execution quality and contract verification, not predicting short-term price movements

- Non-custodial wallets such as Bitget Wallet give users full control over swaps, approvals, and assets—reducing reliance on custodial platforms when trading CLAWD

What Is clawdbot (CLAWD)?

clawdbot (CLAWD) is a community-driven token launched on the Solana blockchain and traded mainly through on-chain liquidity pools. It does not present itself as a traditional utility or governance token; instead, its activity is shaped by narrative momentum, trader attention, and liquidity flows.

As with many meme-style assets, CLAWD’s market behavior is defined less by fundamentals and more by sentiment, rotation speed, and on-chain participation, making it important for users to understand the mechanics before engaging.

What makes clawdbot (CLAWD) different from utility tokens?

- Narrative vs. utility: CLAWD is primarily a narrative-driven token, not a protocol utility or governance asset.

- Price drivers: Short-term sentiment, liquidity depth, and trading activity are the main drivers—rather than revenue or adoption metrics.

- Where it trades: CLAWD trades on Solana DEX liquidity, accessible through wallet-based swaps.

Source: Bitget Wallet

Is clawdbot (CLAWD) a scam or just high-risk?

CLAWD is not automatically a scam, but it should be approached as a high-risk, speculative on-chain asset. Its risk profile is shaped by limited disclosures, fast-moving liquidity, and the absence of traditional fundamentals.

Risk exposure increases when:

- Transparency around the project and token mechanics is limited

- Liquidity is thin, unstable, or rotates rapidly

- Copycat or impersonation tokens emerge during periods of heightened attention

What users should always do before trading CLAWD:

- Verify the official CLAWD contract address on trusted explorers

- Avoid unofficial links, DMs, or look-alike social accounts

- Monitor on-chain liquidity depth and holder concentration to assess execution risk

Recent on-chain data shows genuine trading activity, but high volatility combined with limited public information means outcomes depend heavily on user verification, timing discipline, and execution quality rather than the token itself.

Where to Buy CLAWD?

When users ask “where to buy CLAWD,” they usually mean the best balance of safety, convenience, and execution quality. The real decision is the custody model: custodial platforms hold assets for you, while on-chain swaps let you trade directly from your own wallet.

CLAWD is primarily accessed on-chain, and availability depends on current liquidity and routing support, not guaranteed listings. This makes wallet-based swaps the most consistent method.

Comparison of CLAWD Buying Methods

| Buying Method | Custody Model | Execution | Control | Recommended For | Main Risks |

| On-chain Swap (DEX via Wallet) | Non-custodial | User-controlled, on-chain | High | Self-custody users | Contract impersonation, slippage |

| On-chain UEX (via exchange) | Custodial | Platform-managed | Medium | On-chain exposure without wallets | Withdrawal limits |

| Centralized Exchange (CEX) | Custodial | Platform-managed | Low | Beginners, fiat users | Custodial & regulatory risk |

Why Many Users Buy CLAWD With Bitget Wallet?

If CLAWD liquidity is mainly on-chain, a non-custodial wallet allows users to swap while retaining full control. Bitget Wallet also helps reduce common beginner mistakes, such as interacting with fake or incorrectly routed tokens.

What Bitget Wallet Helps With?

✅ Self-custody and asset control

Users retain full ownership of private keys and funds, reducing exposure to custodial and platform-related risks.

✅ On-chain swaps with transparent execution

Explore over 1M tokens with real-time in-app rankings—discover trending assets early and stay ahead of the market.

✅ Multi-chain access with cost-efficient execution

Bitget Wallet supports 130+ blockchains, including 7 major networks such as Solana, Base, Arbitrum, Polygon, Tron, and more. This allows users to buy, hold, and manage CLAWD across different ecosystems without being locked into a single chain environment.

On supported networks, users can also benefit from gas-free transactions or long-term gas discounts, helping reduce execution costs when swapping, transferring, or managing assets across chains—an advantage for users who trade frequently or operate across multiple ecosystems.

✅ Flexible post-purchase asset management

After buying CLAWD, users can hold, transfer, or manage assets freely across supported chains without withdrawal limits or third-party restrictions, making it easier to adapt to changing liquidity or market conditions.

How to Buy clawdbot (CLAWD) on Bitget Wallet?

Trading clawdbot (CLAWD) is easy on Bitget Wallet. Follow these simple steps to get started:

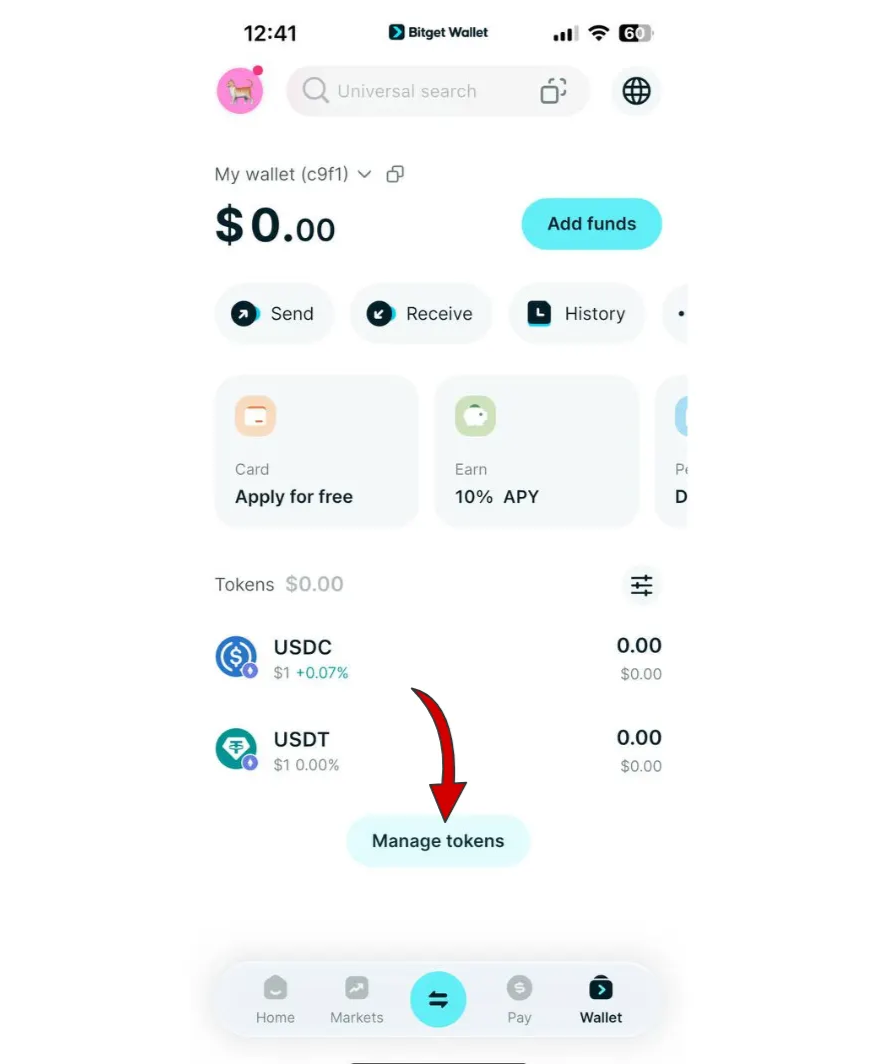

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading clawdbot (CLAWD).

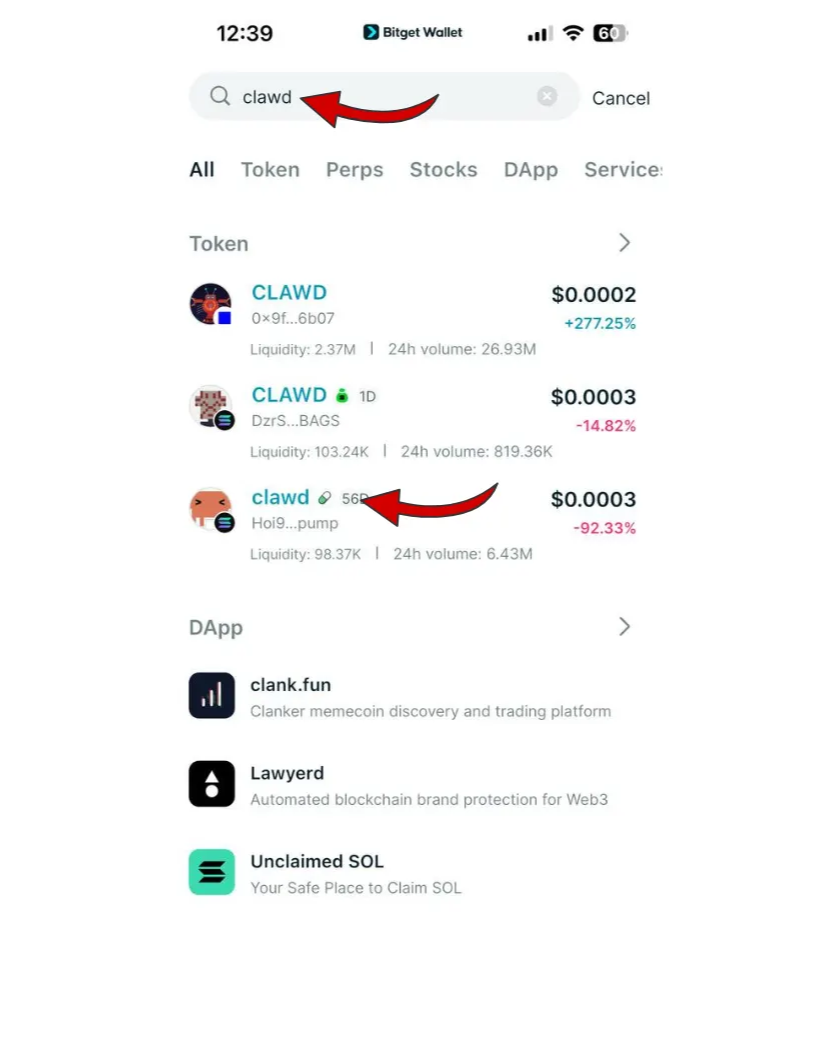

Step 3: Find clawdbot (CLAWD)

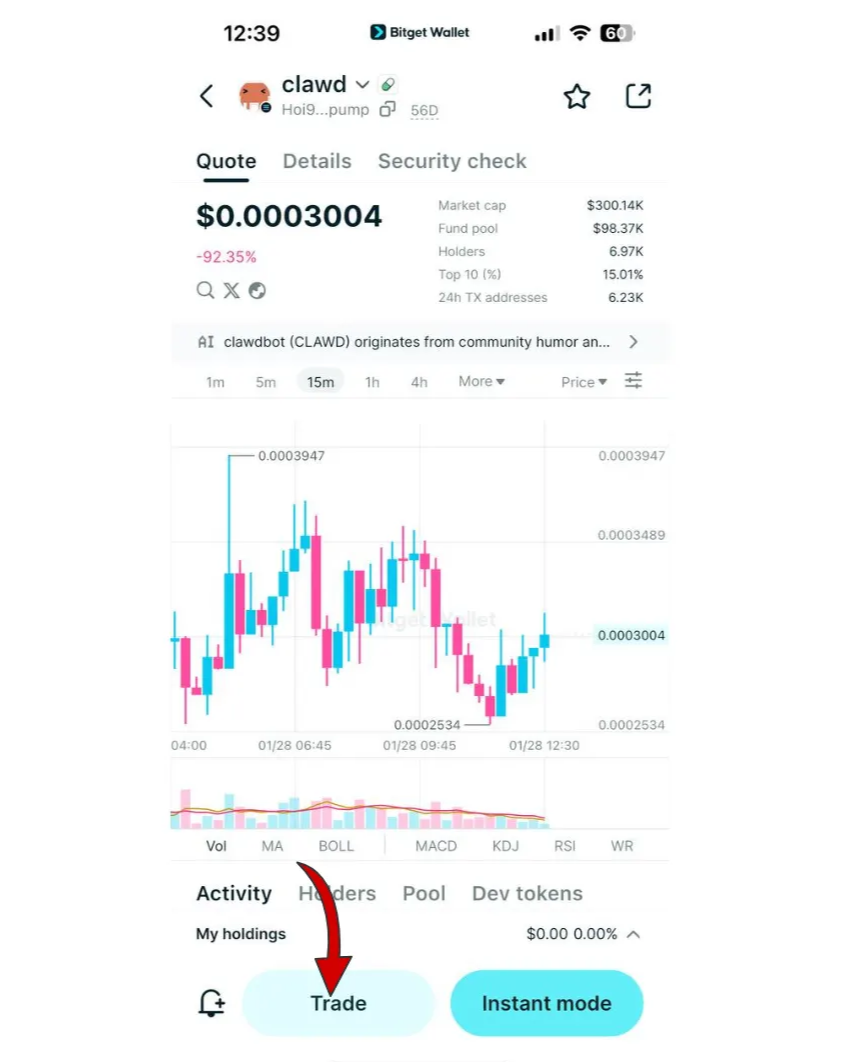

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find clawdbot (CLAWD). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

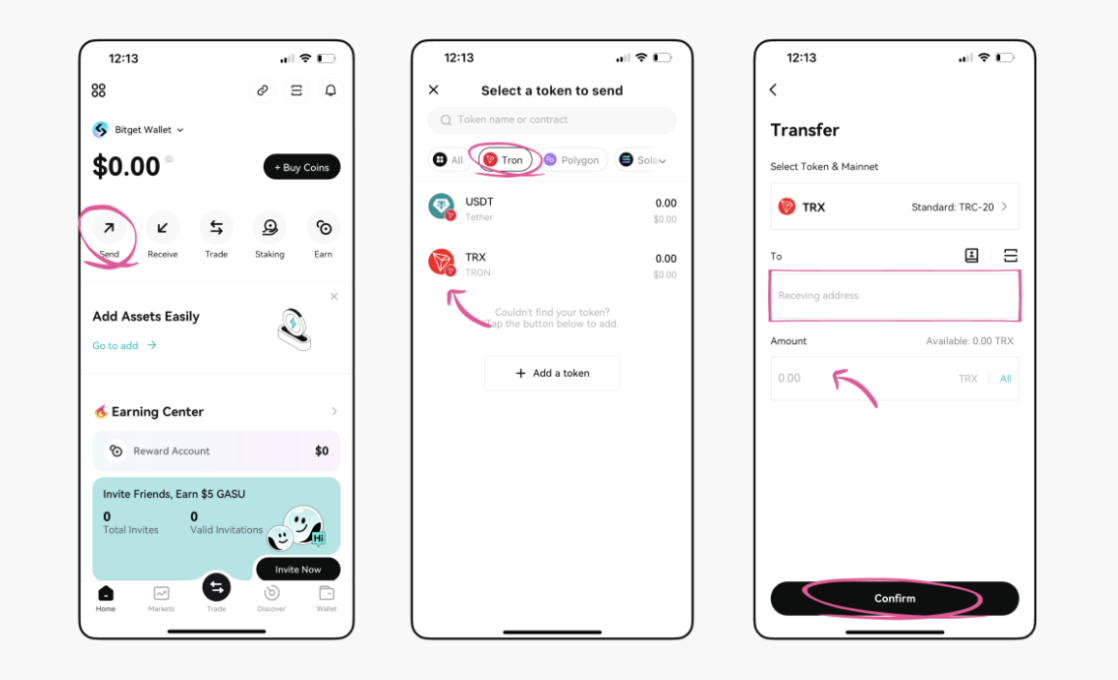

Step 4: Choose Your Trading Pair

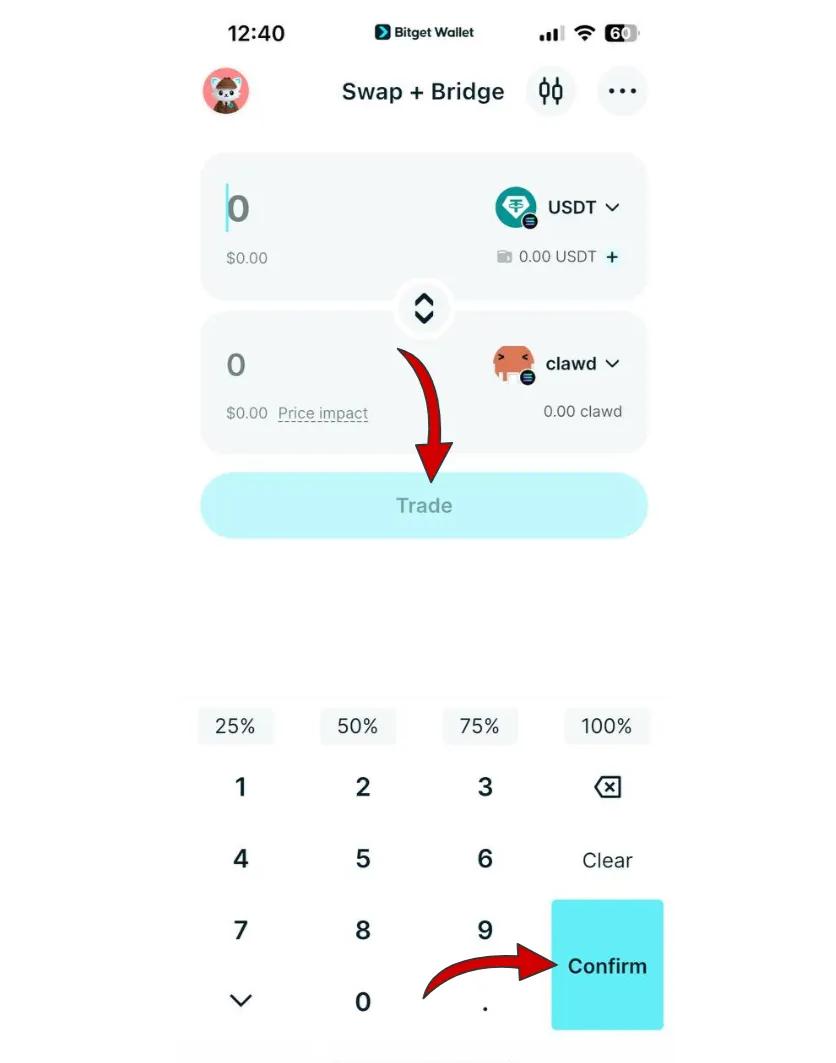

Select the trading pair you wish to use, such as CLAWD/USDT. This will allow you to trade clawdbot (CLAWD) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of clawdbot (CLAWD) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired clawdbot (CLAWD).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your clawdbot (CLAWD) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶ Learn more about clawdbot (CLAWD):

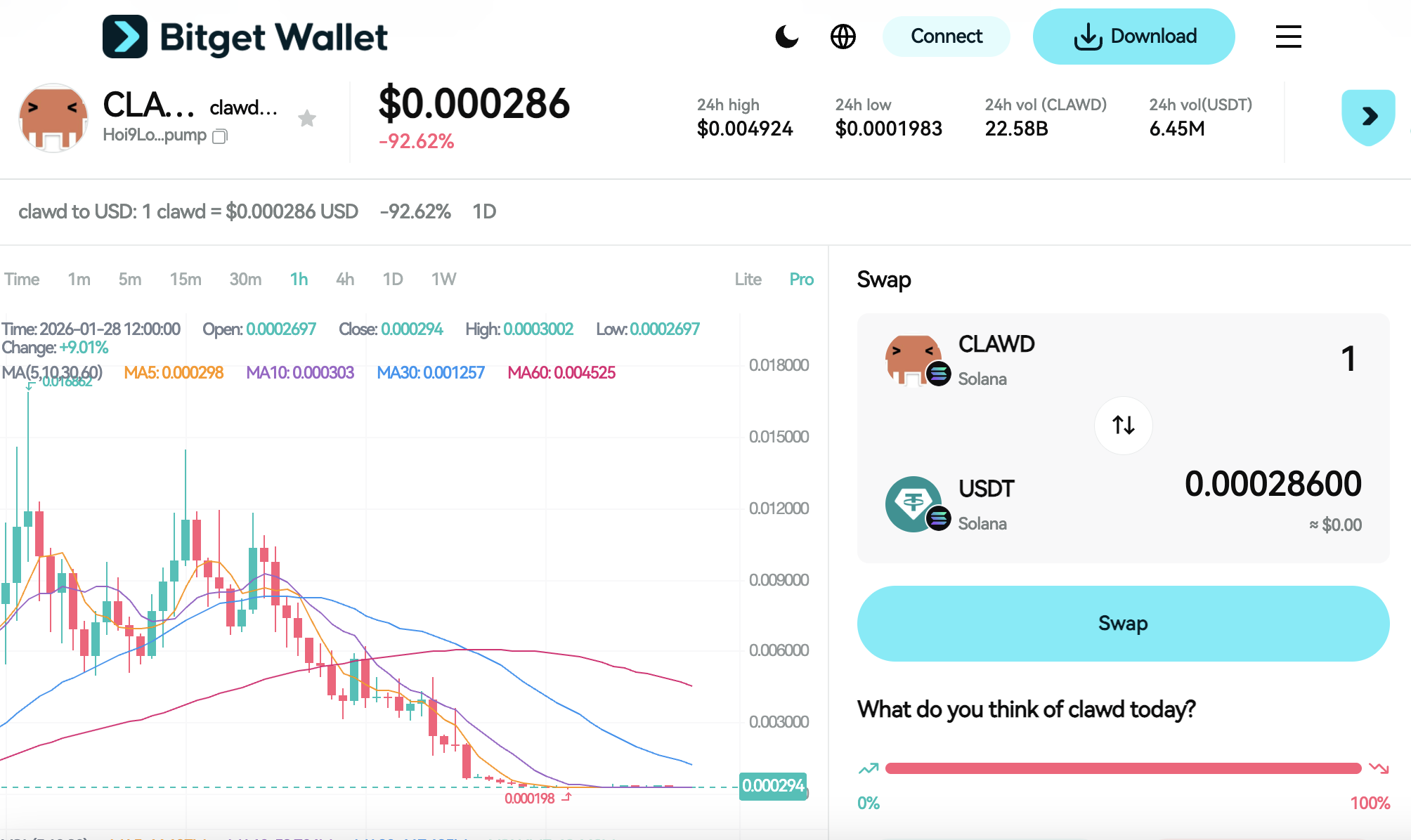

What Should You Know About CLAWD Price Volatility?

CLAWD is a narrative-driven, high-risk Solana token, and its price volatility is primarily driven by market sentiment and on-chain liquidity conditions rather than fundamentals. Rapid shifts in attention combined with uneven liquidity can cause sharp and sudden price movements.

CLAWD experiences sharp price fluctuations because trading activity is highly concentrated during short periods of attention. As a narrative-focused token, its price reacts quickly to changes in trader behavior, swap volume, and routing depth, rather than to measurable adoption or long-term utility.

Recent on-chain activity shows CLAWD undergoing rapid valuation swings within short time frames, as liquidity rotated quickly across Solana trading routes—underscoring how sentiment-driven flows can amplify volatility when liquidity depth is limited.

CLAWD Price Prediction: How High Can clawdbot Go?

The value of clawdbot (CLAWD) is shaped by market sentiment, on-chain liquidity conditions, and community participation. With no defined utility and a narrative-driven trading profile, CLAWD is expected to trade within a price range of $0.004–$0.009, depending on liquidity depth and attention cycles. Should on-chain activity remain elevated, the token could temporarily approach a long-term upper range near $0.010, though this remains highly speculative.

Key Factors Impacting clawdbot (CLAWD) Price

Several aspects influence the potential price movement of clawdbot (CLAWD):

- Market Conditions: Solana meme-token rotation cycles and overall SOL liquidity directly impact capital inflows and outflows.

- Adoption & Utility: CLAWD has no defined protocol utility; demand is driven primarily by speculative trading activity and attention.

- Project Expansion: Price sustainability depends on continued community participation and liquidity presence rather than roadmap execution.

Future Price Outlook

As clawdbot (CLAWD) continues to trade primarily on on-chain Solana markets, price behavior is expected to remain closely tied to attention cycles and liquidity conditions. Forecast models based on historical trading ranges suggest that periods of elevated interest may push prices toward the upper end of the projected range, while declining liquidity or sentiment could result in sharp retracements. Users should carefully assess volatility and risk exposure before participating.

Source: MEXC

Source: Bitget Wallet

Is CLAWD Crypto Safe to Invest In?

Whether CLAWD is “safe” to invest in depends largely on how users trade, verify information, and manage risk, rather than on the token itself. As a narrative-driven, on-chain asset, the most common risks stem from execution mistakes, liquidity conditions, and user behavior.

Safety in the context of CLAWD should be understood as a function of execution quality and risk management discipline. Users who verify contracts, understand liquidity constraints, and control position size are generally better positioned than those who trade based solely on hype or short-term price action.

Key risks to be aware of:

- Fake or impersonation tokens: Copycat contracts with similar names can appear during periods of high attention.

- Low or unstable liquidity: Thin liquidity can lead to high slippage and unexpected execution prices.

- Overexposure: Allocating too much capital to a highly volatile, narrative-driven token increases downside risk.

No speculative crypto asset is risk-free, and CLAWD is no exception. Users should approach it with caution, limit exposure, and treat participation as a high-risk activity rather than a guaranteed investment opportunity.

How to Approach CLAWD Volatility With a Smarter Strategy?

When dealing with CLAWD’s volatility, discipline matters more than timing. Users can reduce avoidable losses by focusing on controlled exposure and execution quality, and this approach helps build transferable on-chain skills that apply beyond a single token.

Rather than chasing short-term price movements, a smarter approach to CLAWD emphasizes education, verification, and risk control. Treating volatility as a condition to manage—not an opportunity to exploit—helps users avoid common mistakes and make more deliberate on-chain decisions.

Key practices to follow:

- Observing on-chain liquidity behavior: Monitor liquidity depth and routing changes before executing swaps.

- Using small position sizes: Limit exposure to reduce the impact of sudden price swings.

- Setting clear capital limits: Define maximum risk per trade and avoid emotional scaling.

- Prioritizing secure execution: Always verify contract addresses and use trusted swap routes.

By applying these principles, users gain long-term benefits that extend beyond CLAWD, including stronger on-chain awareness, better execution habits, and a more disciplined approach to managing risk across different tokens and market conditions.

Conclusion

How to buy CLAWD safely in 2026 ultimately comes down to understanding on-chain execution, verifying the correct contract address, and managing risk with discipline. As a narrative-driven, high-volatility token, CLAWD requires users to focus less on price timing and more on secure execution, liquidity awareness, and controlled exposure.

If you’re planning to explore on-chain tokens like CLAWD, Bitget Wallet provides a non-custodial way to swap while maintaining full control of your assets. Be the first to trade trending on-chain tokens—securely and confidently with Bitget Wallet.

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to buy CLAWD safely as a beginner?

To buy CLAWD safely, use a trusted non-custodial wallet, confirm you’re on the Solana network, and verify the official CLAWD contract address before swapping. Start with a small amount, check slippage, and avoid clicking unofficial links shared via DMs or impersonator accounts.

2. Where can I buy CLAWD?

Where to buy CLAWD depends on current liquidity and listings, but it is primarily available on-chain on Solana via wallet swaps. If a CEX listing exists in your region, you may also be able to buy through a centralized exchange—but on-chain swaps are typically the most direct method when liquidity is mainly on Solana.

3. Do I need KYC to buy CLAWD?

Whether KYC is required depends on the purchase method. Centralized exchanges (CEXs) typically require KYC, as users trade through custodial accounts managed by the platform.

In contrast, buying CLAWD through on-chain swaps using a non-custodial wallet like Bitget Wallet does not require KYC. Users interact directly with decentralized liquidity from their own wallet, without submitting identity information. However, this also means users are fully responsible for security, contract verification, and transaction execution.

4. Is CLAWD crypto high risk?

Yes. CLAWD is a narrative-driven token with high price volatility and risk factors such as thin liquidity, rapid sentiment shifts, and potential copycat tokens. Risk management and secure execution matter more than timing.

5. How can I avoid fake or impersonation CLAWD tokens?

To avoid fake CLAWD tokens, always verify the official Solana contract address before swapping, use trusted wallets and explorers, and avoid links shared through unsolicited DMs or unofficial social accounts. Checking liquidity sources and holder distribution can also help identify suspicious or cloned tokens early.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy T-2049 in 2026: A Beginner’s Step-by-Step Guide to Token 20492026-03-03 | 5mins