How to Buy BFS in 2026: A Beginner’s Step-by-Step Guide to Beast Financial Services

How to buy BFS in 2026 is a common question among beginners exploring viral Solana tokens. BFS (BFS) is a Solana-based meme coin that gained rapid attention in January 2026 after social posts suggested a MrBeast connection—despite no confirmed affiliation.

Most users buy BFS either through a simplified trading interface or by swapping directly on Solana using a self-custody wallet. For trading and storage, Bitget Wallet supports hot token trading and a seamless multi-chain experience. In this article, you’ll learn how to buy BFS step by step, how to verify the correct contract, and what mistakes beginners should avoid.

Key Takeaways

- BFS is a Solana meme coin, and its price can swing aggressively with attention and liquidity.

- The safest beginner habit is to use the contract address (not the ticker) to avoid copycat tokens.

- You can buy BFS through a simplified trading flow or by swapping on Solana DEX routes, depending on your experience level.

What Is Beast Financial Services (BFS)?

Begin with Beast Financial Services (BFS) as a Solana-based meme coin that became widely discussed due to online narrative and speculative trading. BFS is primarily traded based on market attention and liquidity conditions rather than a clearly defined utility model. As with most meme coins, verification and risk control matter more than storytelling.

What makes Beast Financial Services (BFS) different from utility tokens?

- Narrative vs utility: BFS is commonly traded as a meme coin, where market attention and community momentum matter more than product usage.

- Price driver: Liquidity depth, trading flow, and sentiment can cause rapid pumps and sharp reversals.

- Where it trades: BFS is accessed through Solana wallet swaps and DEX routing.

Source: Phantom

Is BFS a scam or just high-risk?

BFS is best treated as high-risk. Meme coins frequently attract copycats, fake tickers, and misleading links—especially during hype cycles. Even when a token is real and actively traded, beginners can still lose money through bad execution (slippage, price impact), poor liquidity timing, or simply buying after a spike.

Key risks beginners should understand:

- Copycat tokens: Multiple tokens can share the same ticker. The contract address is what matters.

- Extreme volatility: Large moves can happen within minutes, including sudden reversals.

- Thin-liquidity moments: Swaps can fill poorly when liquidity shifts, increasing price impact and slippage.

What users should do to reduce risk:

- Verify the Solana token address before any trade: 2k8yZaJjf61unHriuqdmvbxe7CUhEYML5kVJDbcotKjU

- Start with a small test swap and review price impact + minimum received before confirming.

- Avoid random links from comments/DMs—open trusted swap interfaces and paste the address yourself.

Comparison of BFS Buying Methods

Understanding where to buy BFS depends on your custody preference, execution method, and risk tolerance. The comparison below highlights the most common options for users evaluating where to buy BFS safely and efficiently.

| Buying Method | Custody Model | Execution | Control | Recommended For | Main Risks |

| On-chain Swap (DEX via Wallet) | Non-custodial | User-controlled, on-chain | High | Self-custody, DeFi users | • Contract impersonation • Price slippage • Network fees + congestion risk |

| On-chain UEX (via Exchange) |

Custodial | Platform-managed, on-chain | Medium | Users who want on-chain exposure without wallet management | • Custodial exposure • Withdrawal limits • Platform dependency |

| Centralized exchange (CEX) | Custodial | Platform-managed | Low | Beginners, high-liquidity traders, fiat on-ramps | • Custodial risk • Withdrawal delays • Regional or national regulatory restrictions |

Why Many Users Buy BFS With Bitget Wallet?

For users evaluating the best wallet to buy BFS, many prefer to buy BFS with Bitget Wallet because it supports on-chain swaps and makes BFS contract address verification straightforward. Bitget Wallet also supports cross-chain access and helps reduce common beginner mistakes like swapping into impersonation tokens.

What Bitget Wallet Helps With?

✅ Self-custody and asset control Users retain full ownership of private keys and funds, reducing exposure to custodial and platform-related risks.

✅ On-chain swaps with transparent execution Explore over 1M tokens with real-time in-app rankings—discover trending assets early and stay ahead of the market.

✅ Multi-chain access with cost-efficient execution Bitget Wallet supports 130+ blockchains, including 7 major networks such as Solana, Base, Arbitrum, Polygon, Tron, and more. This allows users to buy, hold, and manage BFS across different ecosystems without being locked into a single chain environment.

On supported networks, users can also benefit from gas-free transactions or long-term gas discounts, helping reduce execution costs when swapping, transferring, or managing assets across chains—an advantage for users who trade frequently or operate across multiple ecosystems.

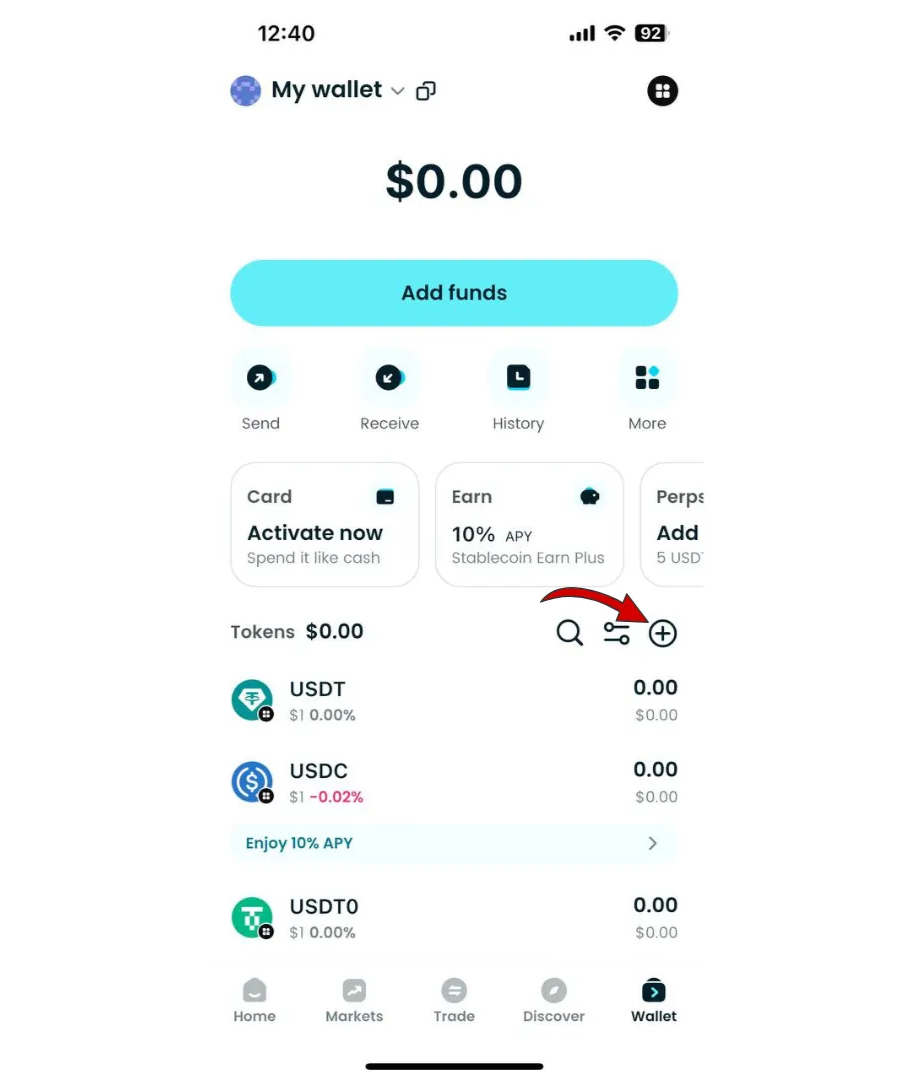

✅ Flexible post-purchase asset management After buying BFS, users can hold, transfer, or manage assets freely across supported chains without withdrawal limits or third-party restrictions, making it easier to adapt to changing liquidity or market conditions.

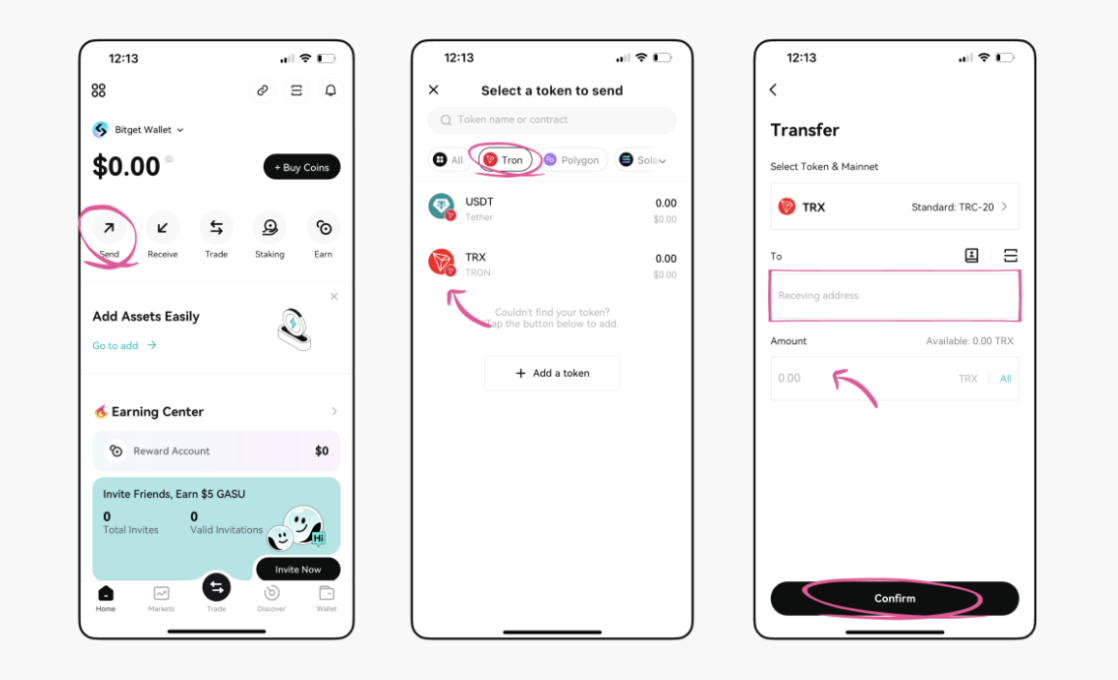

How to Buy Beast Financial Services (BFS) on Bitget Wallet?

Trading Beast Financial Services (BFS) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don’t have one yet, download Bitget Wallet. Create a wallet and back up your recovery phrase securely.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading Beast Financial Services (BFS).

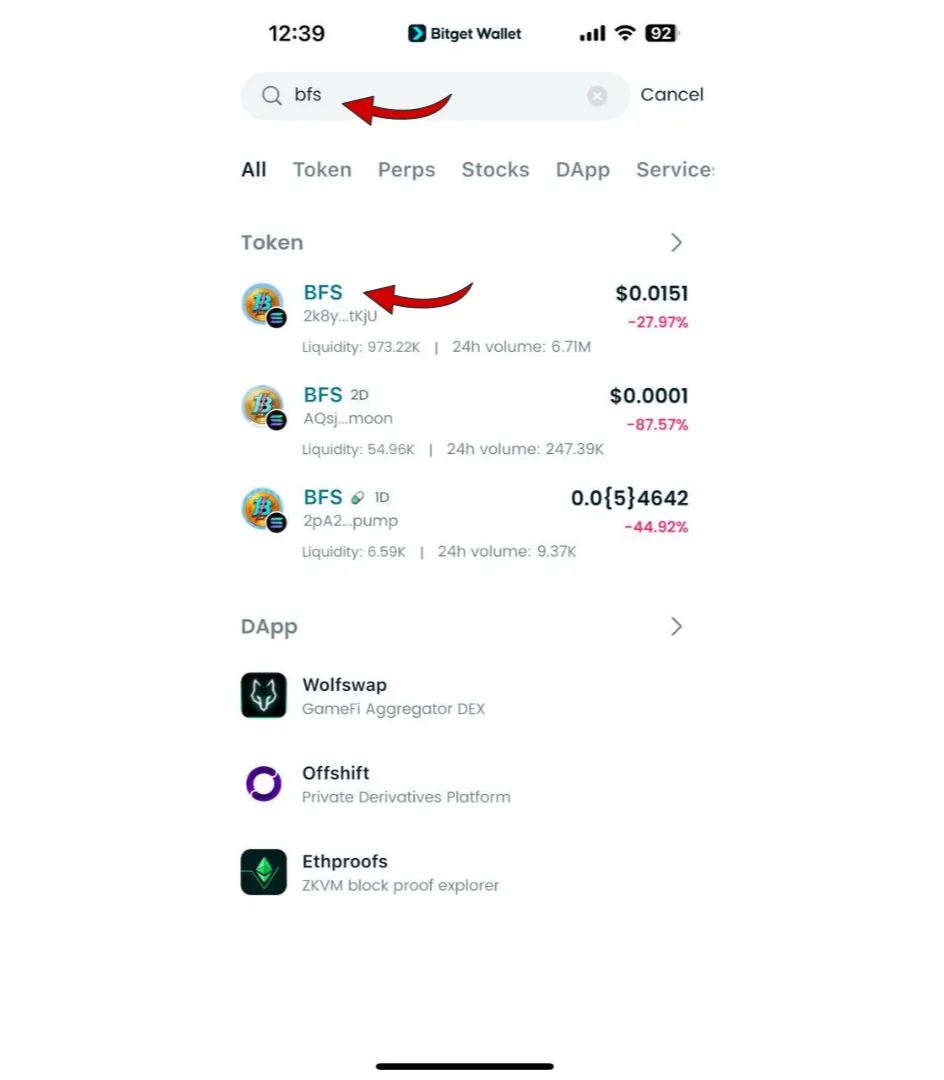

Step 3: Find Beast Financial Services (BFS)

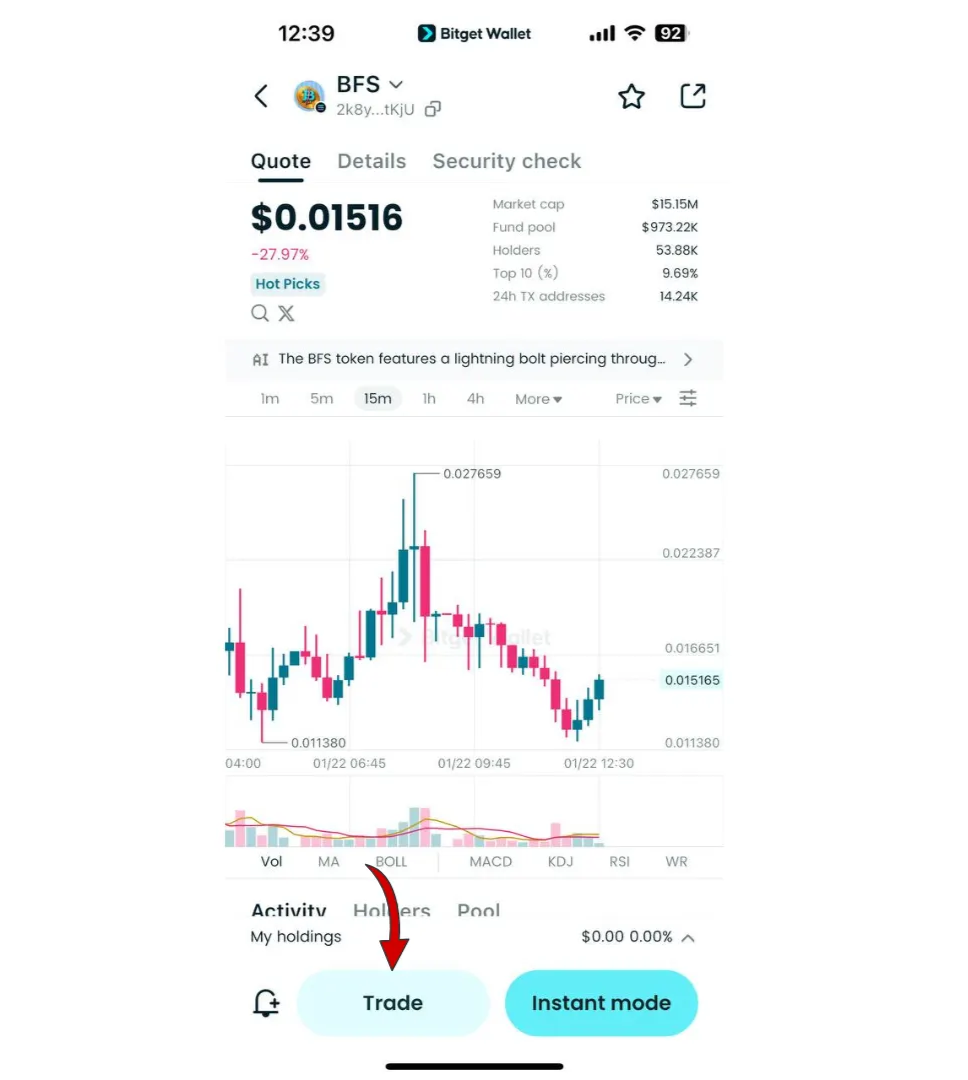

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find Beast Financial Services (BFS). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

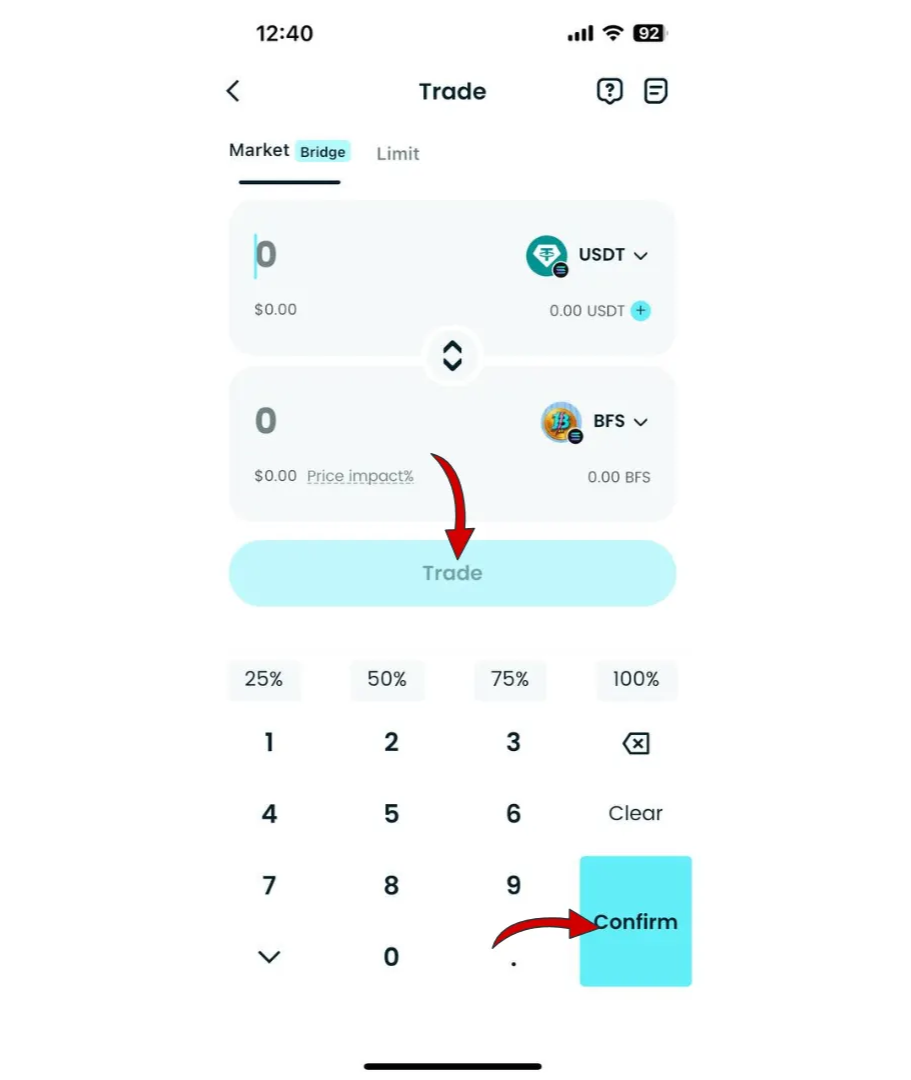

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as BFS/USDT. This will allow you to trade Beast Financial Services (BFS) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of Beast Financial Services (BFS) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired Beast Financial Services (BFS).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your Beast Financial Services (BFS) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶Learn more about Beast Financial Services (BFS):

What Should You Know About BFS Price Volatility?

BFS price volatility is fundamentally different from large, established crypto assets because BFS is a meme coin that trades primarily on fast-moving on-chain liquidity. Rather than following predictable fundamentals, BFS price behavior is shaped by attention cycles, liquidity depth, and rapid shifts in trader positioning. As a result, BFS is best understood as a high-risk token where execution quality matters as much as entry price.

Volatility behavior:

Under normal conditions, BFS can still move sharply because small changes in liquidity or order flow can create outsized price swings. During hype waves, price can spike quickly; when attention fades, reversals can be just as fast. In thin-liquidity moments, swaps may experience high price impact, failed transactions, or unfavorable fills—especially if slippage is set too low or too high.

Liquidity and execution factors:

BFS volatility is closely tied to pool depth and routing conditions. If liquidity is concentrated in a few pools or shifts rapidly, price impact increases and execution becomes less predictable. This is why verifying the token by BFS contract address and reviewing minimum received, price impact, and slippage before confirming a swap are essential steps for beginners.

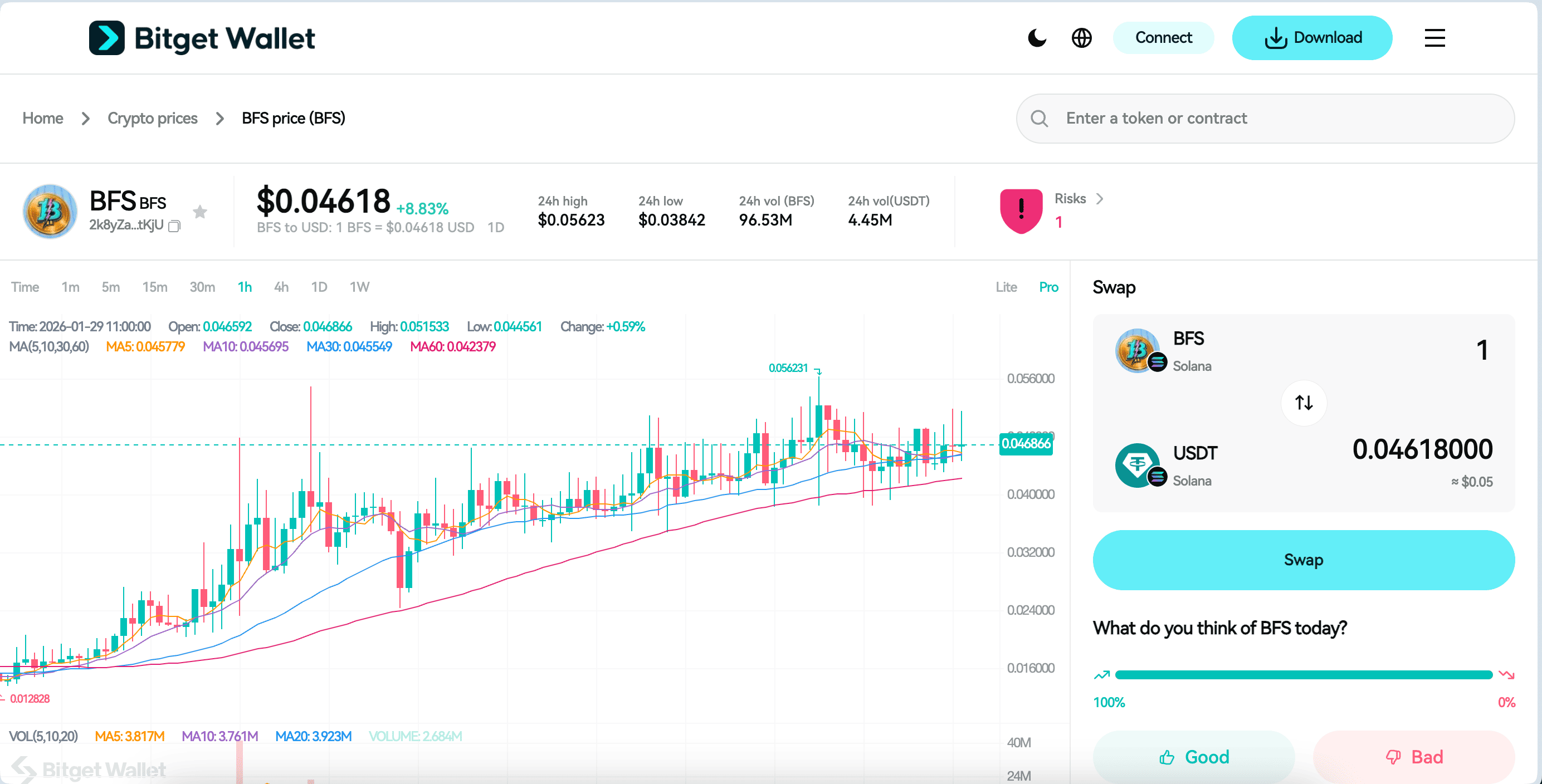

BFS Price Prediction: How High Can BFS Go?

BFS (BFS)’s price is determined mainly by market sentiment, liquidity depth, and short-term trading flow rather than long-term fundamentals. Because BFS is narrative-driven, it can trade within wide ranges over short periods, with rapid spikes and sharp pullbacks depending on attention and on-chain liquidity conditions. In 2026, BFS price action should be viewed as high-risk and highly reactive, not as a predictable trend based on adoption.

Factors Influencing the Price of BFS (BFS)

Several crucial aspects influence BFS (BFS) price movement:

- Market Trends: Broader crypto risk appetite, SOL market direction, and memecoin rotation can quickly lift or suppress BFS demand.

- Liquidity & Trading Flow: Pool depth, price impact, and whale activity can amplify moves; thin liquidity can cause exaggerated swings during buys/sells.

- Narrative & Social Attention: BFS is sensitive to hype cycles, viral content, and attention shifts; when attention fades, liquidity and price often retrace.

Long-Term Growth Potential

BFS (BFS) does not have a guaranteed long-term valuation path because it is primarily traded as a meme coin. Any sustained upside would typically require continued liquidity support, persistent community interest, and consistent on-chain activity. Investors should treat BFS as speculative and monitor risk factors such as sudden liquidity changes, large-holder selling pressure, and overall market volatility.

Source: Bitget Wallet

Is BFS Crypto Safe to Use?

Whether BFS is “safe” to use depends primarily on token verification, execution conditions, and user behavior, rather than any promise of stability. BFS is a high-risk meme coin, so users should evaluate safety through practical controls: confirming the correct token address, avoiding fake links, and managing slippage and liquidity risk.

Key risks to be aware of:

-

Platform or custody risk:

If you use a custodial platform, your access depends on the platform’s security, solvency, and withdrawal policies. With self-custody, security depends on how you store and protect your keys.

-

Liquidity and execution risk:

BFS can experience thin-liquidity moments that lead to high price impact, failed swaps, or poor fills—especially during fast moves.

-

Market and attention risk:

Meme coins can move sharply based on sentiment. Sudden drawdowns can happen quickly if attention fades or large holders sell.

-

Impersonation or fake tokens:

Copycat tickers and fake contracts are common. Always verify the BFS contract address before swapping:

2k8yZaJjf61unHriuqdmvbxe7CUhEYML5kVJDbcotKjU

BFS can be used, but it should be approached as a speculative token where security is mostly about verification and execution discipline.

How to Approach BFS Usage With a Smarter Strategy?

With meme coins like BFS, the objective is risk control, not “holding for stability.” A disciplined approach focuses on minimizing avoidable errors and treating BFS as a speculative trade.

Practical principles to follow:

-

Use BFS as a speculative position:

Treat BFS as high-risk exposure, not a core holding. Size conservatively.

-

Choose reputable swap interfaces:

Use trusted wallet swaps or well-known routing interfaces. Avoid random links shared in comments or private messages.

-

Limit exposure during high volatility:

When BFS is moving fast, reduce trade size, tighten your plan, and avoid increasing slippage blindly.

-

Verify token address every time:

Do not rely on ticker search alone. Confirm the token using the BFS contract address and match it on the exact swap screen you’re using.

Using BFS with a risk-aware mindset reduces the chance of buying the wrong token or getting an unexpectedly bad execution.

Conclusion

How to buy BFS starts with verifying the contract address, using a trusted swap interface, and managing slippage for a high-volatility Solana meme coin. Its price and execution quality are driven by liquidity conditions and market attention, so responsible usage depends on careful verification, disciplined position sizing, and strong custody habits.

If you want a simple wallet-first route, Bitget Wallet offers an all-in-one way to swap and manage BFS on Solana. The app surfaces key execution details—like the BFS contract address and swap preview—so users can verify what they’re buying before confirming. Beyond swaps, Bitget Wallet highlights value-add features such as Stablecoin Earn Plus (up to 10% APY on eligible stablecoin holdings) and periodic zero-fee trading promos for memecoins and RWA U.S. stock tokens (where available).

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to buy BFS safely as a beginner?

Use a trusted swap interface, verify the BFS contract address (2k8yZaJjf61unHriuqdmvbxe7CUhEYML5kVJDbcotKjU) before swapping, start with a small test trade, and review price impact + minimum received.

2. Where to buy BFS?

If you’re deciding where to buy BFS, the safest approach is using a trusted on-chain swap flow and verifying the BFS contract address before you confirm.

BFS is commonly bought through Solana on-chain swaps using a wallet swap feature or a trusted swap interface that routes Solana liquidity.

3. Do I need KYC to buy BFS?

Whether KYC is required depends on the method. Custodial platforms often require KYC because trading happens inside a managed account. In contrast, buying BFS via an on-chain swap using a non-custodial wallet (for example,Bitget Wallet) typically does not require KYC. However, you are fully responsible for wallet security, verifying the BFS contract address, and executing the swap safely.

4. Is BFS high risk?

Yes. BFS is a meme coin and can be highly volatile. Risks include sharp drawdowns, liquidity shifts, whale selling pressure, and fake lookalike tokens.

5. What should I check before buying or using BFS?

Verify the BFS contract address, check you’re on Solana, review liquidity/price impact on the swap quote, set slippage carefully, and avoid unofficial links.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy T-2049 in 2026: A Beginner’s Step-by-Step Guide to Token 20492026-03-03 | 5mins