How to Apply for a Crypto Visa Card and Start Spending Crypto Worldwide

How to Apply for a Crypto Visa Card is becoming a common question in 2025 as more users look for practical ways to spend crypto in everyday life. With Visa expanding its crypto payment infrastructure globally, crypto-funded Visa cards now allow users to pay at millions of merchants without manually converting digital assets in advance.

This guide explains how to apply for a crypto Visa card, covering eligibility, requirements, approval timelines, fees, and a step-by-step application process. It also shows how wallet-based cards, such as the Bitget Wallet Visa Card, work in practice—focusing on process clarity rather than promotion.

Key Takeaways

- How to Apply for a Crypto Visa Card depends on region, identity verification, and wallet compatibility

- Most crypto Visa cards convert crypto to fiat in real time at checkout

- Applications are typically completed fully online with virtual card access first

What Is a Crypto Visa Card and How Does It Work?

A crypto Visa card is a payment card that allows users to spend cryptocurrency at Visa-accepting merchants by converting crypto into local fiat currency at the time of payment. Unlike traditional debit cards, the funding source is a crypto wallet balance rather than a bank account.

How does a crypto Visa card convert crypto into fiat?

Crypto Visa cards use real-time conversion at checkout. When a payment is made, the system converts a supported crypto asset—often a stablecoin—into fiat instantly.

Key mechanics include:

- Conversion happens at the point of sale

- The card is linked to a wallet balance

- No manual pre-conversion is required

- Payments run through Visa’s global network

This model follows standard crypto debit card mechanics used across the industry.

Crypto-funded cards vs bank-funded cards (real-world difference)

Crypto-funded Visa cards

- Funded directly from a crypto wallet balance

- Crypto is converted to fiat only when a payment is made

- No need to pre-load fiat or maintain a bank balance

- Commonly used by Web3-native users who hold stablecoins

Example experience:

A user holds USDT in their wallet. When they pay for groceries, the required amount of USDT is converted into local currency instantly, and the merchant receives fiat through Visa.

Bank-funded Visa cards

- Require users to pre-convert crypto into fiat

- Funds sit in a custodial bank account before spending

- Function more like traditional debit cards with crypto as an on-ramp

How Do Crypto Visa Cards Work With Crypto Wallets?

Crypto Visa cards are designed to work directly with crypto wallets, allowing users to spend digital assets without manually managing fiat balances. The wallet acts as the funding layer, while the Visa network ensures global payment acceptance and security.

Source X

How does crypto-to-fiat conversion happen at checkout?

Crypto-to-fiat conversion happens in real time at the moment of payment. When a user makes a purchase, the card automatically converts a supported crypto asset from the linked wallet into local fiat currency, which is then settled through the Visa network.

In practical terms:

- The wallet balance serves as the funding source

- Conversion occurs only during the transaction, not in advance

- Users do not need to manually swap crypto into fiat before spending

- Merchants always receive fiat currency, not crypto

This mechanism follows standard crypto debit card workflows, where pricing, authorization, and settlement are handled seamlessly in the background, creating a familiar checkout experience for both users and merchants.

How are rewards and benefits shared between issuers and Visa?

Crypto Visa cards typically operate under a dual-layer benefits model, where value is shared between the Visa network and the card issuer.

Visa network benefits usually include:

- Global merchant acceptance

- Transaction security and fraud monitoring

- Participation in Visa-led campaigns or promotions

Issuer-level benefits depend on the card provider and may include:

- Cashback or spending rebates

- Yield or APY-related incentives

- Fee reductions or usage-based rewards

Key clarification for users:

- Bitget Wallet Visa Card provides benefits from both Bitget Wallet and Visa

- Bitget Wallet Mastercard provides benefits from both Bitget Wallet and Mastercard

This layered structure explains why crypto Visa cards can combine traditional payment reliability with crypto-native incentives, while still operating within established financial networks.

What Do You Need Before Applying for a Crypto Visa Card?

Before applying for a crypto Visa card, users need to meet basic identity, compliance, and asset requirements. These requirements are set by the card issuer and vary slightly by region, but the core preparation steps are consistent across most crypto Visa card applications.

What documents are required for a crypto Visa card application?

Most crypto Visa card applications require users to complete identity verification to comply with financial regulations. This process ensures cards can be issued and used legally in each supported country.

Commonly required documents include:

- A government-issued photo ID (passport, national ID, or driver’s license)

- Address verification, such as a utility bill or official document (region-dependent)

- Accurate personal information, matching the submitted documents

Common reasons applications are rejected:

- Name or date-of-birth mismatches

- Blurry, cropped, or expired documents

- Incomplete submissions or inconsistent details

Ensuring document clarity and consistency significantly improves approval success and reduces delays.

Which cryptocurrencies are typically used to fund crypto Visa cards?

Crypto Visa cards are most commonly funded with stablecoins, as they provide predictable value and smoother payment authorization compared to volatile assets.

Primary funding assets include:

- USDT (Tether)

- USDC (USD Coin)

Why stablecoins are preferred:

- Prices are pegged to fiat currencies, reducing volatility risk

- Authorization failures are less likely during market fluctuations

- Spending amounts remain consistent between approval and settlement

Network compatibility considerations:

- Supported blockchains vary by card issuer

- Some cards support multiple networks, while others limit funding to specific chains

- Users must ensure their stablecoins are held on a compatible network before funding the card

This funding model improves transaction reliability while keeping crypto Visa card spending aligned with everyday payment needs.

How to Apply for a Crypto Visa Card

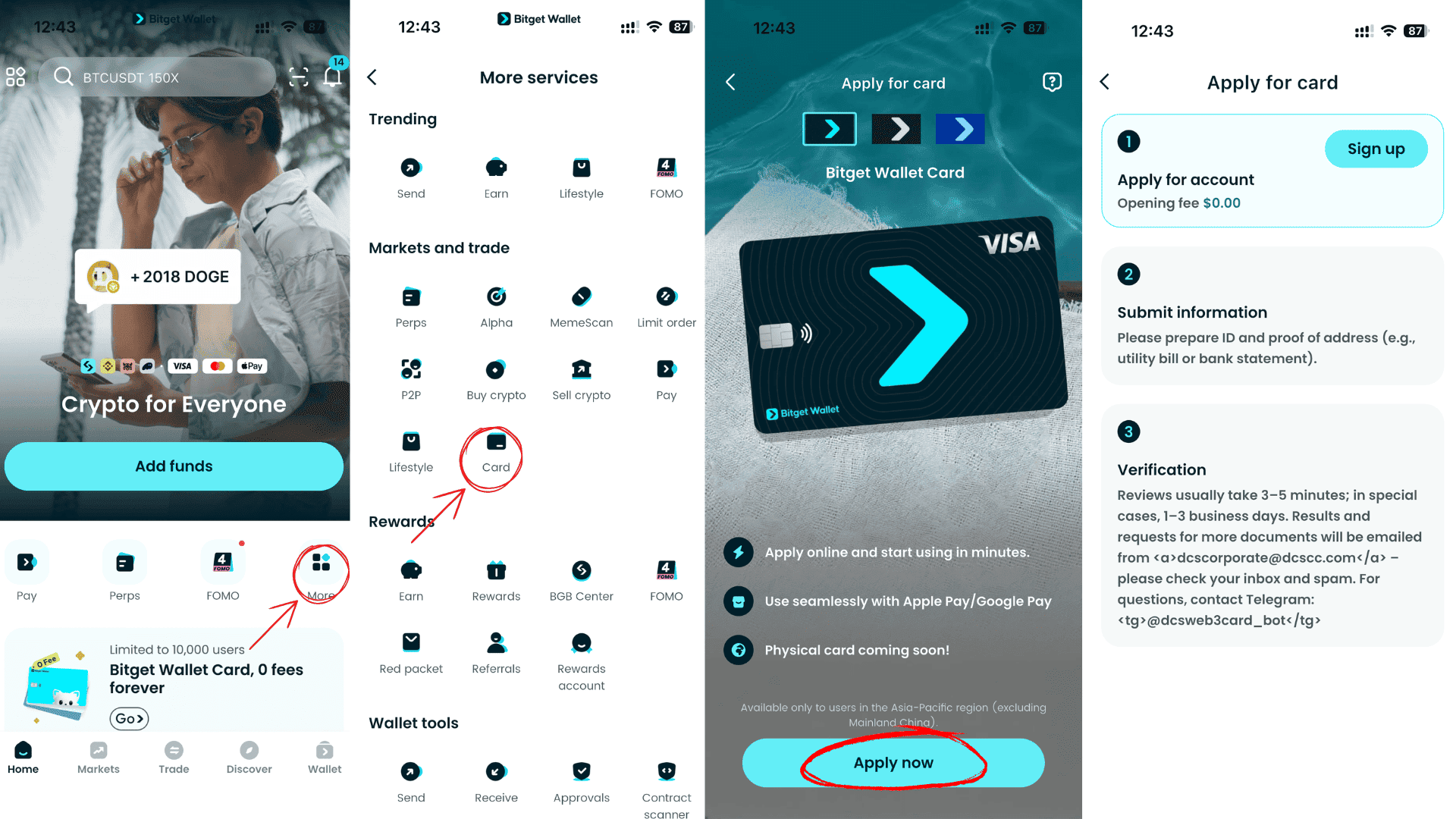

Below is a step-by-step online application process using the Bitget Wallet Visa Card as a case study. All steps can be completed entirely online in the wallet app or web interface without visiting a bank or physical office.

Step 1: Open wallet card section

Open the latest version of the Bitget Wallet app. Navigate to the Wallet tab, then tap the Card or Apply Now option to start the process.

Step 2: System checks regional eligibility

The system automatically checks your location and documents to determine which card options you can apply for. Only supported regions and identities will proceed.

Step 3: Select Visa card option

Choose the Visa card if multiple card networks are available. Eligibility and options may vary by region and issuer partner.

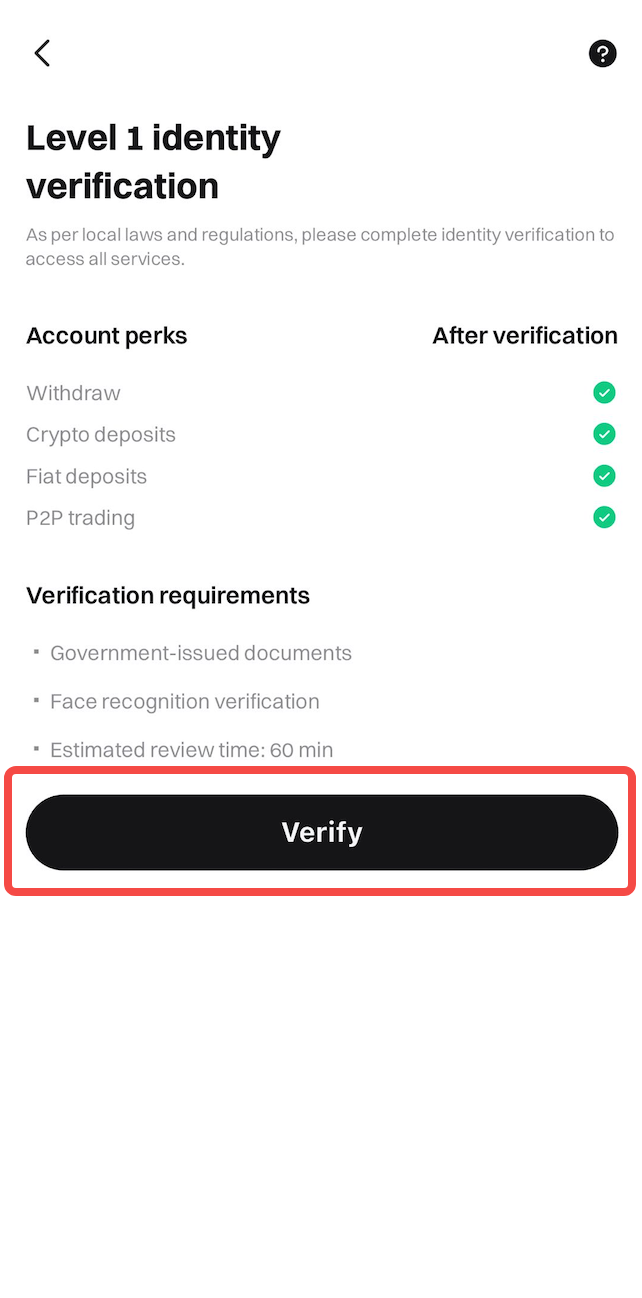

Step 4: Complete identity verification

Submit your identity documents (such as passport or driver’s license) directly in the app. Depending on your region and issuer, address verification may also be required.

Step 5: Submit application

After uploading your documents and filling in required details, review your information carefully and submit the application.

Step 6: Receive virtual card upon approval

Once approved, a virtual card is issued immediately inside the app and ready for online payments and wallets like Google Pay. Physical cards may be delivered later if available in your region.

→ Read more: How to Apply for the Bitget Wallet Card – Step-by-Step Guide

Can you apply for a crypto Visa card entirely online?

Yes, it is possible to apply for a crypto Visa card online without visiting a physical bank or submitting paperwork in person. Most crypto Visa card programs are designed with a mobile-first application flow, allowing users to complete the entire process through a wallet app or web interface.

In practice, this means:

- No physical bank visit or branch appointment is required

- Applications are submitted directly through a mobile app or online wallet

- Identity verification and document uploads are completed digitally

- A virtual crypto Visa card is typically issued upon approval, enabling immediate online spending

This fully online model reflects how crypto wallets integrate payments, making it faster and more accessible for users who want to apply for a crypto Visa card online and start using it without waiting for a physical card.

How Long Does Crypto Visa Card Approval Take?

Applying for a crypto Visa card is generally a streamlined online process, but approval time can vary depending on compliance checks, regional requirements, and issuer capacity. Knowing what affects the review process helps users understand why some applications are approved quickly while others take longer, including those submitted through Bitget Wallet.

What affects crypto Visa card approval speed?

Several factors influence how fast a crypto Visa card application is reviewed and approved:

-

KYC completion accuracy

Applications with clear, valid documents and matching personal information are processed faster. Errors such as blurry images, expired IDs, or mismatched details commonly cause delays.

-

Region and issuer workload

Approval timelines depend on the user’s country and the issuing financial institution. High application volume or stricter regional compliance rules can extend review times.

-

Virtual vs physical card issuance

Virtual cards are typically approved and issued sooner, as they do not require production or shipping. Physical cards may involve additional processing and delivery steps.

-

Typical approval ranges

In many cases, approval can occur within minutes to a few business days. However, timelines vary by issuer and region, and no fixed approval time is guaranteed.

Overall, completing identity verification accurately and applying from a supported region are the most effective ways to avoid delays when applying for a crypto Visa card.

When do users receive a virtual or physical crypto Visa card?

In most cases, users receive a virtual crypto Visa card first, especially when applying through mobile-first platforms such as Bitget Wallet. Virtual cards are typically issued immediately after approval and can be used for online payments without waiting for physical delivery.

Key issuance flow:

- Virtual cards are usually issued upon approval in most supported regions

- Users can begin spending online as soon as the virtual card becomes active

- Physical cards are optional and depend on regional availability and issuer support

Physical card considerations:

- Availability depends on the issuing entity and local regulations

- Not all countries support physical card delivery

- Shipping and delivery timelines vary by country and logistics provider

As a result, the exact timing for receiving a virtual or physical crypto Visa card depends on the issuer, the user’s location, and whether physical card delivery is supported in that region.

What Fees and Limits Apply to Crypto Visa Cards?

Before applying for a crypto Visa card, users should understand the fee structure and usage limits that may apply. These factors vary by issuer, region, and card type, and reviewing them in advance helps users avoid unexpected costs when using a Bitget Wallet Card or similar crypto Visa cards.

What types of fees should applicants expect?

Crypto Visa cards may involve several types of fees, depending on how and where the card is used.

Common fee categories include:

- Crypto-to-fiat conversion fees, applied when assets are converted at checkout

- Foreign exchange (FX) fees for transactions made in a currency different from the card’s base currency

- ATM withdrawal fees, which may include both issuer and local ATM charges

- Card issuance or replacement fees, especially for physical cards

Fee structures differ by issuer and region. For transparency, most crypto wallet platforms display applicable fees directly in the app, allowing users to review charges before completing transactions.

Are there spending and withdrawal limits?

Yes, crypto Visa cards typically include spending and withdrawal limits designed to meet compliance and risk-management requirements.

Common limit types include:

- Per-transaction limits, capping the amount spent in a single payment

- Monthly spending caps, restricting total card usage within a billing period

- ATM withdrawal limits, often set daily or monthly

Limits may also be tier-based (linked to verification level) or issuer-based, meaning they vary depending on the issuing financial institution. Regional regulations can further affect limits, especially in jurisdictions with stricter compliance rules.

Can You Apply for a Crypto Visa Card Without a Bank Account?

Many users ask whether a traditional bank account is required to use a crypto Visa card. In most cases, the answer is no, particularly when the card is linked to a non-custodial crypto wallet.

How do non-custodial wallets enable crypto Visa card access?

Non-custodial wallets allow users to fund crypto Visa cards directly from their crypto holdings, rather than from a bank balance. This model supports crypto-native payment flows within the broader Visa ecosystem.

Key characteristics include:

- Card funding comes from a wallet balance, not a bank account

- No requirement to open or maintain a traditional bank relationship

- Payments rely on real-time crypto-to-fiat conversion at checkout

- Users retain control of their assets until a transaction is executed

This approach aligns with how Visa integrates digital assets into existing payment infrastructure, enabling crypto spending without requiring users to rely on traditional banking systems.

What Common Problems Can Occur During a Crypto Visa Card Application?

Applying for a crypto Visa card can be a smooth process — but many users encounter issues that lead to delays or rejection. Understanding the key roadblocks can help applicants avoid frustration and secure approval faster.

Why Do Crypto Visa Card Applications Get Rejected?

While each card issuer has its own policies, the most common reasons for a crypto Visa card application rejection include:

- Unsupported Region Crypto Visa cards are not available in every country. Regions with strict crypto‑regulatory environments — including some parts of Asia and the Middle East — may not support issuance or activation. Applicants from unsupported regions can see automatic rejection, especially during initial eligibility checks.

- KYC Mismatch KYC (Know Your Customer) verification is a critical step for compliance. Cards can be rejected when:

- The name on your ID does not exactly match your account profile

- The document photo is unclear or expired

- Your date of birth or address differs from public records

This is especially common for Singapore and international users who have recently updated passports or driver’s licenses.

-

Incomplete Verification: Users sometimes skip steps during the verification flow — for example, failing to upload both front and back of identity documents, or missing a selfie capture. An incomplete verification status often results in automated denial.

-

Issuer Compliance Rules: Even with correct documentation, some applications are rejected due to issuer compliance checks. These include:

- Sanctions screening

- Jurisdictional risk scoring

- Transaction history flags

These compliance criteria are internal to the card issuer and can vary by region and regulatory requirements.

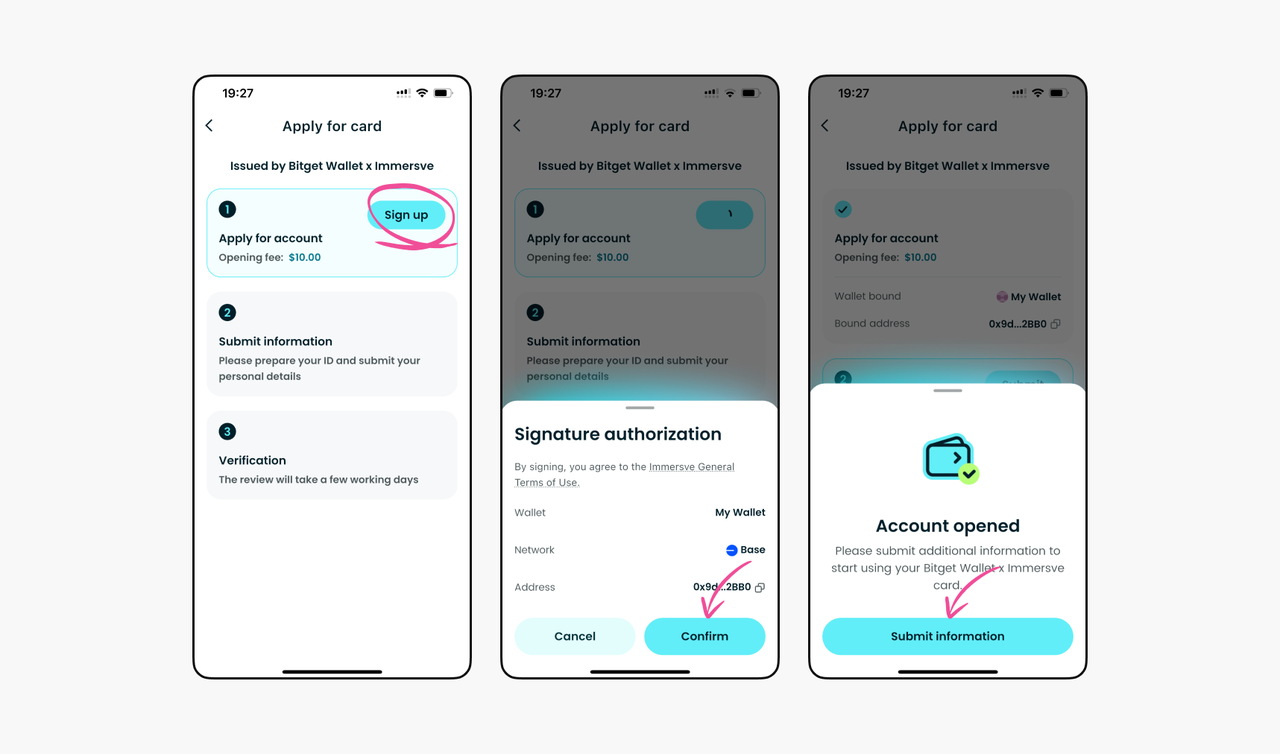

How to Apply for a Crypto Visa Card with the Bitget Wallet Card ?

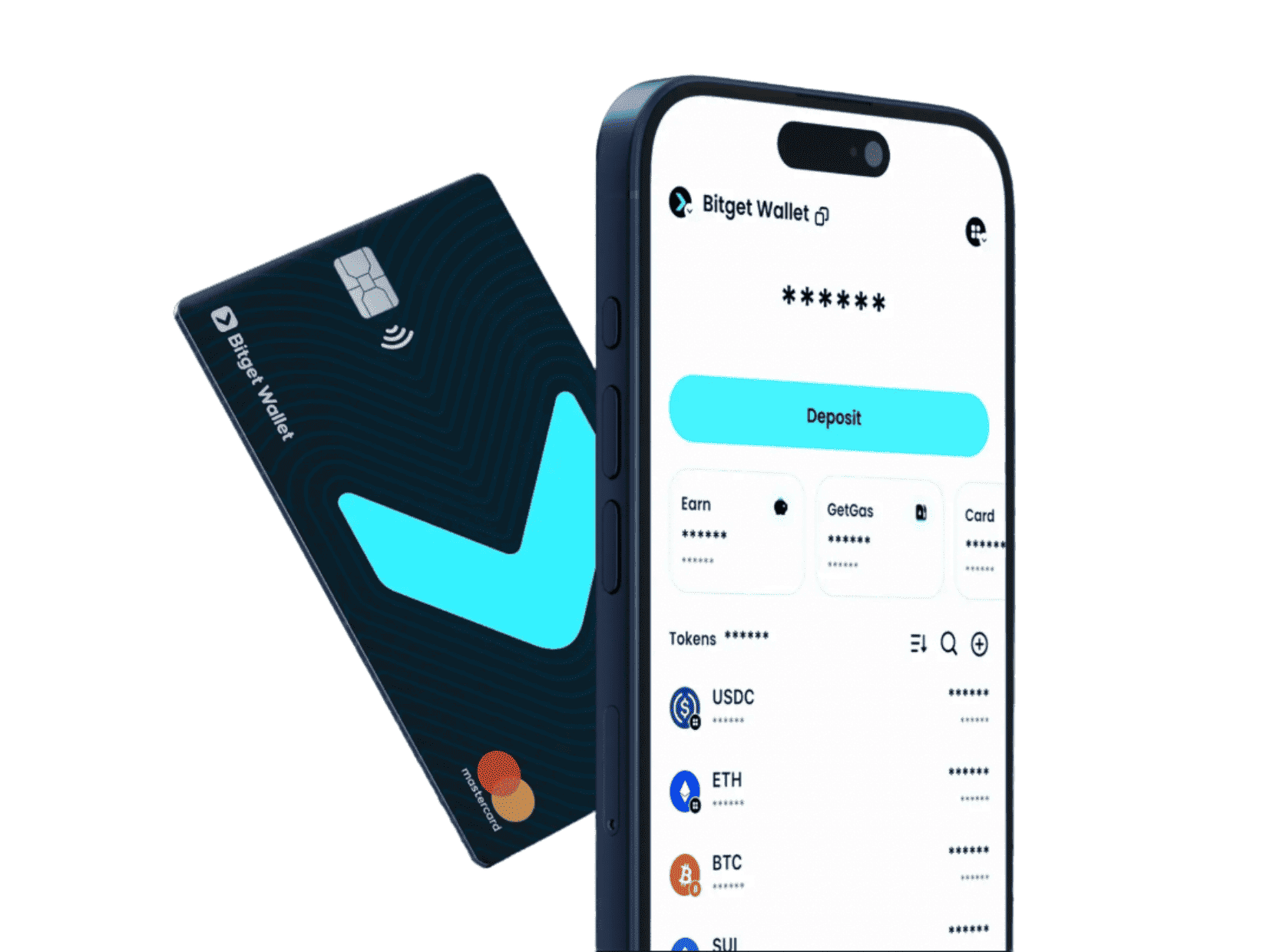

Applying for a crypto Visa card has never been easier with the **Bitget Wallet** This card allows you to spend your crypto anywhere Visa and Mastercard are accepted, while keeping full control of your assets. With real-time crypto-to-fiat conversion, you can pay seamlessly without worrying about market volatility. Best of all, the Bitget Wallet Card is non-custodial — meaning your crypto always stays in your wallet, giving you security and peace of mind.

Step-by-Step Guide to Applying for the Bitget Wallet Card

Using a Bitget Wallet Card is a simple and secure way to turn your crypto into everyday spending power.

This guide walks you through each step — from checking eligibility and submitting your application, to funding your card with stablecoins and managing limits — so you can start using your crypto confidently and safely.

-

Check Eligibility

Open your Bitget Wallet app and verify that your region supports the Bitget Wallet Card. Eligibility varies depending on local regulations.

-

Apply In-App

Navigate to the card section and submit your application. The process is straightforward, and Bitget Wallet ensures secure KYC verification for compliance with global standards.

-

Fund Your Card with Stablecoins

Load the card with stablecoins like USDT or USDC. Using stablecoins helps maintain price stability and ensures predictable spending power.

-

Manage Limits and Fees Transparently

Set spending limits, track transactions in real time, and review any applicable fees directly in the app. The Bitget Wallet Card makes it simple to manage your finances safely.

💥 Learn More and Apply

The Bitget Wallet Card is your bridge from crypto to everyday spending — secure, compliant, and fully in your control.

Conclusion

How to Apply for a Crypto Visa Card is straightforward when you follow the right steps. By checking your eligibility, confirming regional support, and completing verification carefully, you can navigate the application process with confidence. Understanding fees, limits, and approval expectations ensures there are no surprises along the way.

Crypto Visa cards serve as a practical bridge between digital assets and everyday spending, allowing you to use your crypto seamlessly for purchases worldwide. To do this safely and efficiently, rely on trusted, non-custodial tools like the Bitget Wallet — from applying for the Bitget Wallet Card to managing funds and making payments, your crypto remains fully under your control.

FAQs

1. Can anyone apply for a Bitget Wallet Bitget Wallet Card?

Eligibility depends on your region and local crypto regulations. Open the Bitget Wallet app to check if the Bitget Wallet Card is available for your country and ensure your identity documents are ready for KYC verification.

2. What cryptocurrencies can I use to fund the Bitget Wallet Card?

You can fund the Bitget Wallet Card using stablecoins like USDT or USDC for price stability. Other supported crypto assets may vary by region, but using stablecoins helps avoid value fluctuations when spending.

3. Are there fees when using a crypto Visa card for everyday purchases?

The Bitget Wallet Card offers transparent fee management. While basic transactions often have minimal or no fees, you should review in-app details for foreign exchange, ATM withdrawals, or card-specific limits.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Apply for a Crypto Mastercard2026-01-05 | 5 mins

- How to Top Up Your Crypto Debit Card with USDT2025-12-29 | 5mins

- How to Apply for the Bitget Wallet Card: Step-by-Step Guide for New Users2025-12-22 | 5 mins