Ripple Rich List Update: Who Really Controls XRP Supply in 2026?

Ripple Rich List Update data suggests a widening gap between small holders and large wallets as XRP ownership becomes more concentrated and accumulation gets more expensive. The latest wallet distribution charts show that millions of addresses hold tiny balances, while a very small number of large wallets sit on an outsized share of supply.

In 2025–2026, two forces collide: the rising cost to acquire meaningful XRP positions (buying 1,000 XRP is now far more expensive than a year ago), and the difference between headline supply vs. truly liquid supply (escrowed and functionally locked XRP).

This article breaks down XRP from A to Z — covering supply dynamics, liquidity signals, Bitcoin’s influence, and practical, risk-aware strategies retail investors can use in 2026.

Key Takeaways

- Ripple Rich List Update shows XRP whale wallets control most effective float, making XRP ownership concentration a key driver of volatility.

- XRP supply distribution is tighter than headline numbers suggest because escrow and ledger locks limit how much XRP can freely trade.

- XRP retail investors vs whales data proves small holders must adapt strategy as rising entry costs change who controls XRP supply.

XRP Rich List Update: Who Holds Most XRP According to 2026 Wallet Data?

The latest Ripple Rich List Update reveals a structural reality that matters more than short-term price action: XRP ownership is highly uneven. While millions of wallets exist, effective control over supply is concentrated within a very small group of large holders.

This matters because markets move based on liquid, decision-driven supply, not headline totals. In practice, the wallets that can meaningfully add or remove liquidity are far fewer than the total number of XRP holders.

Source: Coinmarketcap.com

How many wallets actually control XRP’s circulating supply?

When XRP wallets are grouped by balance size, a clear hierarchy emerges. Most wallets hold negligible amounts, while a narrow top tier controls a dominant share of circulating XRP.

The summary below outlines how XRP ownership becomes increasingly concentrated at higher wallet tiers.

| Wallet Tier | Approx. Wallet Count | XRP Held (Approx.) | Liquidity Implication |

| Over 1B XRP | 6 | ~8.9B XRP | Price-moving scale |

| 500M–1B XRP | ~20 | ~10.7B XRP | Institutional-level control |

| 100M–500M XRP | ~66 | ~11.6B XRP | Dominant influence on float |

| Top ~90 wallets | <100 | ~31B XRP | Nearly half of circulating supply |

| Top ~300 wallets | <500 | ~42B XRP | Roughly two-thirds of circulation |

This distribution leads to three critical market effects:

-

Price sensitivity increases at the margin

When a large share of XRP is held by a small cohort, incremental demand does not need to be large to move price. Liquidity is thinner than headline supply suggests.

-

Retail exclusion doesn’t require a supply shock

Even without sudden lockups or burns, ownership concentration combined with higher entry costs naturally pushes smaller investors to the edge of relevance.

-

Volatility becomes asymmetric

Concentration can accelerate upside during accumulation phases—but it also magnifies downside when large holders reduce exposure.

Ripple Rich List Update is less about who is “rich” and more about who can realistically influence XRP’s market behavior in 2026.

What Is the Ripple Rich List Update in 2026?

Ripple Rich List Update is a snapshot of how XRP is distributed across wallet balance tiers, shifting the focus away from price and toward who actually holds the supply. By revealing ownership concentration and effective market liquidity, it explains why control over circulating XRP can shape volatility and market reactions—often more decisively than short-term price headlines.

Source: washingtonbeerblog.com

What does “XRP rich list explained” mean in plain English?

XRP rich list explained means a balance-based classification of XRP wallets, grouped into defined tiers such as small holders, mid-sized holders, and large holders. Each tier shows how many wallets exist within a balance range and how much XRP they collectively control.

This framework is commonly used to assess ownership concentration, not to identify individuals or forecast behavior. Its value lies in understanding how evenly—or unevenly—XRP supply is distributed across the network.

How to interpret it responsibly

- Wallets are not individuals: large wallets often belong to exchanges, custodians, or pooled accounts representing many users.

- Concentration is not proof of manipulation: it indicates structural conditions, not coordinated intent.

- The key signal is liquidity dynamics: when a smaller number of holders control a large share of supply, market reactions to demand shifts can become sharper.

What changed between 2024 and 2026 that makes this update important?

Between 2024 and 2026, the significance of the Ripple Rich List increased due to structural, not speculative, changes in the market.

- The entry threshold rose materially**:** accumulating meaningful XRP positions now requires substantially more capital than in prior years.

- The ownership gap became more pronounced: a large population of wallets remains concentrated at lower balance tiers, while a comparatively small group controls a dominant share of circulating supply.

As a result, the retail investors vs whales dynamic shifted. Retail participation may still be broad in number, but its ability to influence supply rotation has diminished as accumulation becomes more capital-intensive.

Is XRP supply centralized, or is the “centralization” narrative oversimplified?

XRP ownership concentration is observable, but labeling XRP as “fully centralized” oversimplifies how supply actually behaves. Concentration increases liquidity sensitivity, yet it does not eliminate supply movement. Because XRP settles quickly and trades actively on exchanges, supply can still rotate under the right market conditions.

Why do some investors argue XRP supply is becoming more centralized?

The concern centers on how ownership structure has evolved, widening the gap between small holders and large wallets:

- Retail fragmentation: The majority of XRP wallets hold relatively small balances, diluting the collective influence of retail participants.

- Rising accumulation barriers: Acquiring a meaningful XRP position now requires significantly more capital than in previous cycles, limiting retail participation during pullbacks.

- Whale dominance: Ranges within the Ripple Rich List show a small group of large wallets controlling a substantial share of circulating supply, sharpening the contrast between XRP retail investors vs whales.

Together, these dynamics fuel the perception that is XRP supply centralized is no longer just a theoretical question, but a structural one.

What evidence suggests XRP liquidity can still be dynamic?

- Myth: “Whales control everything, so XRP’s price is effectively fixed.”

- Fact: Control does not equal immobility. XRP can be moved onto exchanges and traded rapidly, allowing supply to re-enter the market when incentives shift.

Even with high concentration, a tradable layer of XRP supply distribution remains active. This means the critical issue is not simply who controls XRP supply, but when and under what conditions that supply becomes liquid enough to influence price.

How Much XRP Can Actually Move in the Market?

In 2026, XRP supply distribution is shaped less by theoretical circulation numbers and more by structural constraints that limit how much XRP can realistically move at any given time.

This distinction matters when assessing liquidity, volatility, and recovery dynamics.

How much XRP is escrowed, and why does that matter for effective float?

A significant portion of XRP is structurally unavailable to the open market. Beyond escrowed balances, XRP’s ledger design introduces functional constraints that quietly reduce mobility.

XRP Supply vs Tradable Reality

| Metric | XRP Amount (Approx.) | Why It Matters |

| Max supply | 100.0B | Absolute ceiling, not tradable reality |

| XRP escrowed | ~34.49B | Gradually released, not fully liquid |

| Circulating supply | ~65.49B | Baseline reference, not all mobile |

| XRP burned | ~14.27M | Negligible supply impact |

| Activated accounts | ~7.45M | Participation breadth, not depth |

| Exchange balances | ~1.5B | Immediate tradable inventory |

- Parts of circulating XRP are effectively tied up by account reserve requirements, persistent ledger states, and protocol-level mechanics.

- The practical result is a smaller effective float than headline numbers imply, especially during periods of stress.

What could realistically move XRP in 2026: whales, institutions, or Bitcoin?

XRP price dynamics are likely shaped by three overlapping forces: concentration of movable supply, narrative-driven institutional demand, and broader Bitcoin-led market cycles. A Ripple Rich List Update helps clarify supply-side sensitivity, but it does not operate in isolation from macro crypto drivers.

What are the 3 most plausible scenarios for XRP price dynamics in 2026?

This Ripple Rich List Update scenario matrix outlines the most plausible XRP price drivers in 2026 by focusing on structural forces rather than price targets.

Scenario Matrix — Structural Drivers for XRP in 2026

| Scenario | Core Dynamic | Market Implication |

| Institutional participation expands | Demand rises while effective float remains constrained | Even modest inflows can produce amplified price responses |

| Bitcoin-driven market cycles dominate | XRP tracks macro crypto risk sentiment led by Bitcoin | Internal supply structure has limited short-term influence |

| Retail participation remains limited | Dip-buying weakens; accumulation shifts to larger entities | Recoveries rely more on long-term holders and custodial flows |

Risk notes

- High concentration increases sensitivity to large-holder behavior and custody-related flows.

- Bitcoin volatility can override internal XRP supply dynamics in the short to medium term.

Can small investors still benefit without chasing “millionaire” claims?

Ripple Rich List Update suggests that smaller participants benefit most from a disciplined, risk-aware approach that prioritizes position sizing, planned entries, monitoring exchange flows, and managing volatility with stable assets, while avoiding assumptions that ownership concentration guarantees upside, excessive leverage, or viewing whale dominance as a one-directional signal.

How Can Bitget Wallet Help You Trade XRP Safely in 2026?

In 2026, XRP trading risk no longer comes only from price direction — it comes from liquidity timing, custody mistakes, and forced execution during volatility windows. When large holders move supply or effective float tightens, retail traders who rely purely on exchanges often face slippage, withdrawal delays, or rushed decisions.

Bitget Wallet is designed around a different principle: capital control first, execution second. Instead of treating XRP as a single monolithic position, it allows users to split roles — storage, liquidity, yield, and spending — across one self-custodial environment supporting 130+ blockchains and over 1 million assets.

Why execution discipline matters more than prediction for XRP

XRP’s market structure makes it particularly sensitive to short-term supply releases and demand bursts. In these conditions, most losses come from how trades are executed, not where price goes.

A safer execution framework focuses on:

- Reducing forced trades by keeping liquidity optional

- Avoiding venue risk during peak volatility

- Preserving flexibility when spreads widen or liquidity fragments

Bitget Wallet supports XRP-native routing while aggregating liquidity paths across chains, helping users avoid single-venue dependency when conditions shift quickly.

| Feature | What It Helps With | Data Point |

| Stablecoin Earn Plus | Earn on idle stablecoins | Up to 10% APY |

| Token trading access | Catch trending markets fast | Zero-fee trading on memecoins & RWA U.S. stock tokens |

| Crypto card support | Spend crypto more easily | Visa & Mastercard support, zero fees for spending |

| Cross-chain experience | Manage assets across ecosystems | Works across major chains (cross-chain focus) |

Use Bitget Wallet to store stablecoins securely, manage XRP exposure, and trade across chains with a beginner-friendly workflow—especially when XRP supply dynamics make liquidity shifts more sensitive.

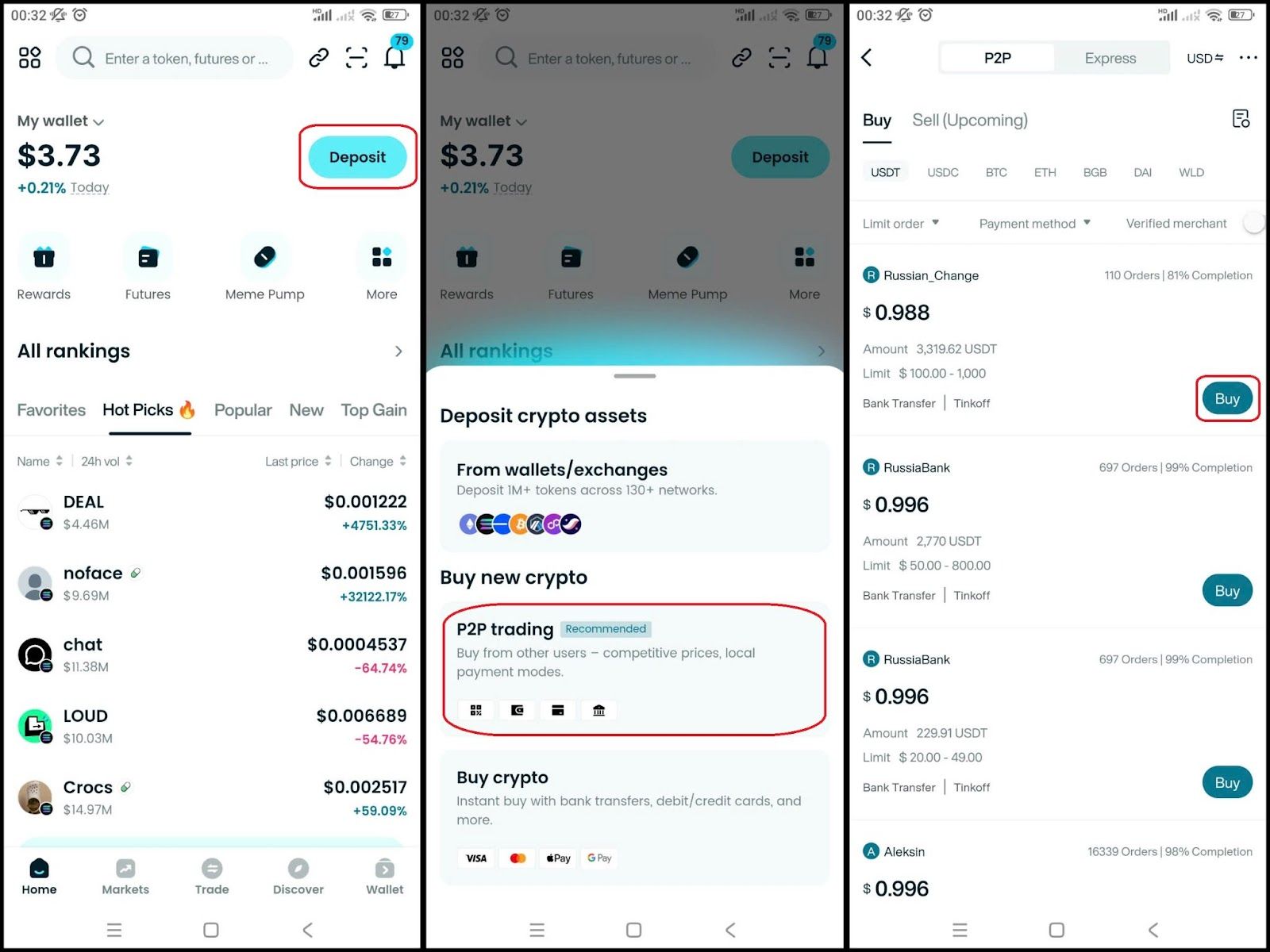

How to Buy XRP (XRP) on Bitget Wallet?

Buying XRP (XRP) on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

Step 3: Find XRP (XRP)

- In the main interface of the wallet, go to Market, type "token name" in the search bar.

- Select XRP (XRP) to see the trading page.

Step 4: Select the trading pair

Select the pair you want to trade, for example XRP/USDT. So you can use USDT to buy XRP (XRP), or vice versa.

Step 5: Place an order

Enter the amount of XRP (XRP) you want to buy, check carefully and confirm the order.

Step 6: Check the order

After buying, you can check your XRP in the Wallet section.

Step 7: Withdraw (if needed)

Once you have XRP (XRP), if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about XRP (XRP):

- What is XRP (XRP)?

- XRP (XRP) Airdrop Guide

- XRP (XRP) Listing Date and How to Buy It

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

Conclusion

Ripple Rich List Update data shows that ownership concentration and effective liquidity matter just as much as price headlines in 2026. A small number of large wallets can control a major share of circulating supply, while escrow and ledger mechanics can reduce how much XRP is freely tradable at any moment.

A balanced view matters: concentration is real, but Bitcoin-driven market cycles and exchange liquidity still influence XRP day-to-day. For retail investors, the practical edge comes from risk control—tracking flows, sizing positions, and using stablecoins intentionally. To participate more safely, consider managing XRP and stablecoins with Bitget Wallet, a non-custodial option designed for cross-chain management and practical trading workflows.

Download Bitget Wallet to manage stablecoins, monitor XRP exposure, and trade across chains with user-controlled custody.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is the Ripple Rich List Update?

The Ripple Rich List Update is a wallet distribution snapshot that shows how XRP balances are spread across address tiers. It helps investors understand concentration, liquidity sensitivity, and how ownership dynamics shift over time.

2. Who controls XRP supply today?

Who controls XRP supply is best answered in layers: whales and large custodial wallets can control a large share of circulating XRP, while exchange inventory drives short-term tradable liquidity and rotation.

3. Is XRP supply centralized compared with other large-cap coins?

Is XRP supply centralized is a debate: ownership concentration can be high, but concentration alone does not prove manipulation. Liquidity conditions, exchange balances, and macro factors (especially BTC) still shape price.

4. What is the Best XRP Wallet?

Bitget Wallet is widely considered a strong XRP wallet choice for users who want full self-custody, a clean and intuitive interface, and flexible tools to manage XRP exposure with more confidence. Beyond basic storage, it supports cross-chain asset management and stablecoin features, making it easier to navigate volatility without relying purely on price speculation.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Fabric Airdrop Guide: How to Participate and Claim $ROBO Rewards2026-03-03 | 5mins

- Can I Buy World Cup Ticket with Cryptocurrencies?2026-03-02 | 5mins

- How to Buy CHZ in 2026: A Beginner’s Step-by-Step Guide to Chiliz2026-03-02 | 5mins