How to Top Up Your Crypto Debit Card with USDT

How to Top Up Your Crypto Debit Card with USDT is one of the most searched questions among crypto users in 2025, especially as more people use stablecoins for daily spending. This guide explains what a crypto debit card is, why USDT is the most popular top-up asset, and how global users can fund and use their card safely and efficiently.

This article is written for beginners, frequent travelers, and Web3 users who want a simple, up-to-date explanation of crypto debit card top up, real fees, processing time, and real-world usage—using Bitget Wallet Card as a practical example.

Key Takeaways

- A crypto debit card lets you spend crypto like a bank card through automatic USDT to fiat conversion

- USDT is widely used because of price stability and global support

- Crypto debit card top ups are usually fast but depend on network and fees

- Bitget Wallet Card supports USDT top ups with multi-chain flexibility and global usage

What Is a Crypto Debit Card and How Does It Work?

A crypto debit card is a payment card that allows users to spend cryptocurrency at merchants that accept Visa or Mastercard. Instead of holding fiat in a bank, users fund the card with crypto assets, such as USDT, which are converted to local currency at the time of payment.

Source X

How crypto debit cards work in practice

Most crypto debit cards are accepted globally across Asia, Europe, and Latin America, making them especially useful for cross-border spending and travel.

- You top up your crypto debit card with assets like USDT

- When you pay, the card performs real-time crypto-to-fiat conversion

- Merchants receive local currency, not crypto

- The user experience feels similar to using a traditional debit card

→ Read more:

What Is a Crypto Debit Card and How Does It Work?

Why Is USDT Commonly Used to Top Up a Crypto Debit Card?

USDT has become the default asset for crypto debit card top ups because it solves the biggest problem of crypto spending: price volatility.

What makes USDT ideal for crypto debit card top ups?

USDT is a stablecoin pegged to the U.S. dollar, which means its value stays relatively stable compared to assets like Bitcoin or Ethereum.

Key reasons users prefer a USDT crypto card:

- Stable spending value without sudden price swings

- Widely supported across card issuers and wallets

- Compatible with multiple networks (ERC20, TRC20, SOL, etc.)

- Lower conversion risk during checkout

- Easier budgeting for daily expenses

For most users, a USDT card top up feels predictable and practical, especially for everyday payments.

→ Read more: How to Spend USDT with a Crypto Card

How to Top Up Your Crypto Debit Card with USDT?

This section explains how to top up your crypto debit card with USDT step by step, using Bitget Wallet Card as a concrete example. While interfaces differ slightly by provider, the overall flow is similar across platforms.

Before starting, make sure:

- Your wallet has sufficient USDT balance

- You select the correct blockchain network

- Your card is activated

- KYC is completed if required in your region

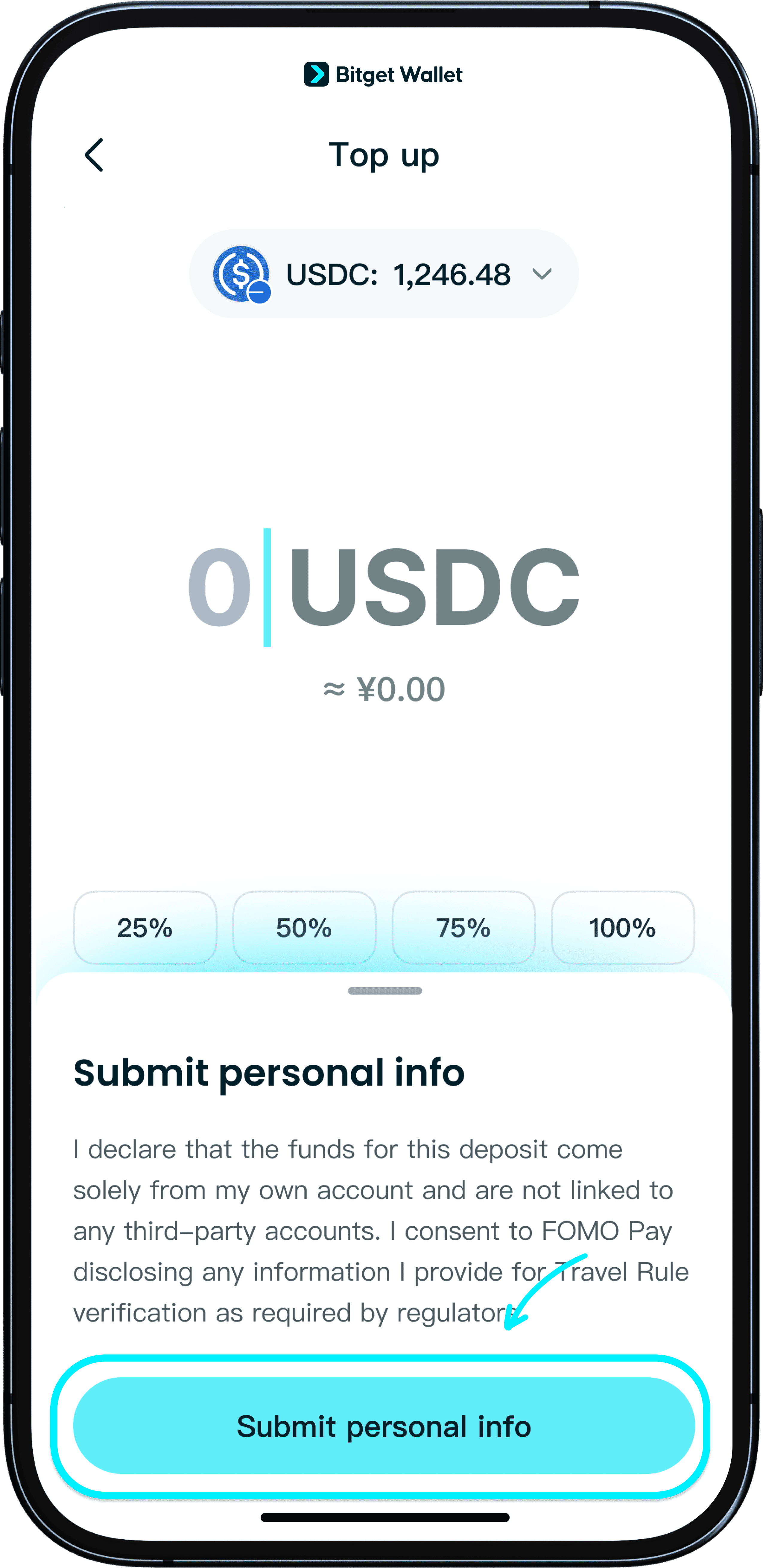

Step 1: Access the Bitget Wallet Card

Open Bitget Wallet and navigate to the Card section. Ensure your crypto debit card is active and ready to receive funds.

Step 2: Select USDT as Your Top-Up Asset

Choose USDT from the list of supported assets. Bitget Wallet supports multiple USDT networks, giving users flexibility based on fees and speed.

Step 3: Enter the Top-Up Amount and Review Fees

Input the amount you want to top up. Always review:

- Network fees

- Conversion fees (if applicable)

- Any issuer spread

Understanding USDT top up fees crypto debit card users face helps avoid surprises.

Step 4: Confirm and Complete the USDT Top Up

Confirm the transaction and wait for blockchain confirmation. Once completed, your crypto debit card balance updates automatically.

→ Read more: How do I top up my card?

What Fees Should You Expect When Topping Up a Crypto Debit Card with USDT?

Topping up a crypto debit card with USDT usually involves more than just sending funds from a wallet, and understanding the fee structure in advance helps users avoid surprises. While some platforms advertise low or zero fees, actual costs can still arise from blockchain transactions, currency conversion, and card issuer policies.

These fees are not fixed and often change based on network activity, the selected USDT chain, and how the crypto debit card handles USDT to fiat conversion at the time of top up. Knowing where fees come from allows users to better compare providers and choose the most cost-efficient way to top up a crypto debit card with USDT.

What are the common USDT top up fees crypto debit card users face?

Some providers offer zero-fee allowances or promotional limits, while others apply small spreads. Always compare before choosing a top up crypto debit card provider.

Typical fees include:

- Blockchain network fees (gas fees)

- Conversion fees during USDT to fiat conversion

- FX spreads for cross-currency payments

- Issuer processing fees

How Long Does a Crypto Debit Card USDT Top Up Take to Process?

A crypto debit card USDT top up is usually processed very quickly, making it suitable for everyday spending and last-minute payments. In most cases, users see their balance updated within seconds to a few minutes after confirming the transaction.

However, a crypto debit card USDT top up time is not always instant, as it depends on blockchain confirmation, the selected USDT network, and the card provider’s internal settlement process. Understanding these factors helps users set realistic expectations and avoid unnecessary concerns when a top up takes slightly longer than expected.

What affects crypto debit card USDT top up time?

In most cases, a crypto debit card USDT top up time ranges from instant to a few minutes. Delays usually come from network congestion rather than the card itself.

Several factors influence timing:

- Blockchain confirmation speed

- Network congestion

- Selected USDT network

- Internal settlement systems

Why Did My Crypto Debit Card Top Up with USDT Fail?

A failed crypto debit card top up with USDT can be frustrating, but in most cases, the issue is not serious and can be resolved quickly.

Top up failures often happen due to simple setup mistakes, temporary network conditions, or regional restrictions rather than a problem with the card itself. Understanding why a crypto debit card top up failed helps users identify the cause faster, avoid repeating the same error, and complete their USDT top up smoothly on the next attempt.

What are the most common crypto debit card top up errors?

If you wonder why crypto debit card top up failed, checking the network and limits solves most issues.

- Using the wrong blockchain network

- Sending USDT on an unsupported chain

- Insufficient gas fees

- Exceeding card or regional limits

- Compliance or KYC restrictions

How Do You Use a Crypto Debit Card After Topping Up with USDT?

After topping up with USDT, a crypto debit card works almost the same way as a regular bank card, making it easy for users to spend without learning new payment habits.

Once the balance is available, the card can be used immediately for everyday purchases, online payments, or travel expenses. The complexity of crypto stays in the background, while the payment process remains familiar, fast, and convenient for real-world use.

How does USDT convert to fiat during card payments?

At checkout, the system automatically performs USDT to fiat conversion, settling the payment in local currency without user action.

Where can you use a crypto debit card globally?

- Online shopping

- In-store payments

- Travel expenses

- Apple Pay and Google Pay integrations

Using Bitget Wallet Card as an example, users can pay globally wherever Visa or Mastercard is accepted.

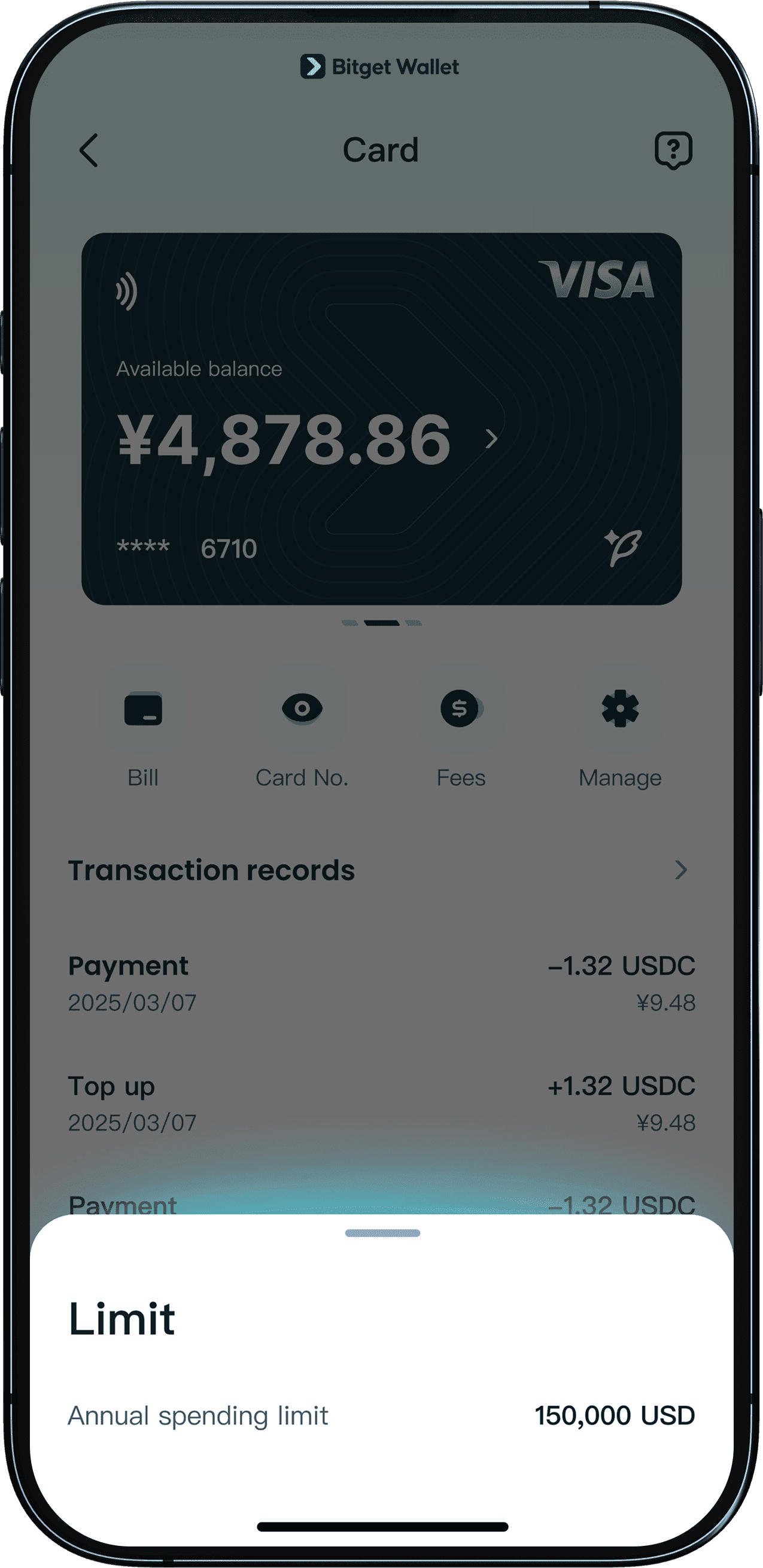

Which Is the Best Crypto Debit Card to Top Up with USDT in 2026 soon?

Not all cards are equal. Choosing the best crypto debit card to top up with USDT depends on practical factors rather than hype.

What factors should you compare when choosing a USDT crypto card?

A good crypto debit card should make funding, spending, and tracking balances simple.

- Fee transparency

- Supported regions

- Blockchain compatibility

- User experience

- Security and wallet control

The Best Crypto Debit Card to Top Up with USDT

For users looking for a practical way to spend USDT without giving up control of their assets, Bitget Wallet Card is designed as an extension of the Bitget Wallet ecosystem rather than a standalone product. It allows users to move seamlessly from holding stablecoins on-chain to paying in real-world scenarios, while keeping the experience simple and familiar.

How Bitget Wallet supports crypto debit card usage:

- Top up the card directly with USDT inside Bitget Wallet, without moving funds to an external exchange

- Support for multiple USDT networks, helping users manage fees and transaction speed more efficiently

- Clear, guided top-up steps that reduce common errors such as selecting the wrong network

- Automatic USDT to fiat conversion at the time of payment, with no manual swapping required

- Acceptance on Visa and Mastercard networks for online and in-store payments worldwide

- Compatibility with Apple Pay and Google Pay for mobile payments in supported regions

- Non-custodial design that lets users retain control over their crypto assets

For detailed instructions and the latest card rules, users can refer to the official Help Center guide:

Read more

- What Is a Crypto Debit Card

- Best 10 Crypto Cards for 2025

- How to Pay with Crypto

- Top Bitcoin Debit Cards

Conclusion

How to Top Up Your Crypto Debit Card with USDT remains one of the most practical ways to bridge crypto and daily payments in 2025. USDT offers price stability, predictable spending, and broad acceptance across crypto debit cards.

Before topping up, users should always check supported networks, fees, and processing time. With proper setup, a crypto debit card becomes a reliable tool for global spending.

For users seeking a secure and flexible solution, Bitget Wallet provides an integrated way to manage USDT, top up cards, and spend crypto globally.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to top up your crypto debit card with USDT safely?

To top up safely, use a supported network, confirm fees before sending, and ensure your card is activated. Following the correct steps prevents most errors.

2. Are USDT crypto card top ups instant?

Most crypto debit card top ups are fast, but timing depends on blockchain congestion and internal settlement.

3. Why is my USDT card top up pending or failed?

Pending or failed top ups usually result from wrong networks, insufficient, gas fees, or exceeded limits.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Apply for a Crypto Mastercard2026-01-05 | 5 mins

- How to Apply for a Crypto Visa Card and Start Spending Crypto Worldwide2026-01-02 | 5 mins

- How to Apply for the Bitget Wallet Card: Step-by-Step Guide for New Users2025-12-22 | 5 mins