What Is StakeStone? How to Buy $STO, the Core of Cross-Chain Yield Farming

StakeStone (STO) listing is around the corner! Breaking news for crypto traders and enthusiasts! StakeStone (STO), a decentralized omnichain liquidity infrastructure designed to optimize yield generation and liquidity distribution across all of the blockchain networks, is officially launching on Bitget.

Starting April 3, 2025 (UTC), users can trade $STO under the trading pair STO/USDT. This marks a huge step for the StakeStone (STO) community and opens up new opportunities for traders worldwide. This article explores everything you need to know about the $STO listing, including how to trade it, key project details, and why this launch matters for investors.

StakeStone (STO) Listing: Trading Guide

Here are the important details about the StakeStone (STO) listing:

-

Exchange: Bitget

-

Trading Pair: STO/USDT

-

Deposit Available: Opened

-

Trading Start: 3 April 2025 (UTC), 10:30 (UTC)

-

Withdrawal Available: 4 April 2025 (UTC), 11:30 (UTC)

Don’t miss your chance to start trading StakeStone (STO) on Bitget and be part of this groundbreaking journey.

*Please refer to the official announcement for the most accurate schedule.

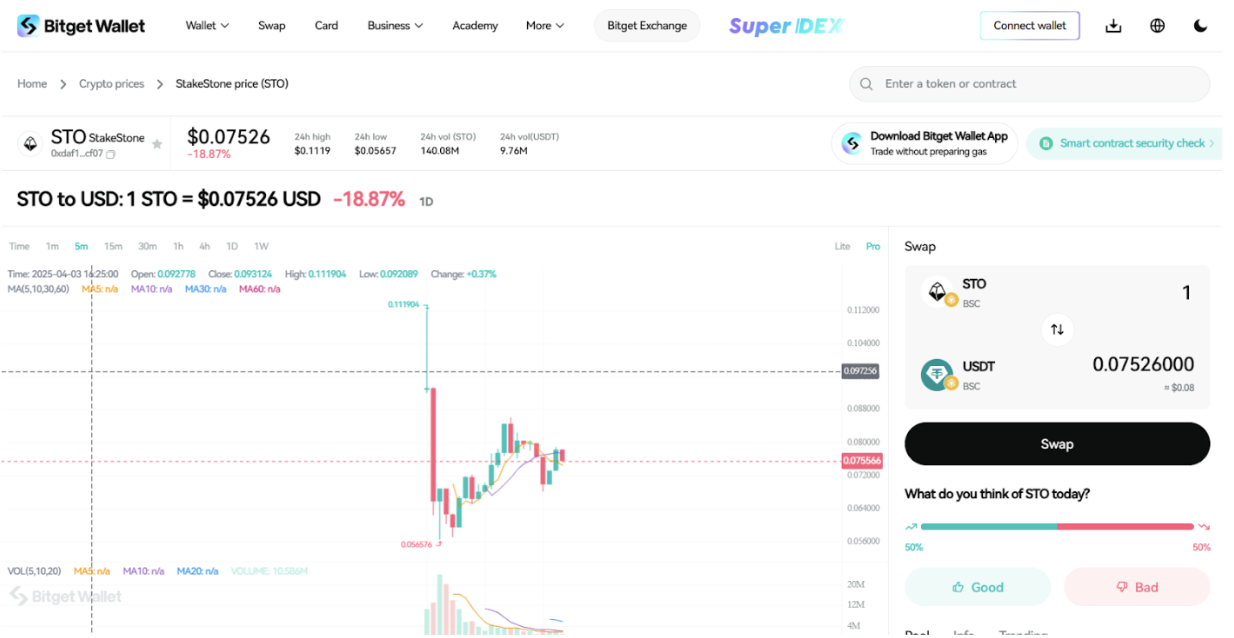

StakeStone (STO) vs. Similar Tokens: Price Prediction & Performance

Comparing StakeStone (STO) to Similar Tokens: Post-Listing Performance Projections

Historical trends offer valuable insights into how StakeStone (STO) may perform after its Bitget listing. By analyzing three comparable tokens from the liquidity or liquid staking sector, we can estimate an average listing premium and potential retracement risk.

Comparative Token Performance (First 30 Days Post-Listing)

| Token |

Initial Price |

Peak Price (T+30 Days) |

% Increase |

Retracement (%) |

| Lido DAO (LDO) |

$0.73 |

$2.45 |

+235% |

-40% |

| Rocket Pool (RPL) |

$2.20 |

$6.80 |

+209% |

-35% |

| Frax Share (FXS) |

$4.30 |

$11.70 |

+172% |

-38% |

| StakeStone (STO) (Projected) |

$1.49 |

$3.29 |

+205% (Avg.) |

-37% (Risk) |

Key Insights from Historical Analysis

-

Average Listing Premium:

Tokens in the liquid staking have historically seen +200% price surges within 30 days of listing. -

Retracement Risk:

Based on previous patterns, a 30-40% price correction is typical within 7-14 days post-peak. -

Market Sentiment Factor:

If $STO follows similar trajectories, its short-term upside potential could reach (Pending Market Data), with a retracement support zone around (Pending Market Data).

Price Projection Based on Market History

| Time Frame |

Predicted Price Range |

Historical Benchmark |

| Short-term (1-3 months) |

$1.49-$3.29 |

Comparable to LDO, RPL post-listing |

| Medium-term (3-6 months) |

$3.47-2.81 |

Aligned with industry growth patterns |

| Long-term (1 year or more) |

$2.67 |

Reflective of market trends and adoption trajectory |

Source: Coincheckup

Note: The price prediction is sourced from third-party media at the time of writing and is for reference only. It does not represent the official stance of StakeStone and Bitget Wallet. Please conduct your own research and refer to official market data before making any investment decisions.

Source: Bitget Wallet

What Is StakeStone (STO): Why This Token Stands Out?

StakeStone (STO) is a unique and innovative liquidity staking protocol that enhances staking efficiency while ensuring seamless liquidity for staking across multiple blockchains. It allows users to stake assets without locking them in a time-limited pool, it enables capital efficiency with optimized rewards. By integrating with omnichain liquidity solutions, StakeStone assures users can stake their assets within any blockchain network without facing any difficulty.

Why StakeStone (STO) Stands Out?

-

Omnichain Liquidity Solutions:

StakeStone enables users to stake assets while maintaining liquidity across the various blockchain platforms. This feature eliminates the traditional trade-off between staking and accessibility. -

Enhanced Staking Yields:

By optimizing advanced yield optimization strategies, StakeStone provides higher staking rewards compared to conventional staking models. -

Secure & Transparent Infra:

The protocol incorporates real-time audits, decentralized governance, and security mechanisms to ensure a trustworthy environment.

Source: StakeStone

StakeStone Expands in DeFi

StakeStone (STO) is gaining traction in decentralized finance. The project tackles liquidity fragmentation by allowing smooth asset transfers across blockchains. Its governance tokens, “STO and veSTO”, ensure sustainability and reward participation.

Binance Wallet has announced its eighth “Token Generation Event (TGE)”. StakeStone is the featured project. Users can subscribe to receive STO tokens during the event. This marks a key milestone for StakeStone’s growth.

Bitget to List StakeStone (STO)

StakeStone will also be listed on Bitget. This listing increases accessibility and liquidity. More traders will have the chance to engage with STO.

StakeStone is building momentum. With major listings and strong governance, it is set to reshape DeFi. More updates will follow soon.

How StakeStone (STO) Operate and Delivers Its Benefits?

-

Built on Ethereum & Multi-chain networks, enabling security and interoperability.

-

Uses a Proof-Of-Stake & Liquidity Staking Mechanism, which allows users to stake assets while retaining the liquidity.

-

Supports Cross-chain Applications, and utility across multiple sectors, including defi, payments, and blockchain-based applications.

Key Benefits of StakeStone (STO)

-

Seamless Liquidity & Asset Mobility

The user can stake without being locked with the assets into a single blockchain, which enhances the flexibility. -

Earning Potential

StakeStone automatically allocates the assets across multiple chains to increase the earning potential from the staked assets. -

Robust Security & Decentralized Governance

The protocol utilizes advanced smart contract security, real-time audits, and community-driven governance to enhance trust and security.

Who Leads StakeStone (STO) - Team & Key Partnerships

The Team

StakeStone is led by Charles K, who serves as a co-founder of the project. Charles K has expressed a commitment to build a long-term, decentralized, omnichain liquidity distribution network, showing the vision and goal of the project.

While the other team members and contributors' profiles aren’t available in public, the leadership is supported by a group of professionals, advisors, and investors who are aligned with the same goal.

Key Partnerships

StakeStone has established strategic collaborations to enhance its ecosystem:

-

Binance Labs:

In March 2024, Binance Labs, the venture arm of Binance, invested in StakeStone to increase the omnichain liquidity distribution network. This partnership facilitates the expansion of StakeStone within multiple networks. -

Plume Network:

In November 2024, StakeStone partnered with Plume Network, a modular chain focused on Real World Asset Finance. This collaboration seeks to unlock new yield opportunities by integrating liquid staking assets with real-world assets.

The Role of StakeStone (STO) in Crypto: Use Cases Explained

Key Use Cases of StakeStone (STO)

- Liquid Staking Solution:

Users can stake assets while maintaining liquidity, allowing them to participate in defi activities. -

Cross Chain Distribution:

StakeStone enables effective liquidity transfers between chains, ensuring interoperability for dApps. -

Lending & Borrowing:

$STO can be integrated with lending protocols, which allows users to collateralize their staked assets while earning additional yield.

How StakeStone (STO) Is Transforming Liquid Staking & DeFi?

StakeStone (STO) making liquid staking in a new trend by introducing yield-bearing assets that enhance capital efficiency.

-

Enhanced Capital Efficiency

By offering yield-bearing ETH and BTC assets, StakeStone ensures that users can maximize earnings while maintaining on-chain liquidity. -

Bridging Traditional Finance (TradFi) & DeFi

The integration with RWA finance platforms allows institutions and retail users to earn from real-world assets while leveraging blockchain transparency. -

Decentralization & Security

The platform eliminates reliance on centralized intermediaries, ensuring users have full control over their funds while benefiting from secure smart contract mechanisms.

StakeStone (STO) Roadmap: Key Milestones and Future Developments

Key Milestones

-

White Paper Release (February 26, 2025):

Introduced STONE (yield-bearing ETH), SBTC, and governance via STO token. -

Exchange Listings (April 3, 2025):

STO is listed on KuCoin, Bitget, MEXC, BingX, and HashKey Global. -

Strategic Partnerships:

Partnerships with Binance Labs & Plume network are bringing more opportunities to the network.

Future Development Plans

-

Cross-Chain Integrations:

Expanding omnichain interoperability. -

New Yield Strategies:

Optimizing STONEBTC returns. -

Governance Expansion:

Enhancing veSTO-based community decision-making.

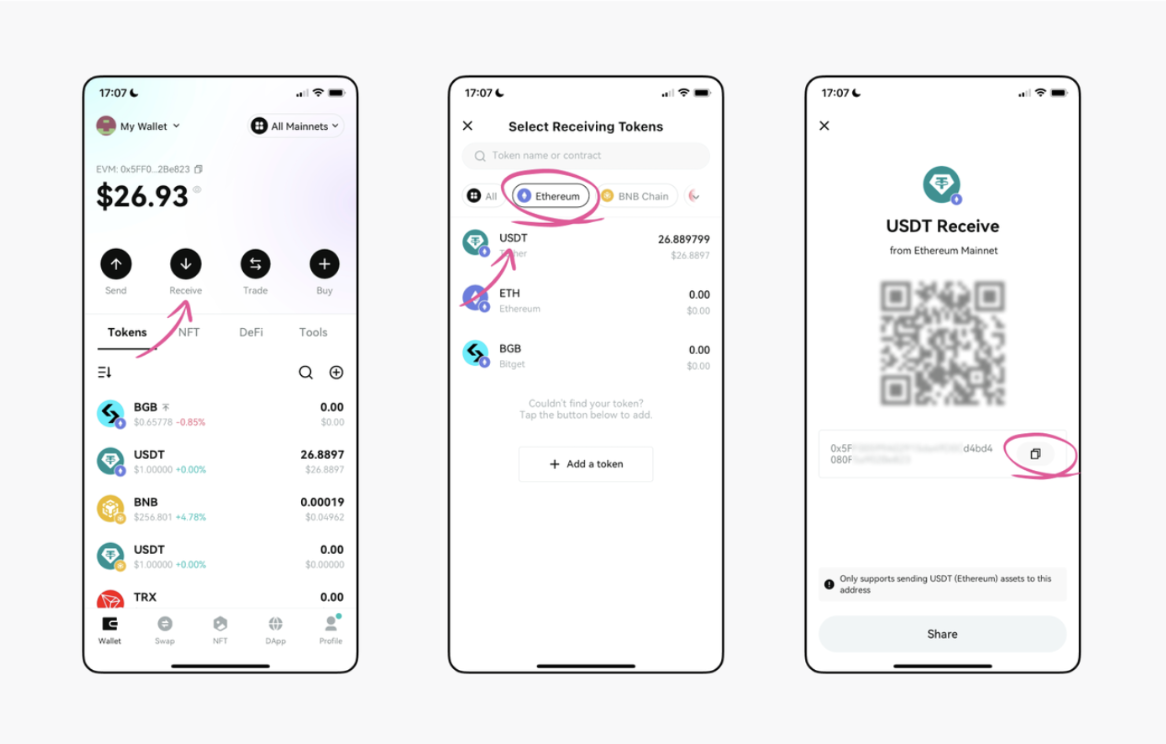

How to Buy StakeStone (STO) on Bitget Wallet?

Trading StakeStone (STO) is easy on Bitget Wallet. Follow these simple steps to get started:

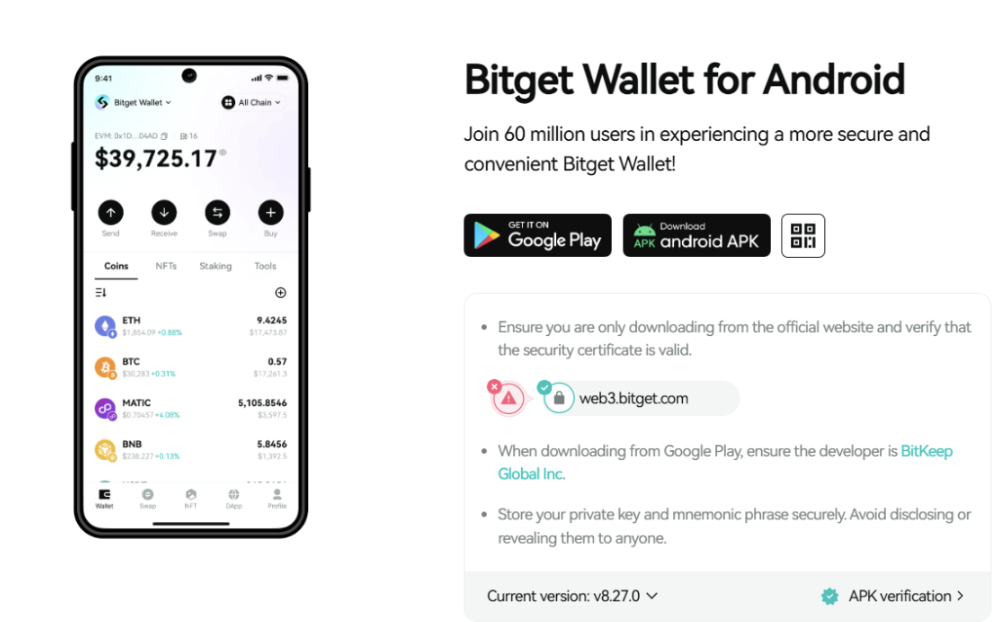

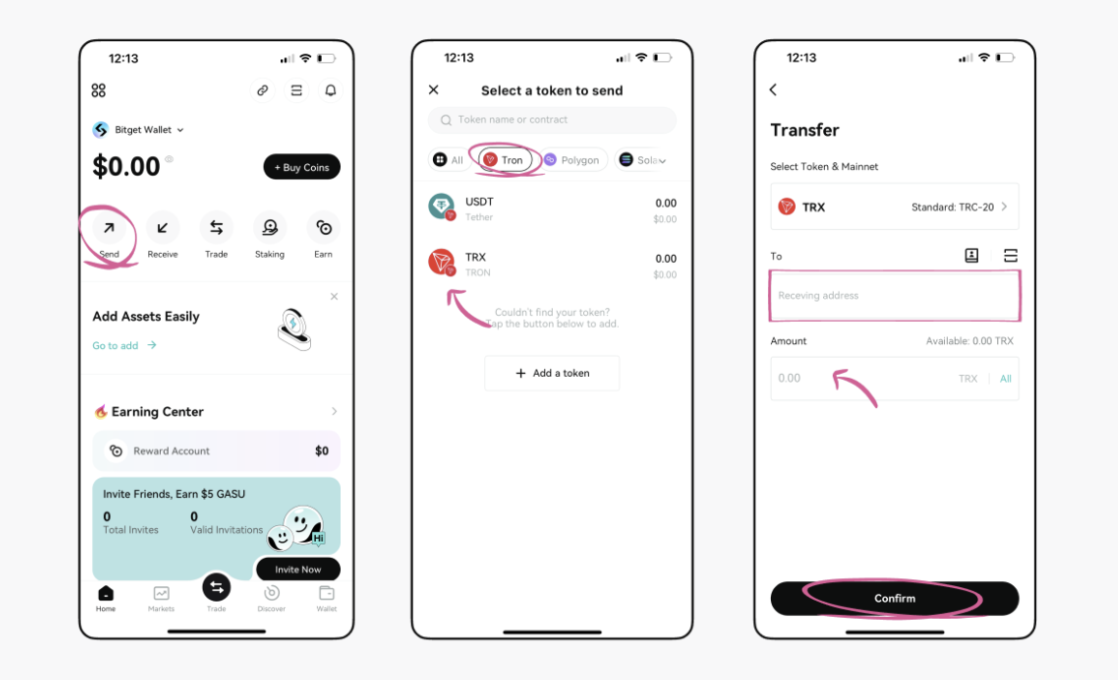

Step 1: Create a Wallet

If you don't have a Wallet, download the Bitget Wallet app. Sign up by creating a new wallet and keep the backup safe.

Step 2: Deposit Funds

Once your wallet is set up, you need to deposit funds. You can do this by:

-

Transferring Cryptocurrency: Send crypto from another wallet.

-

Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading StakeStone (STO).

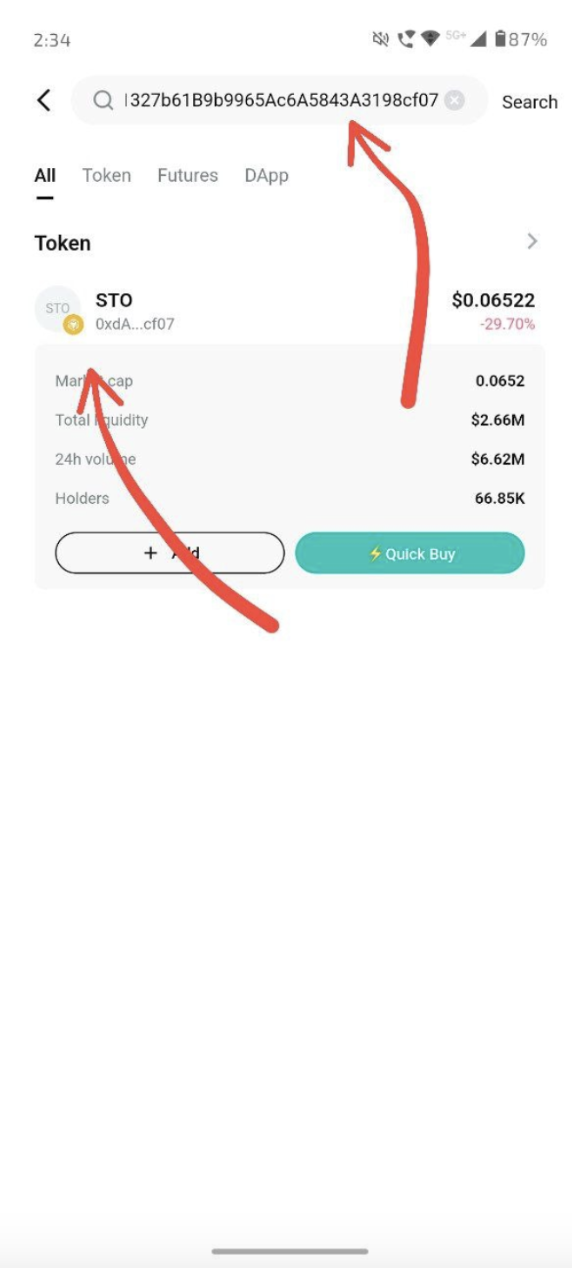

Step 3: Find StakeStone (STO)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find StakeStone (STO). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

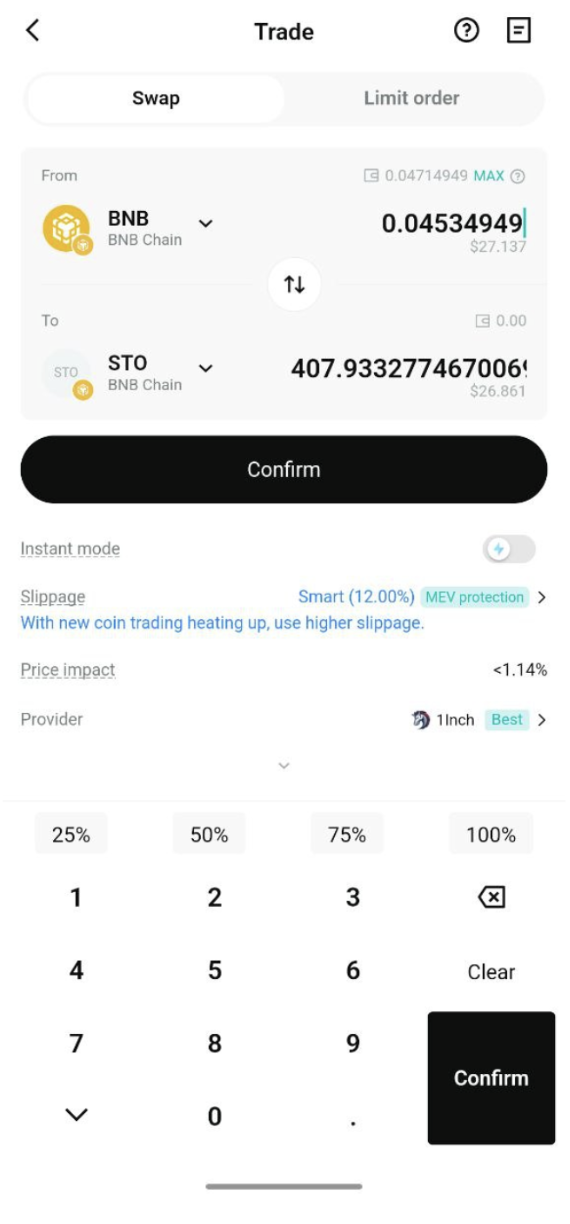

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as STO/USDT. This will allow you to trade StakeStone (STO) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of StakeStone (STO) you wish to buy or sell, then confirm your order.

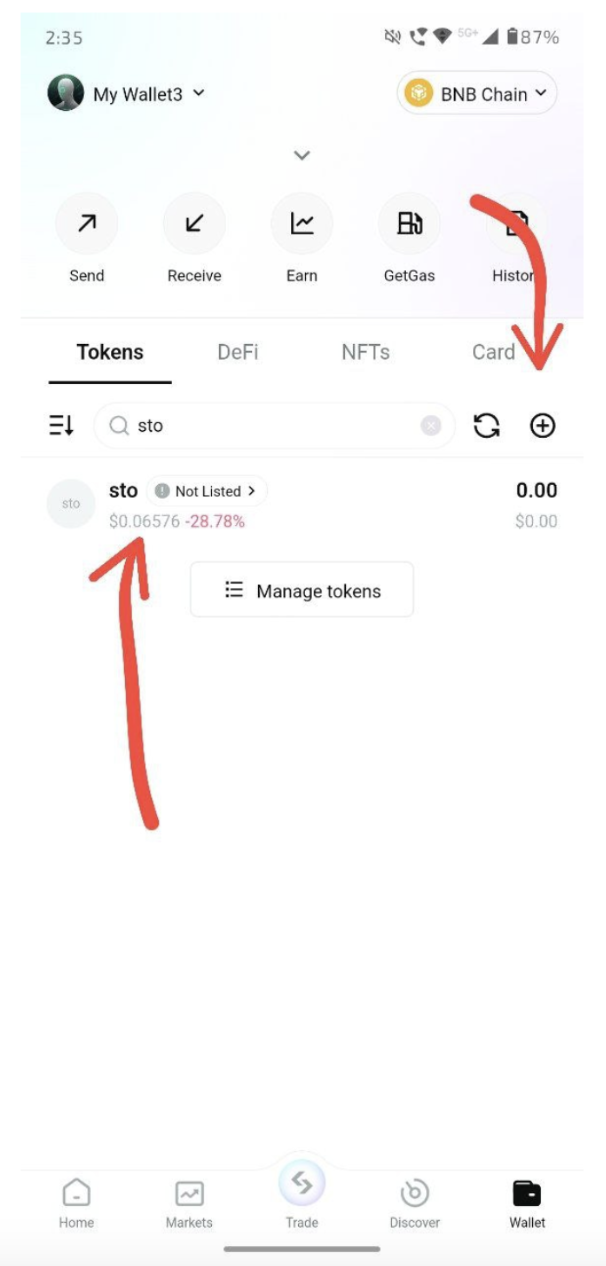

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired StakeStone (STO).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your StakeStone (STO) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

Conclusion

The listing of StakeStone (STO) on Bitget isn’t just about immediate gains—it’s a step toward building a decentralized future. The project’s mission is clear: empower users with seamless liquidity access, providing efficient liquid staking mechanisms, and incentives on staking in the liquid staking space with the help of omnichain liquidity solutions.

As StakeStone (STO) gaining attraction in the market, being an active participant—whether through trading, staking, or community involvement—will be key to staying ahead in this evolving ecosystem.

For secure asset management, Bitget Wallet provides a reliable and efficient platform, ensuring users can trade and store digital assets with confidence in an ever-evolving digital landscape.

Step into the future of finance—download Bitget Wallet today and unlock limitless possibilities in the Web3 world!

FAQs

1. Where can I trade StakeStone (STO) after its listing?

You can trade StakeStone (STO) on Bitget starting April 3, 2025, under the trading pair STO/USDT. Deposits are open, and withdrawals begin on April 4.

2. What is the price prediction for StakeStone (STO) after listing?

Based on similar tokens, $STO may see a 200% surge post-listing, with a potential retracement of 30-40% in the following weeks.

3. How can I buy StakeStone (STO) on Bitget Wallet?

To buy $STO, create a Bitget Wallet, deposit funds, search for STO/USDT, place an order, and monitor your trade for execution.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.