Gemini Launched XRP Card: Reshaping the Crypto Rewards Landscape in 2026

In 2025, Gemini made major waves by introducing its XRP Edition of the Gemini Credit Card, marking a significant push into crypto rewards and real-world utility. Launched in partnership with Ripple and issued by WebBank under Mastercard’s World Elite program, the card offers up to 4% back in XRP, no annual or foreign transaction fees, and promotion with $200 XRP welcome bonuses for qualifying spenders.

This launch was strategically timed ahead of the Gemini IPO and further cemented Gemini’s Ripple partnership, positioning XRP not just as an investment asset but as a practical rewards currency for everyday spending. Crowdfund Insider

However, while the card has generated strong interest—especially among the XRP Army—users should also consider real-world user experience reports, operational limitations, and global accessibility constraints when comparing alternatives like the Bitget Wallet Card.

Key Takeaways

- Gemini launched XRP Card with Ripple is a milestone in crypto rewards, offering up to 4% XRP cashback, no annual or FX fees, and integration with the RLUSD stablecoin, positioning Gemini as a bold innovator ahead of its IPO.

- Despite strong user incentives and even briefly overtaking Coinbase in App Store rankings, Gemini faces profitability challenges, past trust issues (Earn collapse), and regional exclusivity—limiting global adoption and raising sustainability concerns.

- For users seeking a secure, versatile, and globally available crypto card, the Bitget Wallet Card offers broader multi-chain support, stablecoin-friendly payments, and a beginner-ready experience without U.S.-only restrictions.

Gemini and Ripple Partnership: A Strategic Alliance

An integral part of the Gemini × Ripple collaboration, the unveiling of the XRP Edition of the Gemini Credit Card marked a significant step toward integrating crypto rewards and real-world payments. More than a simple rewards product, this initiative has become a cornerstone of a broader strategic alliance aimed at mainstreaming blockchain-based settlement and stablecoin infrastructure.

- Ripple embeds real-world utility into XRP and RLUSD — By connecting XRP rewards with everyday transactions and expanding support for Ripple’s RLUSD stablecoin, Ripple continues its push to make crypto useful outside purely speculative markets.

- Gemini becomes a pioneering issuer — Gemini is among the first U.S. exchange-backed issuers to launch a credit card that rewards users in crypto (XRP), while also participating in pilots to settle transactions using a blockchain-native stablecoin.

This partnership further differentiates Gemini from competitors like Coinbase by combining stablecoin innovation, rewards in digital assets, and new settlement models. By tying rewards to XRP and expanding RLUSD integration, Gemini strengthens its narrative of innovation and ecosystem growth.

Source: X

How Much XRP Cashback Can Cardholders Earn Daily?

The Gemini launched XRP Card is truly unique among cards for XRP cashbacks, having different competitive tiers that separate it from traditional cards. Holders are allowed to earn:

- 4% XRP cashback on gas stations and EV charging.

- 3% XRP cashback on dining and restaurants.

- 2% XRP cashback at grocery stores.

- 1% XRP cashback on every other spending category.

Some selected partner merchants of the card are giving customers up to 10% XRP rewards on top of the card’s cashback, among the best-kept crypto rewards programs offered in 2025. This tiered rewards system allows every cardholder to get XRP rewards for every other spending, proving once again the value of the Gemini Ripple Partnership in optimizing and humanizing new technology.

Are There Fees, Eligibility Limits, or Hidden Charges?

One of the strongest selling points of the Gemini-launched XRP Card is its transparent fee structure. According to official details, cardholders enjoy:

- No annual fee, aligning with traditional premium rewards cards.

- No foreign exchange fees, making it travel-friendly.

- No crypto withdrawal fees, ensuring earned XRP is fully accessible.

However, the XRP Cashback Card does come with eligibility limitations:

- Currently available only in the U.S. and Puerto Rico.

- Applicants must meet creditworthiness standards, as the card is issued under Mastercard’s U.S. framework.

This balance of high rewards with low costs makes the Gemini XRP Card attractive, but its regional exclusivity limits adoption for international users compared to global alternatives like the Bitget Wallet Card.

How Is Gemini Leveraging Ripple and RLUSD in 2025?

Gemini’s strategy around Ripple and RLUSD has evolved significantly beyond the launch of the XRP Credit Card in 2025, moving into deeper blockchain integration and stablecoin settlement infrastructure as 2026 approaches.

Gemini disclosed significant net losses in the first half of 2025—over $282 million—while revenue declined year-over-year. These financial headwinds make external financing important to support day-to-day operations and strategic initiatives while approaching a public market debut. The credit line acts as a financial runway, giving Gemini flexibility in managing cash flow and credit card receivables tied to products like the XRP Credit Card

Why Did Ripple Extend $150M Credit to Gemini?

Gemini’s SEC S-1 IPO filing reaffirmed that the exchange entered a secured revolving credit agreement with Ripple Labs, beginning with a $75 million facility that may be increased up to $150 million based on performance triggers. This credit line is collateralized and carries interest, and serves as a strategic financing tool as Gemini positions itself for a Nasdaq listing under the ticker GEMI.

Additionally, once Gemini exceeds the initial borrowing amount, the agreement allows borrowing in RLUSD stablecoin, embedding Ripple’s token deeper into Gemini’s financial infrastructure.

How Is RLUSD Expanding Across Gemini’s Trading Pairs?

Since its initial deployment on Gemini in 2025, RLUSD (Ripple USD) has seen significant expansion in utility and accessibility across the platform, beyond simply acting as an optional base currency for trading

Simultaneously with the credit agreement, Gemini expanded the utility of RLUSD (Ripple USD), positioning it as a base currency for all U.S. spot trading pairs on its platform. This enables users to trade directly in RLUSD without additional conversion steps, streamlining access and reducing fees. The introduction of RLUSD also prompted immediate market activity: following its listing that enabled trading, deposits, and withdrawals, RLUSD experienced a remarkable 24-hour volume surge of 63.7%, accompanied by a market cap increase of over 300% in 2025, highlighting burgeoning adoption and liquidity.

Is the Gemini XRP Card a Game-Changer for Users?

Gemini’s XRP Edition Credit Card is proving to be more than just a novel crypto rewards mechanism, it’s reshaping user engagement by delivering strong financial results and temporarily shifting the competitive landscape against Coinbase.

What Growth Results Did XRP Card Rewards Deliver?

When Gemini launched XRP Card, one of its strongest selling points was the rewards program. According to Gemini and industry trackers like Crypto Briefing and PaymentsJournal, cardholders who selected XRP as their rewards currency and held those rewards for at least one year saw their value grow by +453% as of July 27, 2025. This ROI made XRP the most lucrative reward option compared to other supported digital assets, strengthening the card’s appeal among long-term crypto users.

Did the Gemini XRP Card Impact Coinbase’s Market Dominance?

Ever since Gemini released this XRP Card, it became very close to dethroning the top app in the crypto marketplace, Coinbase. According to Sensor Tower, "Gemini's mobile app was a surprise winner in engagement as it shot to 16th position in user downloads in the U.S. App Store in the finance category, compared to Coinbase that fell to 20th position." However, regardless of this forced visibility for Gemini, Coinbase still has considerably higher daily transaction volume, and it's completely present as the dominant player in the market.

What Are the Risks and Limitations of Gemini’s Approach?

Gemini’s bold strategies—from launching the XRP Card to leveraging its Ripple partnership—come with significant financial and reputational risks. Below are the key concerns that users and investors should consider.

How Does Gemini’s Profitability Challenge Affect Users?

Gemini’s financials have continued to reflect significant profitability challenges as it transitions through product expansion, costly marketing campaigns, and its IPO process. According to regulatory filings and the company’s first public quarterly earnings reports, these pressures have real implications for users, investors, and long-term confidence in the platform.

These numbers suggest that, despite its innovations, Gemini is operating under intense financial stress. This raises concerns:

- Card sustainability: Will rewards programs like the XRP Card remain viable if profitability doesn't improve?

- Issuer reliability: Users may worry about Gemini’s ability to support long-term benefits if ongoing losses persist.

- IPO risk: A weak financial footing entering public markets could limit future investments or strategic flexibility.

What Lessons Came from the Gemini Earn Collapse?

Gemini’s ill-fated Earn program, which let users deposit assets to earn interest via partner Genesis, ended disastrously when Genesis declared bankruptcy. Gemini had to commit to returning over $1.1 billion to affected users and pay a $37 million fine, plus $40 million in contributions to the Genesis bankruptcy proceedings.

Ultimately, Gemini succeeded in reimbursing users—returning their assets in kind, including appreciation, leading to an estimated $2.18 billion in recoveries. However, this chapter revealed key operational shortcomings:

- Due diligence lapses: Gemini failed to properly vet its lending partner, a third party that was ultimately unregulated and financially unstable.

- Trust erosion: This incident severely dented user confidence—especially relevant now as the company pushes a crypto-based credit product like the XRP Card.

- Regulatory scrutiny: The fallout triggered investigations and regulatory backlash, highlighting the importance of safety and oversight in financial innovation.

How to Apply Bitget Wallet Card?

The world is changing, and so is the way we use money. For too long, crypto holders have been limited by high fees, clunky interfaces, or confusing top-up models. We set out to change that. Hence, we're thrilled to introduce the Bitget Wallet Card, now officially live for users in the United Kingdom and the European Union.

In partnership with Mastercard and crypto payments provider Immersve, this card is a big step forward in making crypto a practical part of everyday life. With it, you can spend your crypto as easily as fiat—online, in stores, wherever Mastercard is accepted. There's no need to fuss over complicated conversions, top-up fees, and failed transactions.

What Makes the Bitget Wallet Card Special

The Bitget Wallet Card is designed to remove the friction that's stopped many people from using crypto in real life. Powered by onchain swaps and deposits, the card lets you spend directly from your wallet with zero annual fees and no top-up requirements. It's fast, flexible, and fully integrated with your daily life.

You can apply in minutes, add the card to Apple Pay or Google Pay, and start using it instantly at millions of Mastercard-enabled merchants around the world. And yes, this includes both online and in-store purchases.

Here's some of the key features of the Bitget Wallet Card:

- Sign up in minutes: No credit checks or staking required. Just sign up with your ID or passport.

- Convenient payments: Add your card to Apple Pay or Google Pay for everyday spending.

- Low fees, high value: No annual fees, no top-up fees, and competitive exchange rates.

- Spend anywhere: Make payments at any merchant that accepts Mastercard.

- Real-time funding: Top up with onchain deposits and multichain swaps, instantly.

- Extra perks and more:

- Earn up to 8% APY on staked stablecoins

- Enjoy cashback bonuses during your first 30 days

All transactions are settled directly onchain, powered by Immersve's infrastructure and Mastercard's regulatory framework, including full KYC and AML compliance.

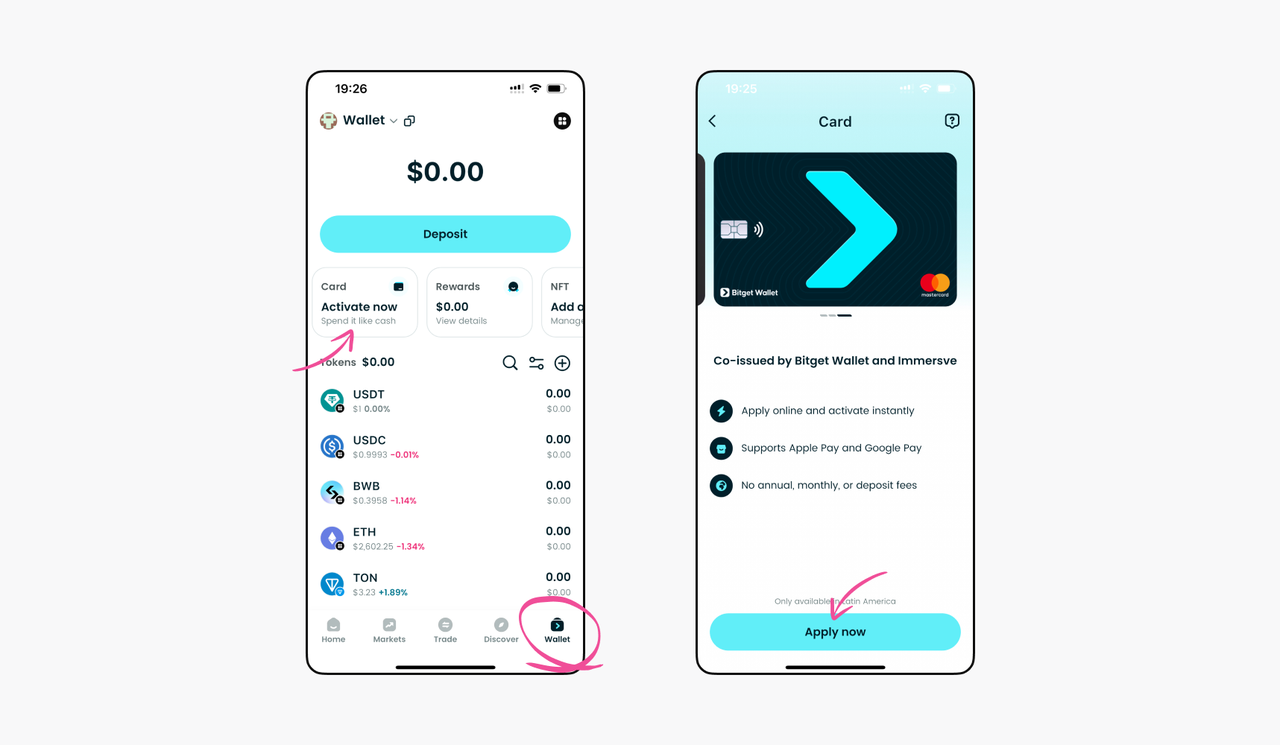

How to Apply for the Bitget Wallet Card

Getting started takes just a few simple steps:

1. Download Bitget Wallet to Apply

[Download the Bitget Wallet app](https://web3.bitget.com/en/wallet-download?) and head to Wallet > Card > Apply now.

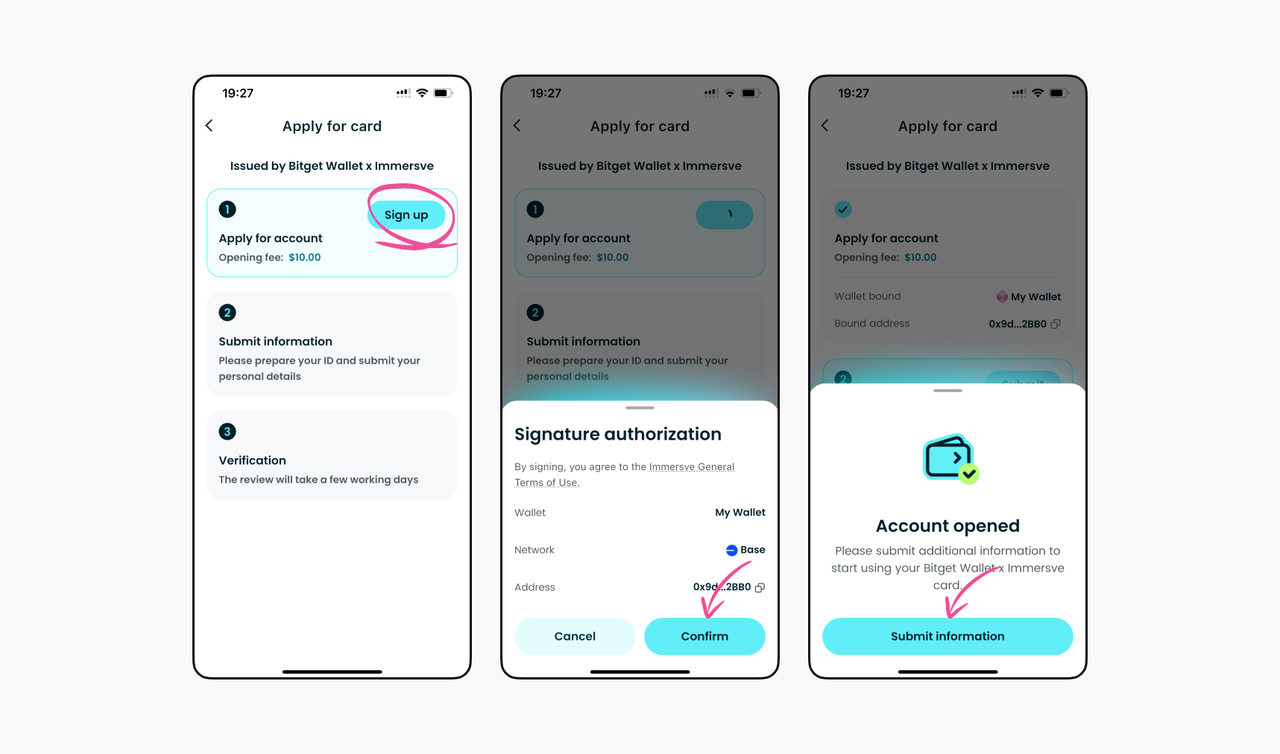

2. Sign up for an account

Click Sign up and sign the transaction to create your card account. An opening fee of 10 USDC applies.

3. Submit your personal information

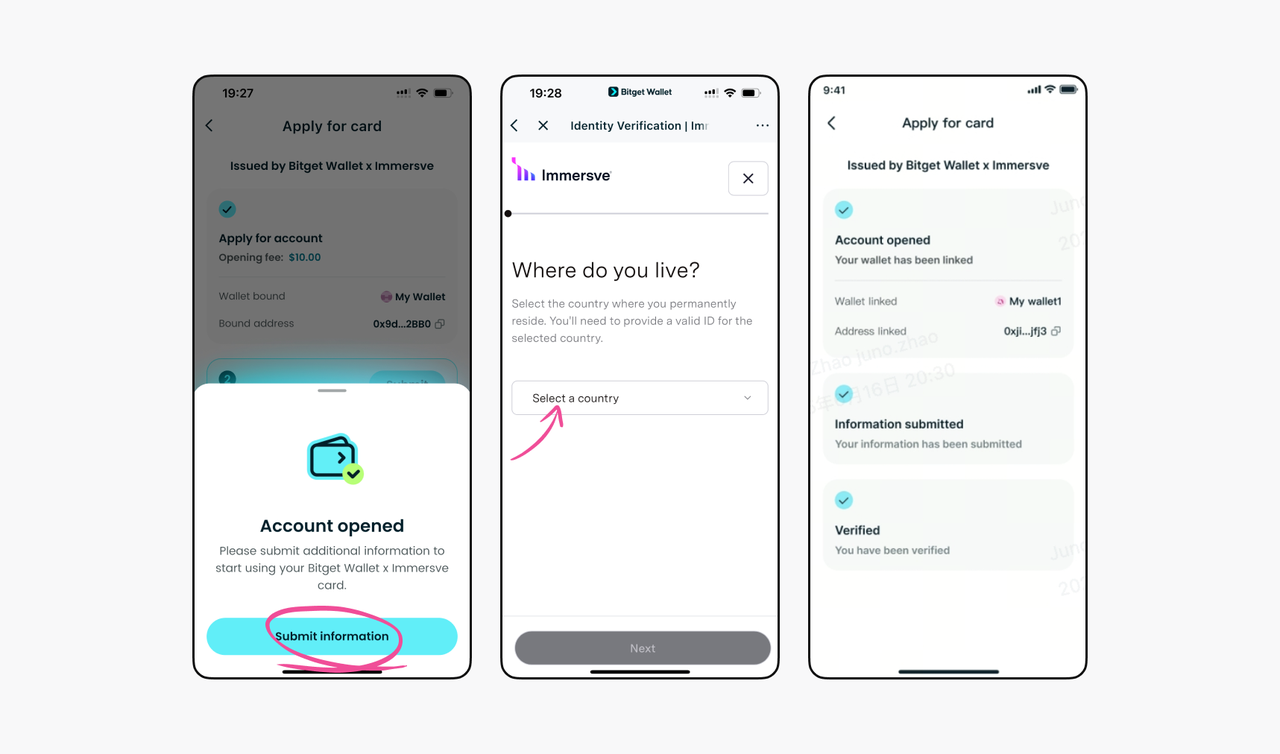

Once your account is opened, you'll be redirected to submit personal information such as your country, address, contact details, and estimated monthly spend.

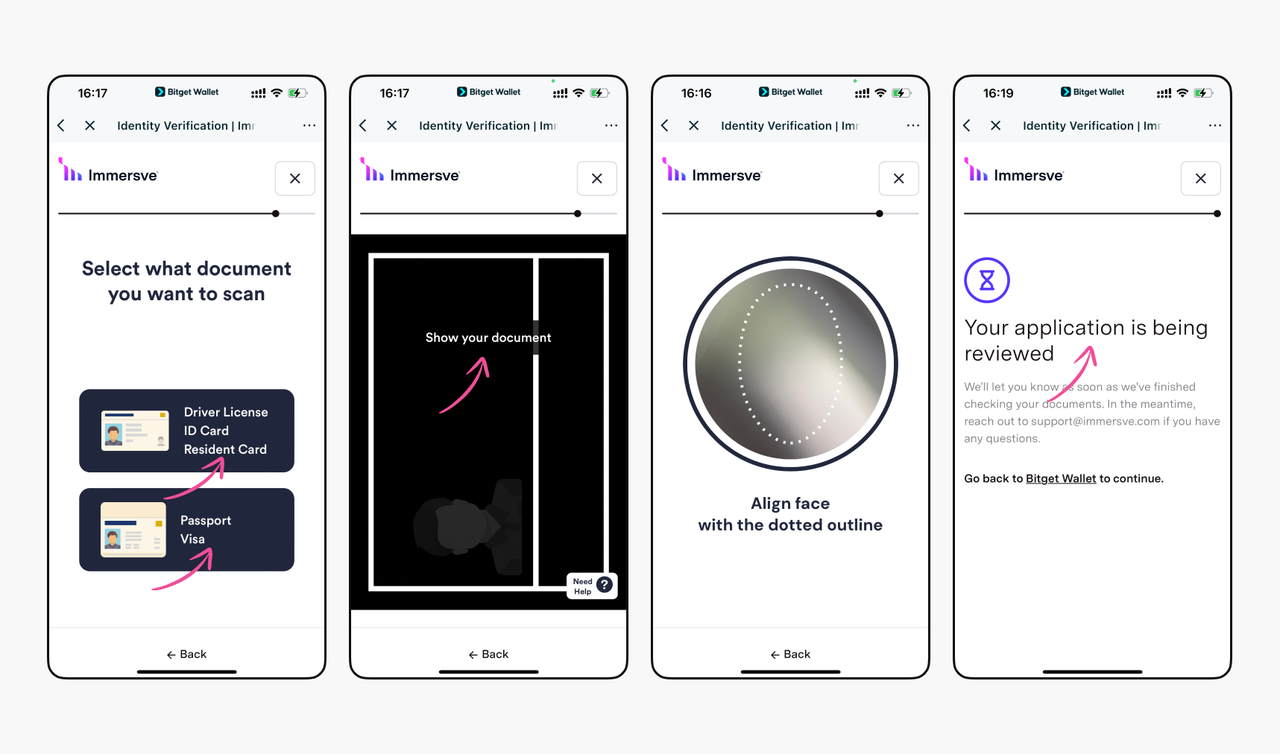

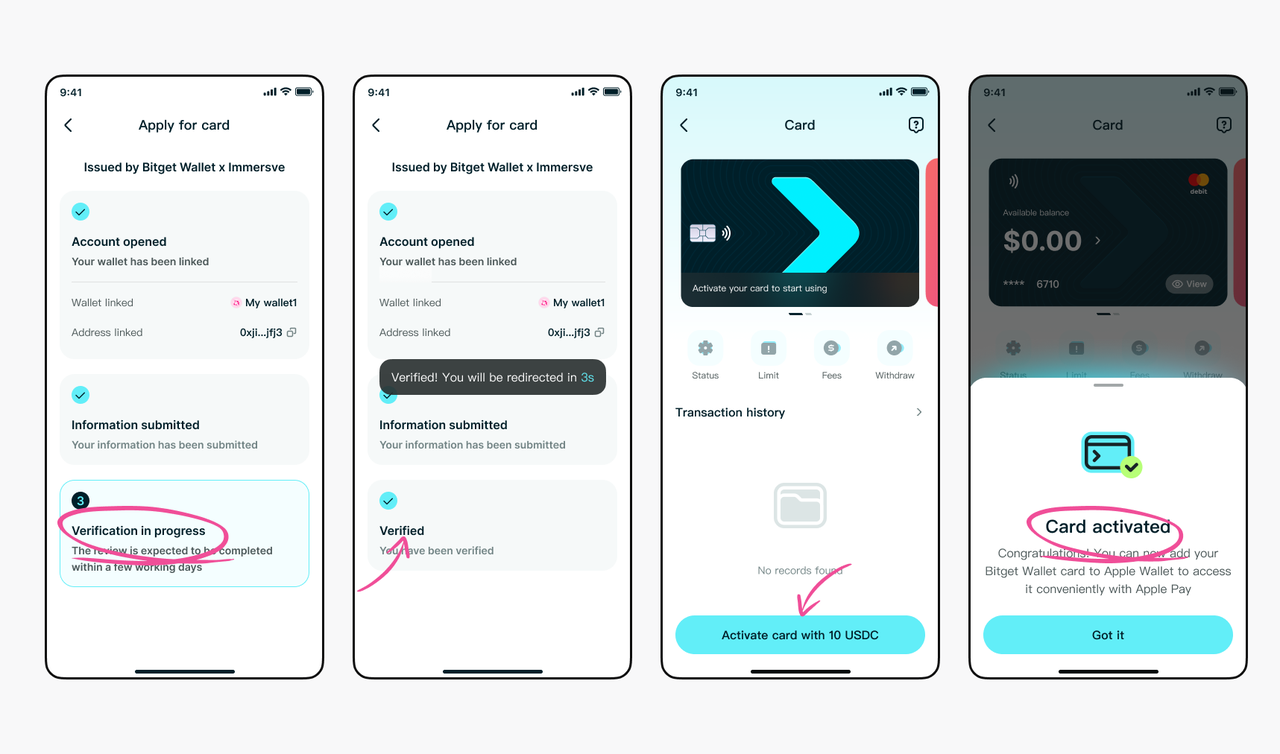

4. Verify your identity

You'll then need to verify your identity by uploading a valid ID (passport, driver's license, or national ID) and completing a quick face verification. Most applications are approved within 3 minutes.

5. Activate your card

After verification is complete, you can activate your card by paying the 10 USDC issuance fee. Once done, you can view your digital card details and add it to Apple Pay or Google Pay.

How to Add your Bitget Wallet Card to Google Pay/Apple Pay

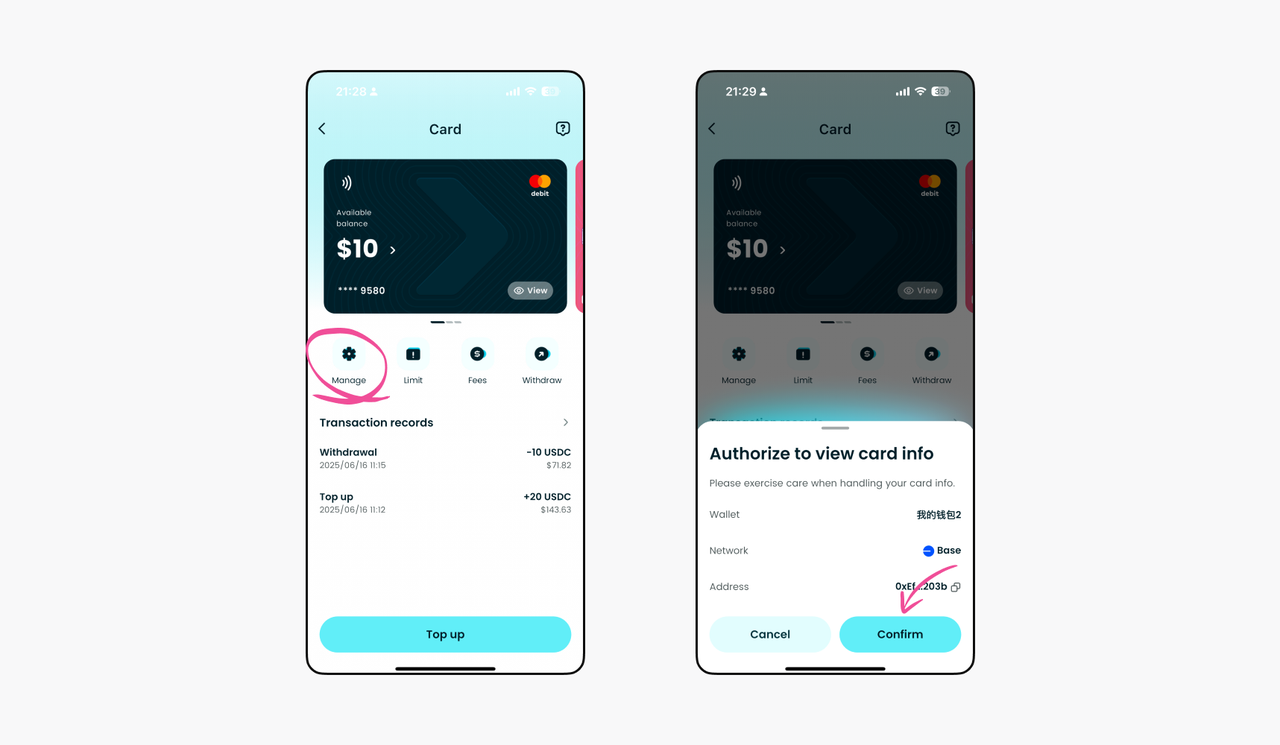

1. View your card details

To view your card details, click Manage > View card info, and then select Confirm to view the full card details.

2. Enter card details on Apple Pay/Google Pay

Once you've accessed your card details in the Bitget Wallet app, you can copy the card details and head over to Google Pay or Apple Pay to add your Bitget Wallet Card to key them in manually.

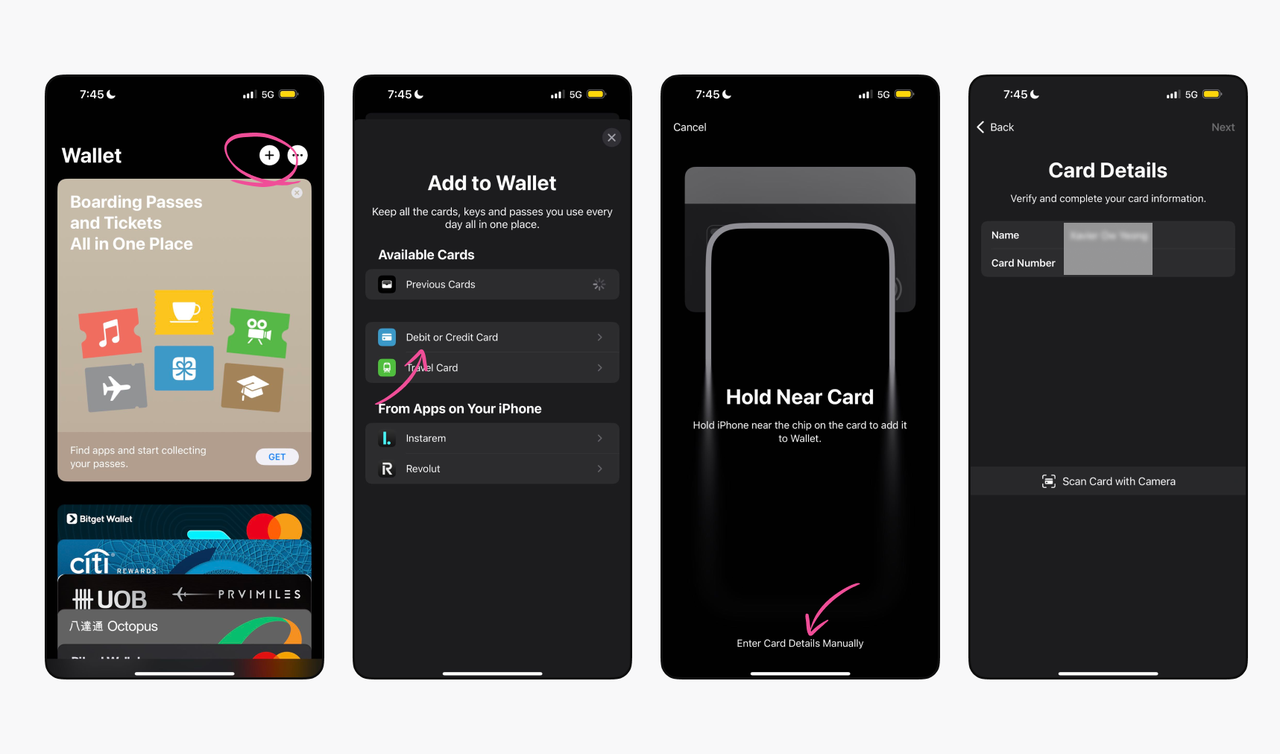

For Apple Pay:

Open your Apple Pay app and tap the + at the top-right corner to add a new card. Select Debit or Credit Card > Enter Card Details Manually. Enter your credit card number and follow through with the verification steps. Once your card has been successfully added, you can start spending it immediately!

For Google Pay:

Open your Google Wallet app and tap Add to Wallet > Payment card > New credit or debit card to add a new card. Select or enter details manually, enter your credit card number, and follow through with the verification steps. Once your card has been successfully added, you can start spending it immediately!

How to Top-up your Bitget Wallet Card

While Gemini launched XRP Card focuses on U.S.-only availability, the **Bitget Wallet Card** offers a more global and beginner-friendly alternative. To top up your Bitget Wallet Card, tap Top up, enter the amount of USDC (Base) you want to add, and click Confirm. The funds will appear instantly in your card’s available balance, and you can start using your Bitget Wallet Card for payments right away.

Exclusive for the First 2,000 Cardholders: 5% BGB Cashback

Unlike the Gemini launched XRP Card rewards up to 4% cashback structure limited to categories like dining or gas, Bitget Wallet is rolling out a special campaign for early adopters:

Earn 5% BGB cashback on purchases made with your Bitget Wallet Card.

Who is eligible:

- Only available from June 25, 2025, to September 30, 2025, for the first 2,000 users to complete KYC and activate their Bitget Wallet Card.

- Offer applies to new users (first-time Bitget Wallet Card applicants) only.

- During the first 3 months, new users can receive 5% BGB cashback on purchases capped at $200 monthly spend, with a maximum cashback of 10 USDT per month, distributed as BGB to your wallet.

When is cashback calculated:

- You start accumulating cashback from the first full calendar month after your card is approved and activated. Sign-up opens June 25, 2025.

Reward distribution:

- Cashback will be airdropped to your Bitget Wallet address linked to your card by the 3rd of each month. (For example, if you activate your card on July 1, your July cashback will be airdropped by August 3.)

Eligible Regions:

- This campaign is available for users in: United Kingdom, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Sweden.

What's Next

We're starting with the EU and UK with many other countries in the pipeline. The Bitget Wallet Card will soon roll out in Latin America, Australia, and New Zealand. As we expand, so will the features: more rewards, more currencies, more ways to use your crypto anywhere, anytime. Crypto is evolving. It's no longer just something you trade, it's something you live with. And with the Bitget Wallet Card, that future is already here.

So it's time to spend your crypto like cash.

About Bitget Wallet

Bitget Wallet is a non-custodial crypto wallet designed to make crypto simple and secure for everyone. With over 80 million users, it brings together a full suite of crypto services, including swaps, market insights, staking, rewards, DApp exploration, and payment solutions. Supporting 130+ blockchains and millions of tokens, Bitget Wallet enables seamless multi-chain trading across hundreds of DEXs and cross-chain bridges. Backed by a $300+ million user protection fund, it ensures the highest level of security for users' assets. Its vision is Crypto for Everyone — to make crypto simpler, safer, and part of everyday life for a billion people.

Conclusion

Gemini launched XRP Card with Ripple in 2025, introducing compelling XRP cashback rewards and signaling bold crypto-fueled innovation. At first glance, the Gemini launched XRP Card appears groundbreaking—with up to 4% back in XRP, zero fees, and RLUSD integration promising both upside and stability. Yet, Gemini’s substantial $282.5M loss in H1 2025, the Gemini Earn saga, and the card’s restriction to the U.S. and Puerto Rico raise valid concerns about long-term reliability and accessibility.

For those seeking a global, cross-chain, and beginner-friendly crypto card, the Bitget Wallet Card emerges as a smarter alternative. With legal licenses in the EU and Asia, seamless wallet integration, competitive fees, stablecoin staking perks, and no top-ups or monthly charges, it offers flexibility and security in one package.

Own your Web3 journey easily with [Bitget Wallet](https://web3.bitget.com/en/wallet-download?) Card — secure, fast, and beginner-ready. Spend stablecoins globally and trade trending tokens in one seamless app.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

Can I apply for the Gemini XRP Card outside the US?

No, eligibility is limited to residents of the U.S. and Puerto Rico only.

What is the difference between Gemini XRP Card and Bitget Wallet Card?

The Gemini launched XRP Card offers U.S.-exclusive XRP cashback, zero fees, RLUSD support, but limited geography.

The Bitget Wallet Card provides global availability, multi-chain crypto functionality, integrated wallet convenience, and low fees.

Does the Gemini XRP Card pay out rewards instantly?

Yes, XRP rewards are deposited instantly into your Gemini account right after each purchase.

Which crypto card is better for stablecoin payments?

The Bitget Wallet Card excels with native stablecoin support (like USDT), seamless on-chain digital-to-fiat conversion, and staking options—making it more optimized for everyday stablecoin use.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Crypto's Halloween Rally: 5 Best Cryptos to Haunt Before Christmas 20262025-10-24 | 5 mins