WLFI Token Buyback: How World Liberty Financial Uses Treasury Unlocks?

The WLFI Token Buyback strategy by World Liberty Financial is a governance-driven initiative designed to enhance ecosystem stability and investor confidence. By leveraging treasury reserves and the native USD1 stablecoin, WLFI implements structured buybacks that reduce circulating supply, support liquidity, and incentivize community participation. Users can safely monitor and participate in WLFI buybacks via Bitget Wallet, which provides secure tracking of governance proposals, USD1 flows, and token trading. This integration ensures transparency, accessibility, and long-term ecosystem growth, setting WLFI apart from typical speculative token buybacks.

Key Takeaways

- WLFI token buybacks are a structured method to reduce circulating supply while signaling governance discipline.

- USD1 stablecoin acts as both a buyback medium and liquidity tool within the ecosystem.

- Community governance plays a key role in treasury unlocks and buyback execution.

WLFI Token Buyback: How It Works and Its Impact on USD1 and Governance?

WLFI token buybacks are designed to remove tokens from circulation gradually, maintaining market stability and signaling confidence. Unlike token burns or random treasury allocations, WLFI buybacks actively redistribute treasury resources using USD1 stablecoins to enhance liquidity and ecosystem participation.

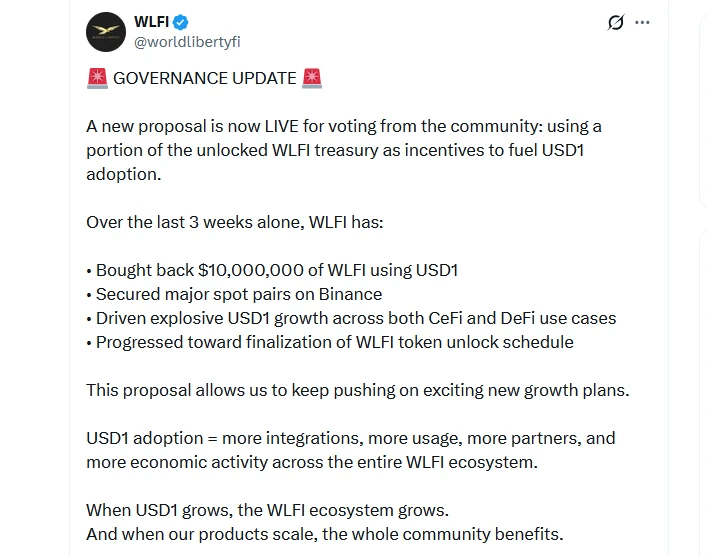

Source X

Key Mechanisms Behind WLFI Token Buyback

The WLFI token buyback strategy follows a structured approach to maintain transparency and community trust:

- Treasury Allocation: A fixed percentage of the treasury is earmarked for buybacks, ensuring a steady supply reduction.

- USD1 Integration: Buybacks are executed using USD1 stablecoin, maintaining ecosystem liquidity and reducing volatility.

- Governance Approval: Token holders vote on buyback amounts and timing through governance proposals.

- Market Signaling: Buybacks demonstrate disciplined treasury management, boosting investor confidence.

By combining these mechanisms, WLFI ensures that buybacks support long-term ecosystem growth rather than short-term price speculation.

How Does the WLFI Treasury Unlock Work in Practice?

WLFI treasury unlocks are central to the buyback strategy. The community can approve proposals, such as unlocking 5% of the treasury for buybacks, through a governance vote. This process ensures that treasury use is transparent and aligns with both protocol sustainability and ecosystem incentives.

How Much WLFI Is Allocated to the Treasury?

The size of the WLFI treasury matters significantly for protocol credibility:

- Total treasury holdings are sufficient to support multiple buyback events without depleting reserves.

- A large treasury strengthens community confidence in long-term ecosystem sustainability.

- Funds are allocated in phases to match ecosystem needs and governance decisions.

- Treasury allocation supports both buyback events and broader USD1 ecosystem development.

How Are Treasury Unlock Decisions Governed?

Treasury unlocks are subject to transparent governance processes:

- Community votes determine whether to unlock specific treasury percentages.

- Voting options include “for,” “against,” and “abstain,” reflecting stakeholder preferences.

- Execution follows the governance-approved timeline, ensuring clarity and accountability.

- Decisions are communicated transparently, promoting community trust and engagement.

How Is USD1 Used in the WLFI Token Buyback Strategy?

USD1 stablecoin serves as a core instrument for buybacks and ecosystem liquidity management. By using USD1, WLFI maintains buyback efficiency and creates internal liquidity loops for staking, governance, and platform operations.

Source X

Why Use a Native Stablecoin for Buybacks?

There are several advantages to using USD1 in buybacks:

- Capital Efficiency: Reduces reliance on external liquidity sources.

- Internal Economic Loop: Funds circulate within the WLFI ecosystem, enhancing token utility.

- Market Stability: Avoids sudden disruptions in WLFI trading.

- Platform Integration: Supports staking and liquidity programs across DeFi and CeFi platforms.

How Does USD1 Adoption Affect WLFI Ecosystem Demand?

The adoption of USD1 impacts both liquidity and governance participation:

- Encourages staking and liquidity provision within WLFI protocols.

- Enhances demand for tokens through CeFi and DeFi partnerships.

- Promotes active engagement with governance decisions.

- Supports long-term ecosystem growth and token circulation balance.

Read more: How to Buy USDC/USDT via Bitget Wallet via Mercuryo with 0% Fees

What Happened During the $10M WLFI Token Buyback?

WLFI executed a structured $10M buyback to support supply management and demonstrate treasury discipline. Execution focused on transparency and gradual market impact rather than speculative price movements.

How Was the Buyback Executed Over Time?

The buyback was implemented in multiple phases to maintain market balance:

- Gradual purchase of WLFI tokens across exchanges.

- Controlled token supply removal to reduce inflation.

- Treasury-managed execution aligned with governance-approved schedules.

- Monitoring of liquidity and market depth to avoid sudden shocks.

What Signals Did the Buyback Send to the Market?

Buybacks sent clear signals to the community and market participants:

- Demonstrated strong treasury discipline and responsible governance.

- Showed commitment to long-term ecosystem sustainability.

- Increased confidence among investors in the WLFI ecosystem.

- Reinforced protocol transparency and stakeholder trust.

How Does the WLFI Token Buyback Compare to Other Crypto Buybacks?

WLFI token buybacks focus on governance oversight and integration with USD1 stablecoin. Compared to other buyback strategies, WLFI emphasizes:

- Structured execution rather than opportunistic market timing.

- Transparent treasury and governance communication.

- Ecosystem utility and long-term participation.

- Controlled supply reduction aligned with community consensus.

What Are the Risks and Limitations of WLFI Token Buybacks?

Buybacks provide strategic benefits but come with certain limitations:

- Buybacks do not guarantee token price growth.

- Treasury sustainability must be carefully managed.

- Market conditions may affect execution effectiveness.

- Low governance participation may limit buyback impact.

- Oversized unlocks could compromise long-term ecosystem stability.

What Are the Risks and Limitations of WLFI Token Buybacks?

Buybacks provide strategic benefits but come with certain limitations:

- Buybacks do not guarantee token price growth.

- Treasury sustainability must be carefully managed.

- Market conditions may affect execution effectiveness.

- Low governance participation may limit buyback impact.

- Oversized unlocks could compromise long-term ecosystem stability.

How Can Users Safely Monitor and Participate in WLFI-Related On-Chain Activity Using Bitget Wallet?

Bitget Wallet allows users to track, manage, and participate in WLFI governance safely:

- Track governance proposals for treasury unlocks.

- Monitor USD1 stablecoin flows and liquidity changes.

- Engage with DeFi protocols while retaining full custody of assets.

- Multi-chain support ensures participation across networks.

- Non-custodial security prevents third-party exposure during buybacks.

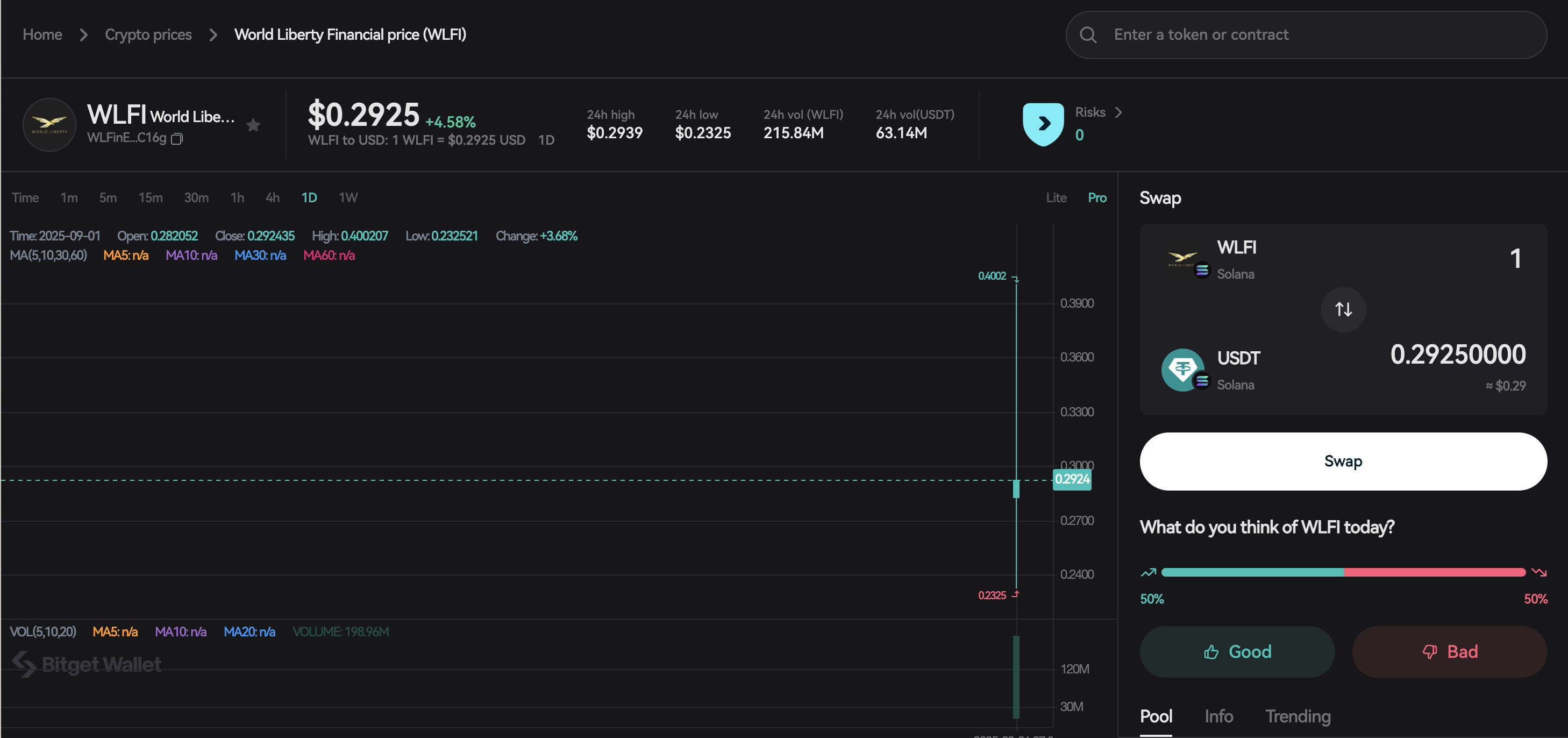

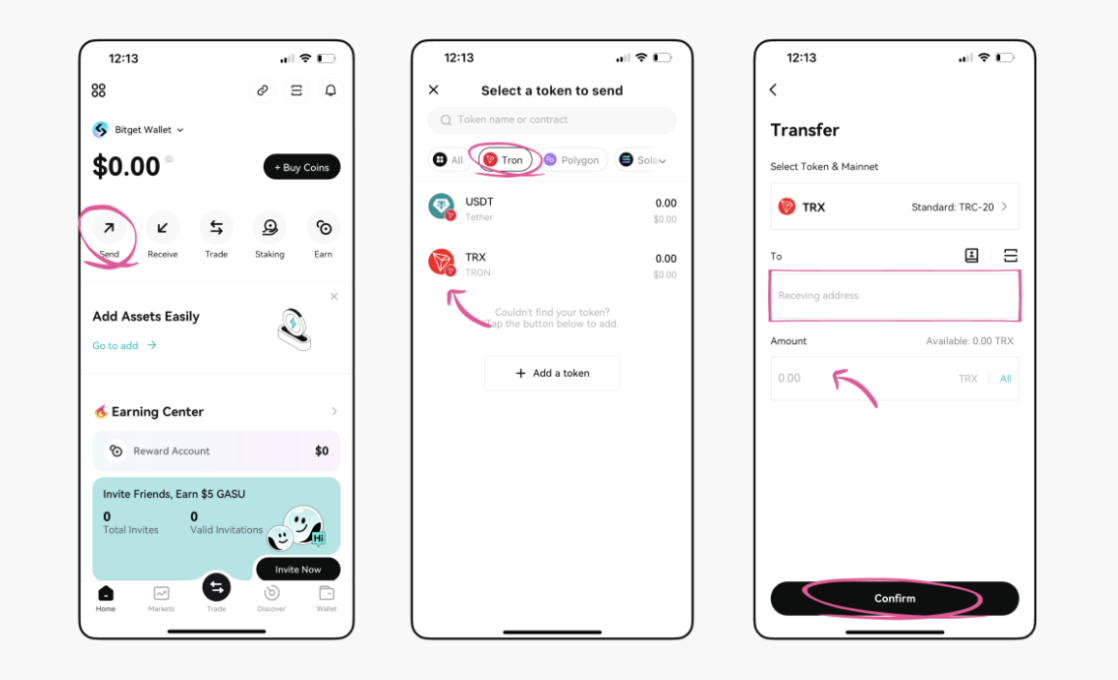

How to Buy WLFI Token (WLFI) on Bitget Wallet?

Trading World Liberty Financial (WLFI) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading World Liberty Financial (WLFI).

Step 3: Find World Liberty Financial (WLFI)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find World Liberty Financial (WLFI). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as [Token Name]/USDT. This will allow you to trade World Liberty Financial (WLFI) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of World Liberty Financial (WLFI) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired World Liberty Financial (WLFI).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your World Liberty Financial (WLFI) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶Learn more about World Liberty Financial (WLFI):

- What is World Liberty Financial (WLFI)?

- What to Know about WLFI Listing: Date, News, and Investor Updates

- World Liberty Financial (WLFI) Listing Date and How to Buy It

- WLFI Token Unlock Schedule: Key Dates, Vesting Periods, and Price Impact

- Where to Buy WLFI Tokens: Beginner’s Step-by-Step Trading Guide

Conclusion

In summary, WLFI Token Buybacks showcase how strategic treasury management can strengthen market confidence and promote ecosystem sustainability. By integrating USD1 stablecoins, leveraging transparent governance, and executing phased buybacks, World Liberty Financial ensures long-term token stability while supporting community incentives.

Users can safely monitor, participate, and trade WLFI using Bitget Wallet, engaging directly in governance proposals and ecosystem activities. This disciplined approach underscores WLFI’s commitment to sustainable growth, transparent operations, and active community involvement, making it a model for responsible crypto treasury management.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

Question 1: What is a WLFI Token Buyback?

A WLFI Token Buyback is a governance-led strategy where World Liberty Financial uses treasury reserves and USD1 stablecoins to reduce circulating supply, support liquidity, and strengthen market confidence.

Question 2: How can I participate in WLFI buybacks?

You can participate in WLFI buybacks by tracking governance proposals, voting on treasury unlocks, and trading WLFI tokens securely using Bitget Wallet.

Question 3: Why does WLFI use USD1 for buybacks?

USD1 stablecoins ensure capital efficiency, maintain ecosystem liquidity, reduce market volatility, and create internal economic loops that support staking and governance participation.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Fabric Airdrop Guide: How to Participate and Claim $ROBO Rewards2026-03-03 | 5mins

- Can I Buy World Cup Ticket with Cryptocurrencies?2026-03-02 | 5mins

- How to Buy CHZ in 2026: A Beginner’s Step-by-Step Guide to Chiliz2026-03-02 | 5mins