How to Buy USOR in 2026: A Beginner’s Step-by-Step Guide to U.S. Oil Reserve

How to buy USOR is a question many crypto users are asking as the U.S. Oil Reserve (USOR) token gains attention across on-chain trading communities. USOR is a narrative-driven crypto asset that references energy and geopolitics but operates entirely within the decentralized crypto ecosystem rather than traditional commodity markets.

Unlike utility-focused blockchain projects, USOR appeals mainly to traders interested in short-term momentum, market narratives, and speculative opportunities. As a result, users searching how to buy USOR often want clarity on where to buy USOR, how execution works on-chain, and how to manage risk after purchasing. Many users also explore tools such as Bitget Wallet to access on-chain liquidity and retain asset control.

In this article, we’ll explain what USOR is, where and how to buy USOR crypto, and what users should understand before participating.

Key Takeaways

- U.S. Oil Reserve (USOR) is a speculative, narrative-driven crypto asset that is not backed by physical oil, meaning USOR price volatility is driven by sentiment rather than real-world reserves.

- Most users buy USOR crypto through on-chain decentralized trading, which explains why understanding where to buy USOR and how execution works with a non-custodial wallet is important.

- Learning how to buy USOR safely involves more than placing a trade — users must manage volatility, verify contract addresses, and apply basic risk control before participating.

What Is U.S. Oil Reserve (USOR)?

USOR crypto refers to the U.S. Oil Reserve (USOR) token, a narrative-driven digital asset inspired by energy-related themes rather than real-world oil reserves. Despite its name, USOR is not backed by physical oil or any government-held reserve.

Instead, USOR functions as a speculative crypto asset whose value is shaped by market sentiment, on-chain liquidity, and short-term trading momentum. As a narrative-driven crypto, USOR attracts attention during periods of heightened geopolitical discussion or energy market volatility, even though its price does not track real oil prices.

Users exploring how to buy USOR should approach it as a high-risk on-chain asset rather than a commodity investment.

Source: X

Is USOR a Scam or a High-Risk Meme-Style Token?

USOR is not automatically a scam simply because it is speculative. However, it should be classified as a high-risk meme-style token rather than a fundamentally backed asset.

Common risks associated with USOR crypto include:

- USOR price volatility, which can cause rapid price swings

- Imitation or fake tokens using similar names

- Liquidity shifts driven by short-term trading behavior

Learning how to buy USOR safely starts with verifying contract addresses, avoiding unofficial links, and setting realistic expectations. Risk management is essential when engaging with any narrative-driven crypto asset.

Where Can You Buy USOR Crypto?

When users search where to buy USOR, they generally encounter two main access paths: centralized platforms and on-chain decentralized trading.

Centralized access typically offers convenience but involves custodial risk, where the platform controls user assets. On-chain decentralized access allows users to trade directly from their own wallets, maintaining control over funds and execution.

Because USOR is a speculative crypto asset, many users prefer decentralized trading environments that emphasize transparency and self-custody rather than relying on third-party custody.

Which Platforms or Methods Support Buying USOR?

Different methods for buying USOR crypto vary in custody, execution control, and risk exposure. For narrative-driven crypto assets like U.S. Oil Reserve (USOR), understanding where to buy USOR and how execution works is just as important as the price.

Comparison of USOR Buying Methods

| Buying Method | Custody Model | Execution Control | Suitable For |

| On-chain decentralized trading | Non-custodial | User-controlled, on-chain execution | Users prioritizing transparency and self-custody when buying USOR crypto |

| Custodial platforms | Custodial | Platform-managed execution | Users seeking convenience when deciding where to buy USOR |

Why Many Users Prefer Bitget Wallet for USOR?

Many users prefer Bitget Wallet when buying USOR because it supports non-custodial, on-chain access while simplifying execution for both beginners and experienced traders. With a non-custodial wallet, users retain full control over private keys and assets.

Bitget Wallet enables:

- Direct on-chain swaps without giving up custody

- Transparent execution using decentralized trading

- Contract address verification to reduce impersonation risk

- Flexible asset management after purchase

For users learning how to buy USOR safely, self-custody tools help reduce platform-related risks while offering on-chain transparency.

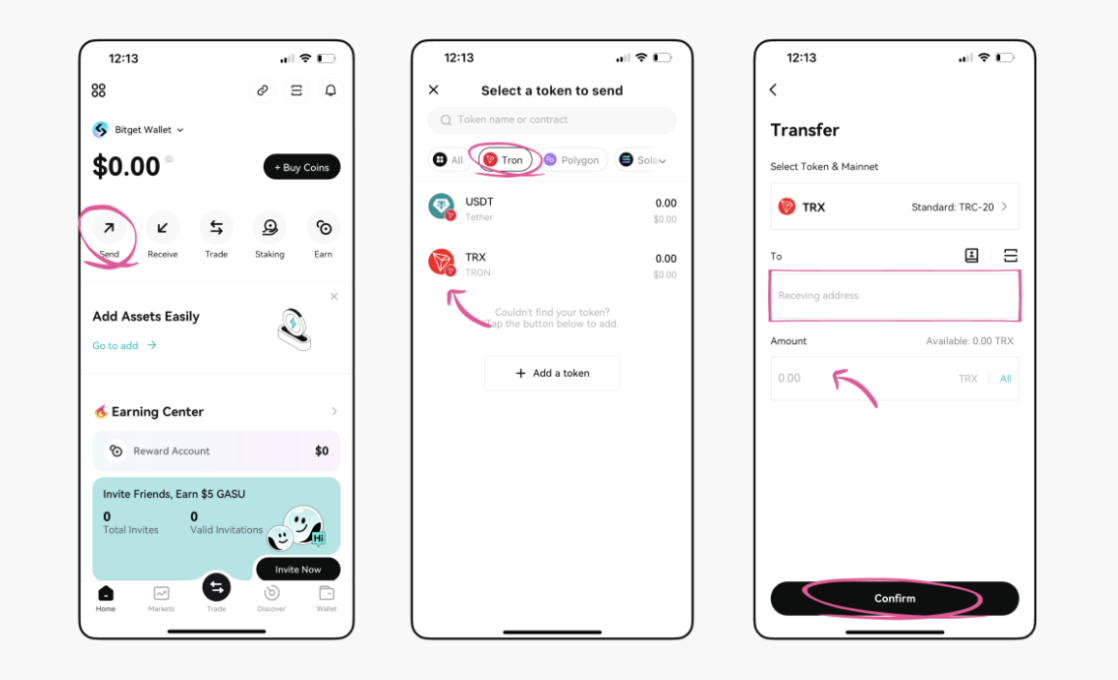

How to Buy USOR on Bitget Wallet?

Trading U.S. Oil Reserve (USOR) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

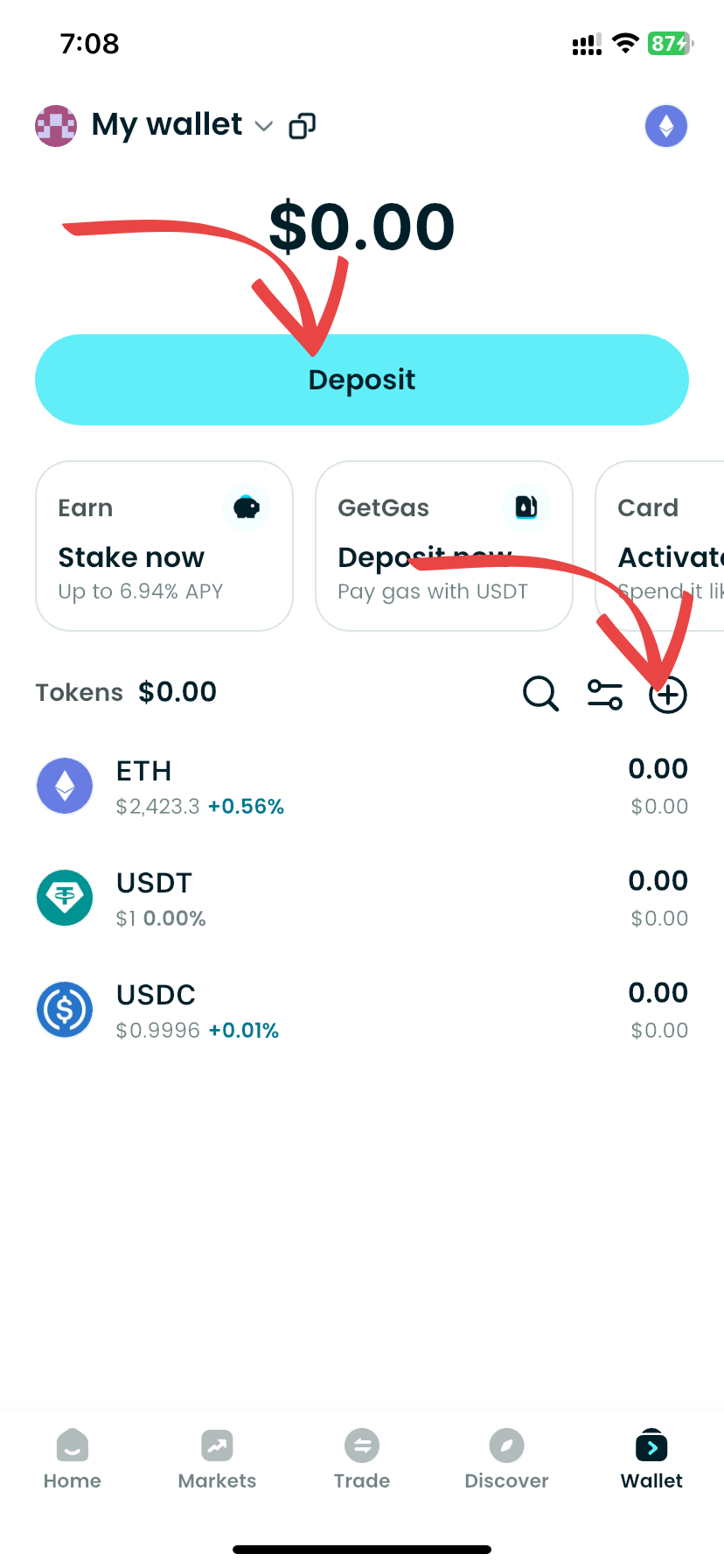

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading U.S. Oil Reserve (USOR).

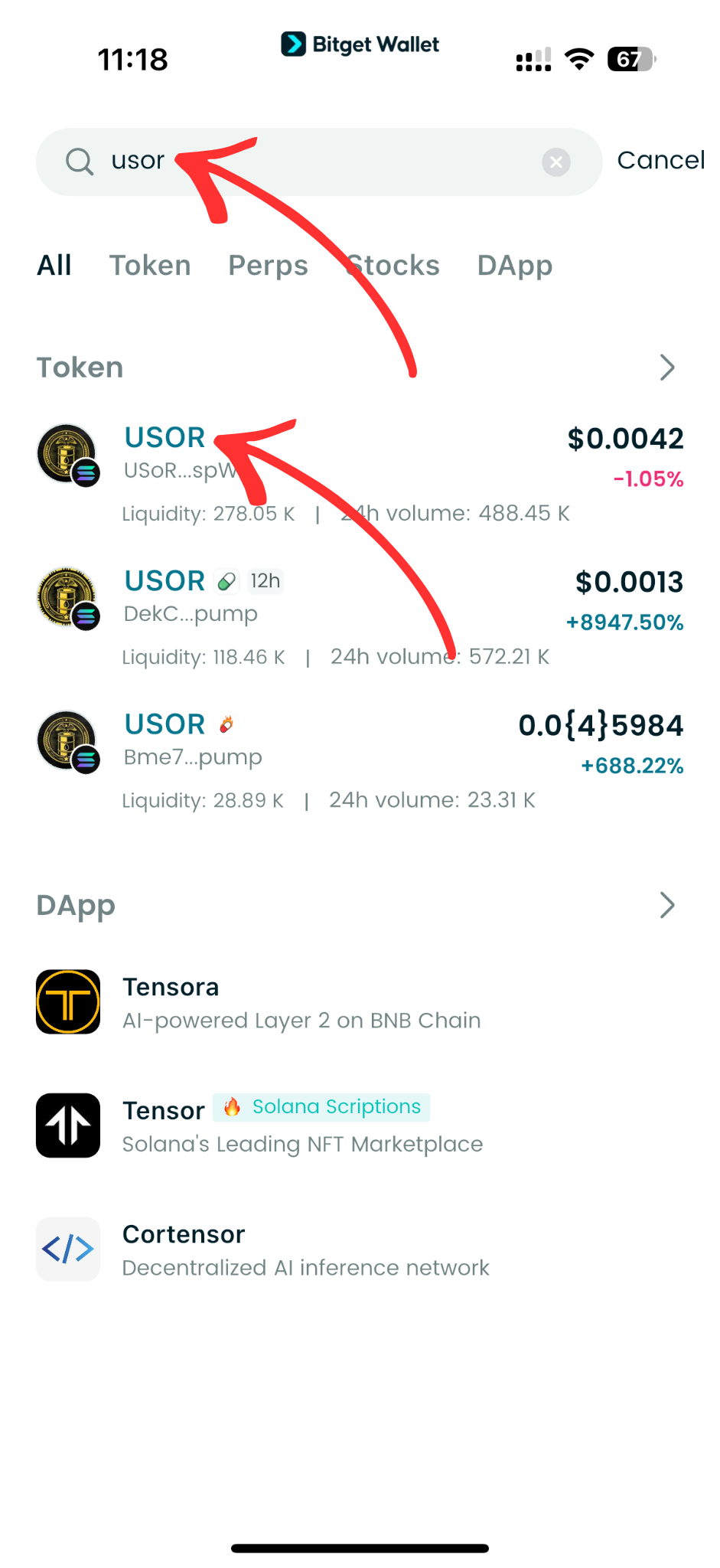

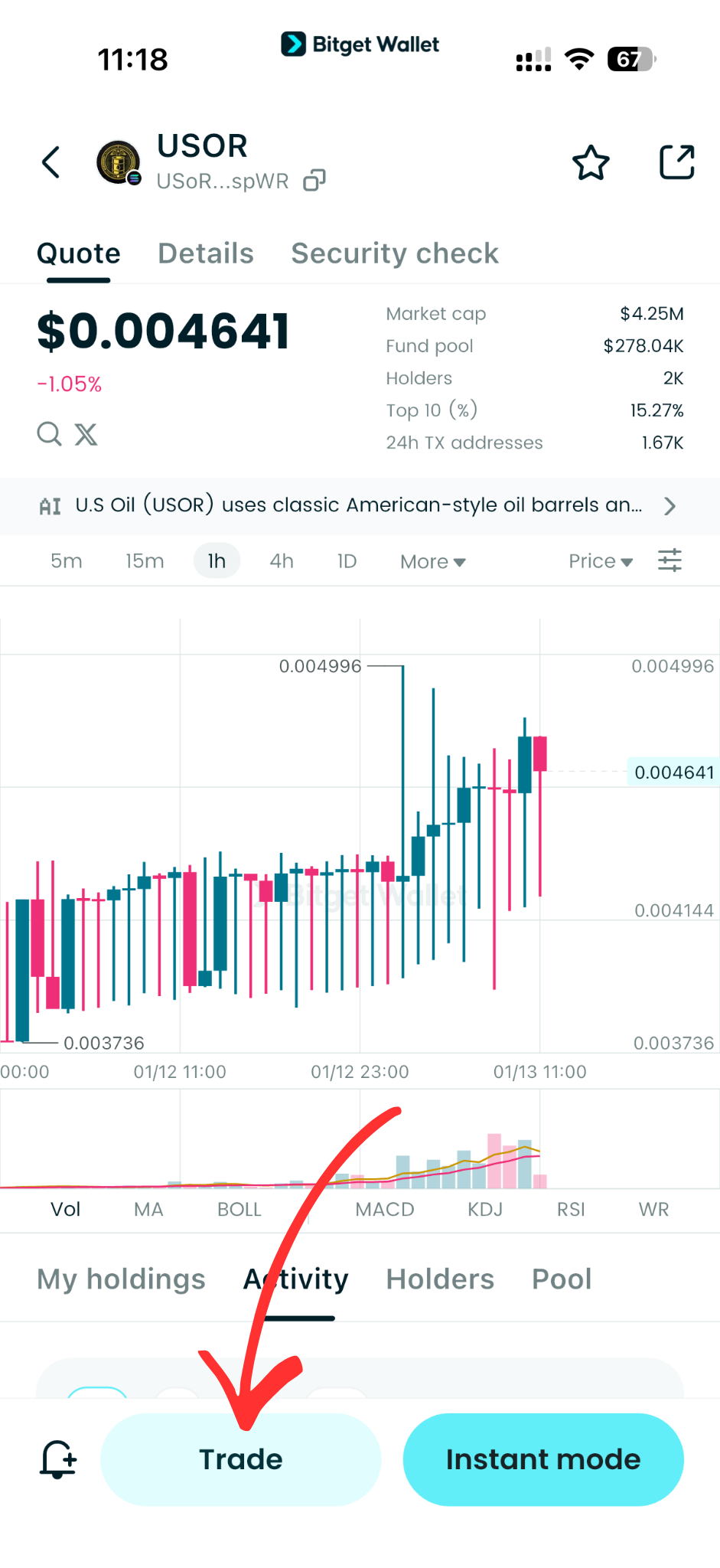

Step 3: Find U.S. Oil Reserve (USOR)

On the Bitget Wallet platform, go to the market area. Search for U.S. Oil Reserve (USOR) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Choose Your Trading Pair

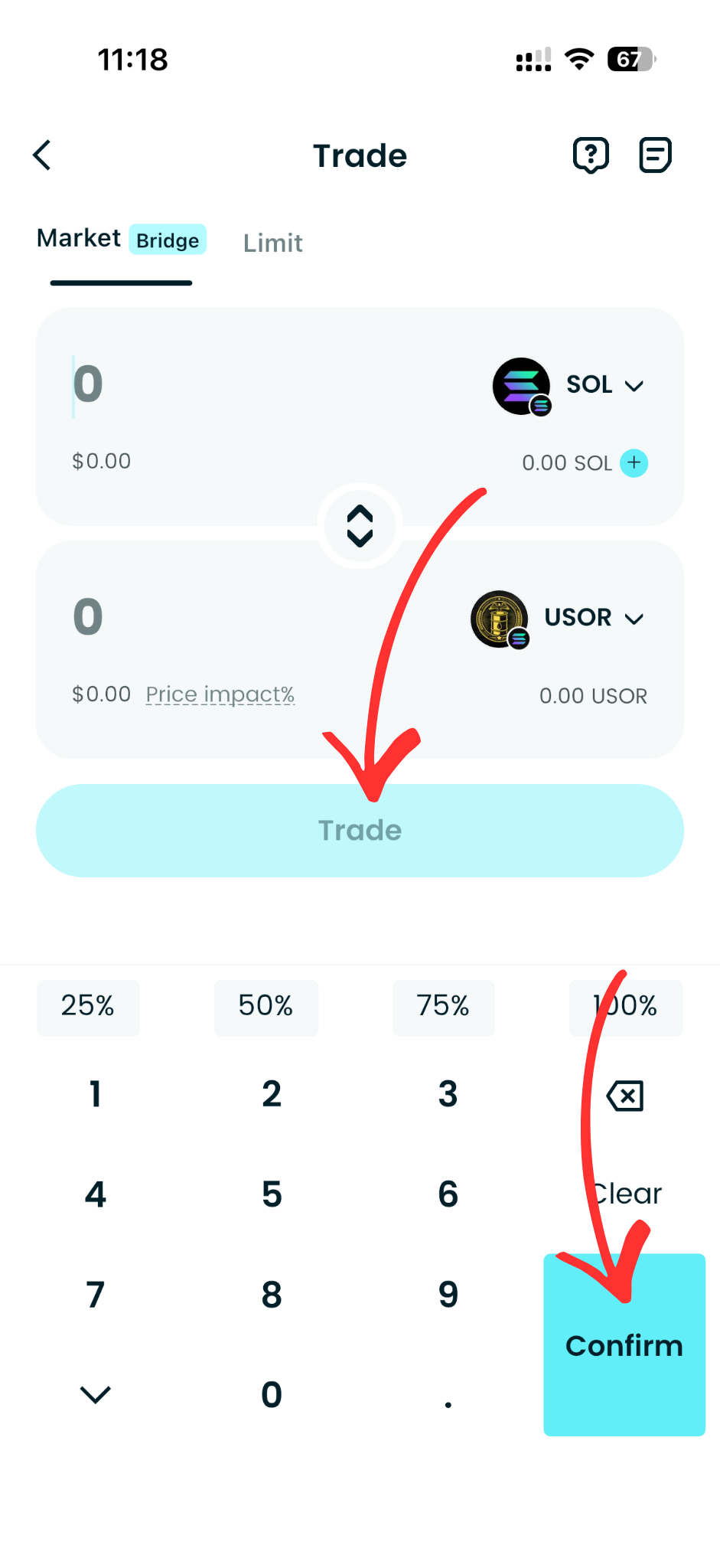

Select your trading pair you would like to deal with, for instance, USOR/USDT.

By doing this, you will be able to exchange U.S. Oil Reserve (USOR) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of U.S. Oil Reserve (USOR) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased U.S. Oil Reserve (USOR).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your U.S. Oil Reserve (USOR) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

▶Learn more about U.S. Oil Reserve (USOR):

What Should You Know About USOR Price Volatility?

USOR price volatility is driven primarily by sentiment and short-term momentum rather than fundamentals. As a narrative-driven crypto, USOR can experience rapid price increases followed by equally fast declines.

There are no guarantees of sustained value. Users should view volatility as a characteristic of speculative assets and avoid overexposure. Understanding on-chain liquidity behavior helps users interpret price movement more accurately.

How High Can USOR Go?

There is no fixed answer to how high USOR can go. Meme-style assets do not follow traditional valuation models, and price movement depends on community attention, liquidity depth, and broader market conditions.

Instead of focusing on price targets, users learning how to buy USOR should focus on understanding volatility, execution mechanics, and exit liquidity.

Is USOR Crypto Safe to Invest In?

Safety depends less on USOR itself and more on user behavior. Key risks include:

- Purchasing fake tokens

- Entering trades without liquidity awareness

- Overexposure to volatile positions

Learning how to buy USOR safely includes contract address verification, disciplined position sizing, and secure storage practices. No speculative crypto asset is risk-free.

How to Approach USOR Volatility With a Smarter Strategy?

A smarter approach to USOR emphasizes education over profit chasing. Users can:

- Observe on-chain liquidity behavior during active trading

- Practice with small position sizes

- Set clear capital limits

- Prioritize secure execution and discipline

This mindset helps users gain experience without unnecessary losses and builds skills applicable across decentralized trading environments.

How Can Bitget Wallet Help You Manage USOR After Buying?

After you buy USOR, effective asset management becomes critical. Bitget Wallet helps users manage USOR crypto by providing non-custodial control and on-chain transparency throughout the holding period.

With Bitget Wallet, users can:

- Store USOR securely in a non-custodial wallet with full control over private keys

- Maintain on-chain transparency, allowing users to track balances and transactions directly

- Transfer or manage USOR across supported networks without third-party restrictions

- Monitor holdings and respond quickly to market changes

By retaining custody and execution control, Bitget Wallet is well suited for managing speculative, narrative-driven crypto assets like USOR after purchase.

Conclusion

Understanding how to buy USOR goes beyond placing a trade. Users should know where to buy USOR, how to execute on-chain trades safely, and why USOR is a speculative, narrative-driven crypto asset subject to volatility.

Using a self-custody tool like Bitget Wallet allows users to manage USOR crypto with greater control, on-chain transparency, and reduced reliance on third parties. Bitget Wallet also offers added utility through Stablecoin Earn Plus, with up to 10% APY on supported stablecoins, and zero-fee trading on memecoins and selected RWA U.S. stock tokens.

Download Bitget Wallet to verify contracts, access on-chain liquidity, and manage USOR with Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to buy USOR safely as a beginner?

To buy USOR safely, beginners should use a non-custodial wallet to retain control of their assets, verify the official contract address before trading, and start with small position sizes.

2. Where can I buy USOR crypto?

Most users buy USOR crypto through on-chain decentralized trading, where swaps are executed directly from a non-custodial wallet. This method allows users to maintain custody of their assets while accessing transparent on-chain liquidity.

3. Is USOR backed by real oil?

No. USOR is not backed by real oil or physical reserves. Despite its name, U.S. Oil Reserve (USOR) is a narrative-driven crypto asset whose value is influenced by market sentiment rather than commodity fundamentals.

4. Is USOR crypto high risk?

Yes. USOR crypto is considered high risk due to its speculative nature, exposure to short-term momentum, and sensitivity to liquidity changes. Users should approach USOR with risk awareness and avoid overexposure.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy T-2049 in 2026: A Beginner’s Step-by-Step Guide to Token 20492026-03-03 | 5mins