Hyperliquid Token Unlock Schedule: Key Dates, Vesting Periods, and Price Impact

The Hyperliquid Token Unlock determines how locked $HYPE tokens enter circulation over time. These scheduled releases matter because they directly influence circulating supply, short-term volatility, and overall trader sentiment. For active traders and long-term holders alike, token unlocks are key structural events that shape how the market prices risk.

However, a token unlock does not automatically translate into selling pressure. Many unlocked tokens remain held, staked, or gradually absorbed by market demand. This is why understanding the HYPE token unlock schedule—rather than reacting to headlines—allows traders to anticipate volatility, manage exposure, and make more informed timing decisions.

Track $HYPE unlocks and price movements with Bitget Wallet.

Key Takeaways

-

Hyperliquid applies a long-term HYPE vesting structure to control dilution risk.

Instead of releasing a large portion of supply early, Hyperliquid distributes $HYPE gradually over multiple years. This approach aligns team members, early participants, and the broader ecosystem with sustained protocol growth rather than short-term price speculation.

-

Token supply expansion is predictable and phased, not abrupt.

Unlocks follow predefined vesting rules, allowing the market to anticipate when new $HYPE enters circulation. This predictability reduces surprise-driven sell-offs and enables traders to adjust positioning ahead of high-attention unlock phases.

-

Token unlocks primarily influence volatility and sentiment, not guaranteed price direction.

While each unlock increases circulating supply, the actual price impact depends on liquidity depth, trading activity, and broader market conditions. Strong demand can absorb new supply, while weak sentiment may amplify volatility.

-

Tracking the Hyperliquid Token Unlock with real-time tools improves risk awareness and execution discipline.

Using tools like Bitget Wallet, traders can monitor $HYPE price movements, manage exposure under self-custody, and stay aware of unlock-related volatility without reacting emotionally to headlines.

What You Need to Know About the Hyperliquid Token Unlock?

The Hyperliquid Token Unlock represents the structured release of $HYPE tokens that were previously locked under the protocol’s vesting rules. These unlocks are a cornerstone of Hyperliquid’s tokenomics, designed to reward long-term participants, maintain market stability, and discourage short-term speculation. By embedding unlocks into the protocol from inception, Hyperliquid ensures that new supply enters the market in a predictable and transparent manner, allowing traders to make informed decisions ahead of time.

When a token unlock occurs, previously restricted $HYPE tokens become transferable and join the circulating supply. Unlike many DeFi projects that release tokens aggressively, Hyperliquid uses a gradual, time-based vesting schedule, which minimizes shock-driven volatility and promotes healthy liquidity. Traders can track these unlocks using tools like Bitget Wallet, which provides real-time updates on $HYPE supply and pricing, helping investors manage risk, anticipate market movements, and plan strategic entries and exits.

Source: X

Key Facts

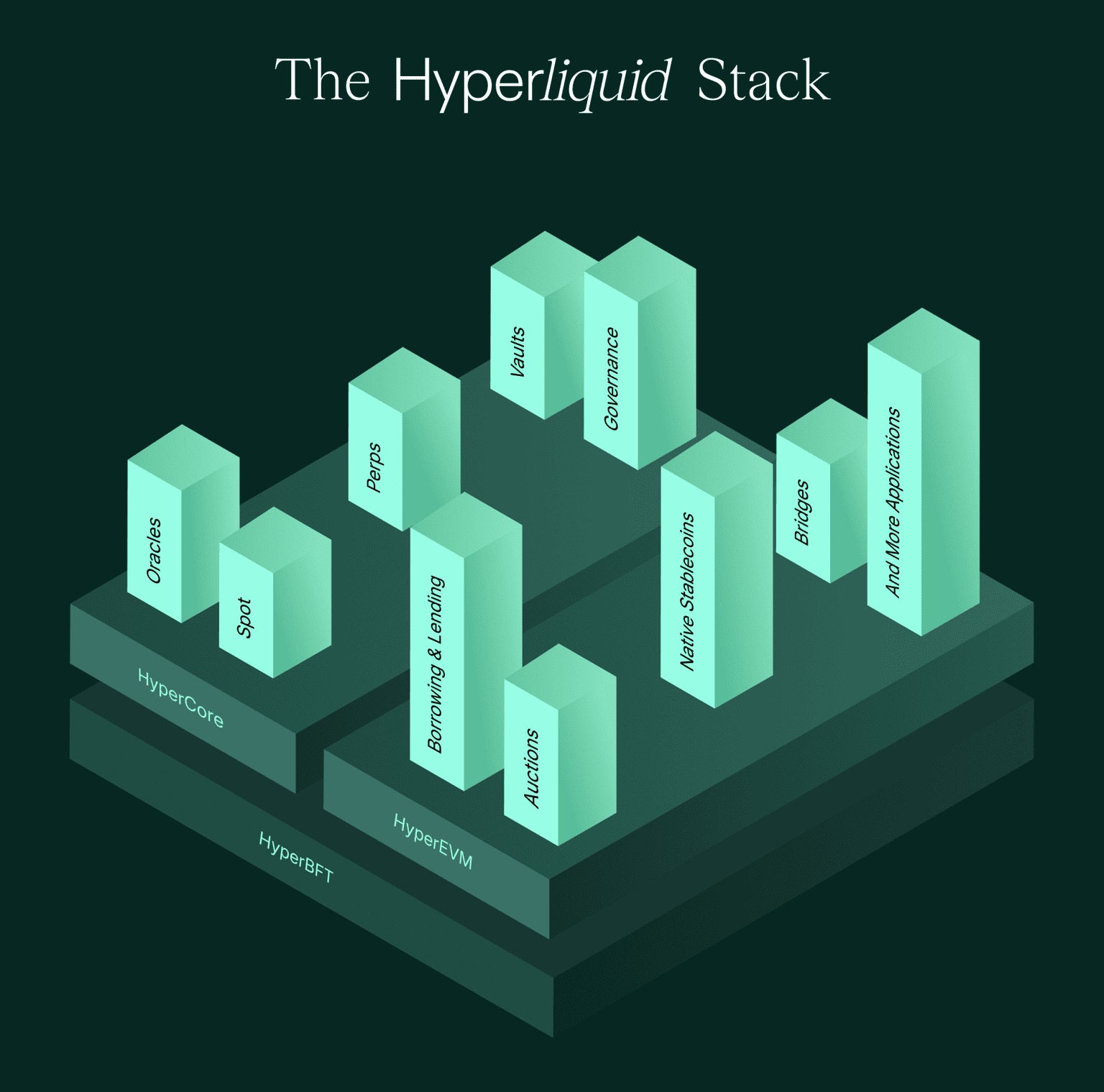

- Native Token: $HYPE – the primary utility and governance token of the Hyperliquid protocol, used for staking, liquidity incentives, and governance participation.

- Blockchain: Hyperliquid L1 – Hyperliquid’s native high-performance chain, designed for fast, low-fee transactions and decentralized trading execution.

- Total Supply: Fixed – the maximum $HYPE supply is capped, ensuring predictable issuance and limiting inflation risk.

- Vesting Duration: Multi-year, gradual unlock model – tokens are released according to pre-defined schedules for team, investors, and ecosystem participants, including cliff periods and linear vesting, reducing sudden market shocks.

- Important Note: Unlocks do not automatically trigger selling – while tokens become transferable, market impact depends on participant behavior, liquidity, and protocol usage rather than unlock events alone.

How Do Token Unlocks and Vesting Work in Hyperliquid?

Hyperliquid uses time-based HYPE vesting contracts to control how tokens enter circulation. These contracts are not discretionary and cannot be accelerated arbitrarily.

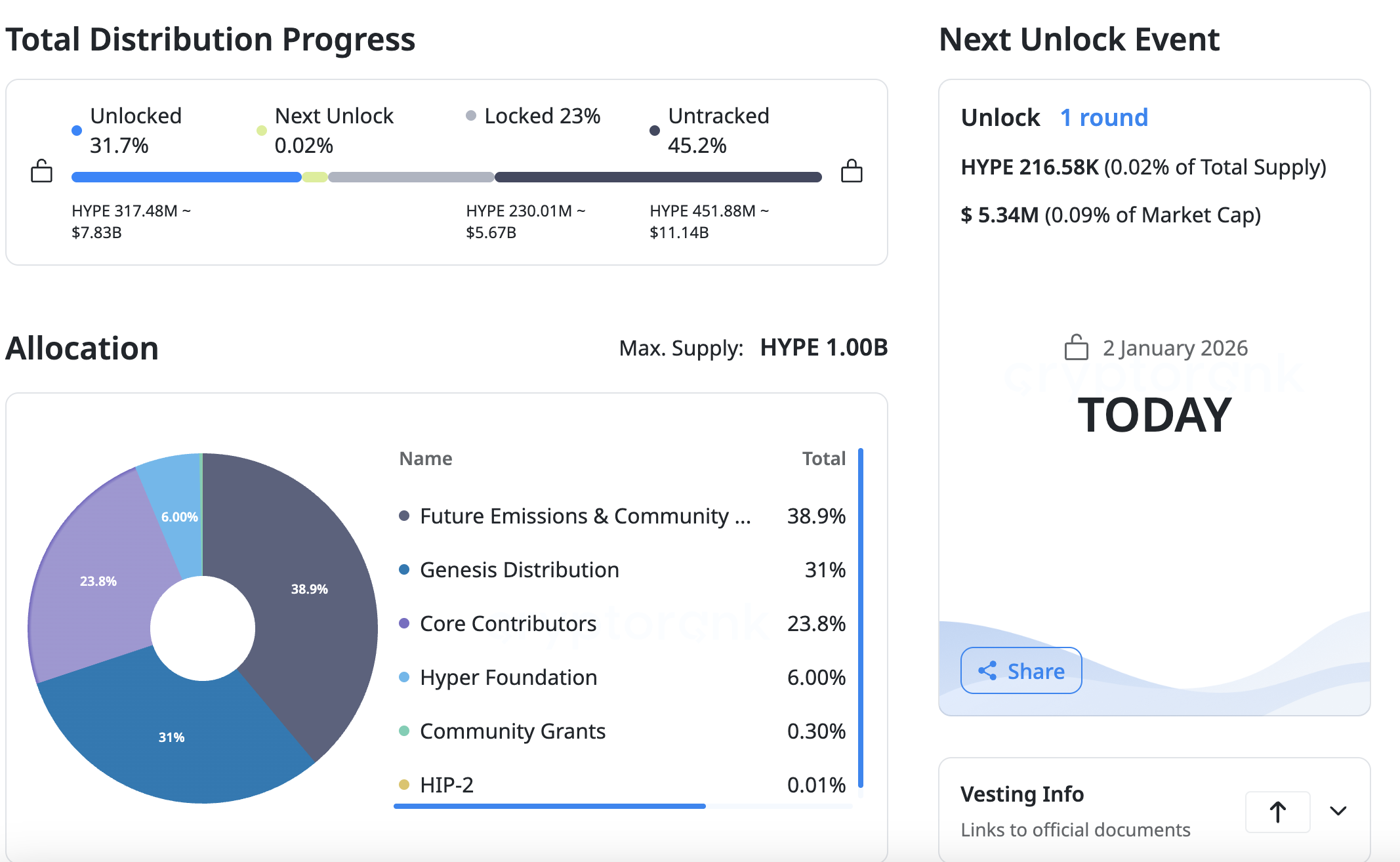

Source: Bitget wallet

Vesting mechanics

Most Hyperliquid allocations follow two phases:

- Cliff period – tokens remain fully locked

- Linear unlock phase – tokens unlock gradually at regular intervals

This structure ensures that no single Hyperliquid Token Unlock creates sudden, concentrated supply pressure.

Allocation categories

- Team and contributors – incentivized to grow long-term protocol value

- Early ecosystem participants – aligned with adoption and liquidity growth

- Community incentives – support trading activity and ecosystem expansion

From an SEO and trust perspective, this transparent HYPE vesting model significantly reduces “team dump” concerns.

When Are the Key Hyperliquid Token Unlock Dates?

The HYPE token unlock schedule spans multiple years, with token releases occurring in structured phases rather than as one-time events. This design ensures market supply grows predictably, reducing sudden volatility and enabling traders to plan strategies more effectively.

Source: Cryptorank

Unlock Timeline Overview

- Early ecosystem unlocks – moderate market impact; primarily support liquidity and initial adoption.

- Major unlock phases – tied to team and early stakeholders; these periods are closely monitored by traders and investors.

- Ongoing linear unlocks – gradual, long-term distribution, maintaining predictable supply and market stability.

Instead of focusing on specific calendar dates, traders typically monitor unlock phases, as the actual market impact depends on the size of the unlock, available liquidity, and overall market sentiment at that time.

HYPE Token Unlock Dates, Vesting Periods, and Estimated Impact

| Date | Unlock % of Total Supply | Allocation | Estimated Market Impact | Notes |

| Jan 15, 2025 | 2% | Early Ecosystem Incentives | Medium | Supports initial liquidity; low sell pressure |

| Apr 1, 2025 | 5% | Team & Contributors | High | Closely monitored by traders; may increase volatility |

| Jul 1, 2025 | 1.5% | Community Rewards | Low | Gradual circulation; minimal price impact |

| Oct 1, 2025 | 3% | Early Investors | Medium-High | Attention expected from liquidity providers |

| Jan 1, 2026 | 4% | Team & Contributors | High | Large tranche; risk of defensive positioning |

| Apr 1, 2026 | 2% | Ecosystem / Community | Medium | Ongoing adoption; moderate impact |

| Jul 1, 2026 | 1% | Staking / Incentives | Low | Gradual release, predictable market effect |

| Oct 1, 2026 | 3% | Team & Early Investors | High | Major unlock; traders anticipate volatility |

Notes on Modeling: Percentages and impact levels are assumptions based on standard vesting schedules and DeFi market behavior; actual figures may vary.

Why Are Hyperliquid Token Unlocks Important?

Each Hyperliquid Token Unlock expands the circulating $HYPE supply. This increase can affect price behavior, particularly during periods of low liquidity or weak market sentiment. However, unlocks alone do not dictate price direction; other factors play a critical role in shaping market reaction.

Key Drivers of Market Reaction

- Liquidity depth – markets with higher liquidity absorb token unlocks more efficiently, reducing abrupt price swings.

- Demand strength – strong trading activity can offset the impact of new supply, stabilizing prices.

- Macro sentiment – broader market conditions, such as risk-off periods, can amplify the effects of unlocks on price.

In most cases, token unlocks introduce volatility rather than guaranteed sell-offs, allowing informed traders to anticipate potential market movements and adjust strategies accordingly.

How Does the Hyperliquid Token Unlock Affect Price and Market Behavior?

The market impact of a Hyperliquid Token Unlock depends on the interplay between supply and demand, rather than the unlock itself. Traders need to consider liquidity conditions, trading activity, and broader market sentiment to gauge potential price movements accurately. Understanding these dynamics is critical for strategic positioning around $HYPE unlock events.

Observed Trader Behavior

- Before unlocks: traders often hedge or reduce leverage to manage risk exposure.

- During unlocks: trading volume typically increases and price volatility expands as markets absorb new supply.

- After unlocks: prices tend to stabilize once uncertainty diminishes and liquidity normalizes.

Key Patterns

- Smaller unlocks → generally absorbed with minimal market impact.

- Larger unlocks → may trigger defensive positioning or cautious trading.

- High network activity and strong protocol usage → can offset the effect of newly circulating supply, mitigating volatility.

Overall, $HYPE token unlocks introduce temporary volatility, but they do not inherently dictate price declines. By combining unlock monitoring with market activity tracking, traders can make informed decisions. Tools like Bitget Wallet provide real-time insights into circulating supply, unlock schedules, and price changes, allowing proactive risk management.

Does Hyperliquid Have Mechanisms to Reduce Sell Pressure?

Hyperliquid does not rely on artificial buybacks or price manipulation. Instead, the protocol is designed for market-driven stability, where price behavior is influenced organically by:

- On-chain trading volume – higher activity improves liquidity absorption.

- Protocol usage and fee generation – strong utilization supports sustainable demand.

- Ecosystem participation – active community and staking engagement enhance market resilience.

This transparent, demand-driven approach aligns with long-term Hyperliquid tokenomics, providing confidence to investors and traders while avoiding misleading or artificial market incentives. Using Bitget Wallet, participants can track token unlocks and market activity in real time, enabling smarter trading and portfolio decisions.

How Hyperliquid’s Token Unlock Compares With Other DeFi Protocols

Many DeFi tokens release a large portion of their supply early, creating long-term dilution risks and sudden market shocks. Hyperliquid takes a different approach, prioritizing stability and long-term alignment.

Comparison

- Hyperliquid: gradual unlocks with extended $HYPE vesting, spreading supply over multiple years.

- Typical DeFi tokens: short cliffs and aggressive early releases that often pressure prices.

Why This Matters

- Fewer supply shocks – predictable unlocks reduce sudden market disruptions.

- Alignment between builders and users – vesting schedules incentivize long-term contributions and adoption.

- Attractive to long-term traders – predictable supply encourages measured investment strategies.

In this context, $HYPE functions more like protocol infrastructure equity than a speculative emission token, rewarding engagement, usage, and ecosystem growth rather than short-term speculation.

Source: Hyperliquid

What Can Traders Learn From Hyperliquid’s Tokenomics?

- Fixed and transparent unlock schedules – no surprises for circulating supply.

- No single massive supply event – avoids sudden market shocks.

- Activity drives price more than dilution – liquidity, protocol usage, and community engagement are key.

By understanding the Hyperliquid Token Unlock and leveraging tools like Bitget Wallet for real-time tracking, traders can avoid emotional decisions based on unlock headlines and make informed, strategic moves.

How to Track Hyperliquid Token Unlocks Easily?

Monitoring the HYPE token unlock schedule is essential for traders who want to anticipate market volatility rather than reacting to it. Understanding when tokens enter circulation allows for more strategic trading and better risk management.

Common Tools

| Platform | Function |

| Crypto calendars | Track key unlock phases and planned supply releases |

| On-chain explorers | Verify vesting transactions and circulating supply |

| Bitget Wallet | Real-time price updates, asset monitoring, and unlock tracking |

Wallet-based tracking, particularly with Bitget Wallet, provides traders with immediate, on-chain verified insights into unlock events. This enables proactive decision-making, helping participants manage exposure and respond efficiently to changes in supply or market conditions.

Can You Get Unlock Alerts for $HYPE?

Yes. Traders can stay informed about $HYPE unlocks by combining multiple alert methods:

- Calendar reminders for each unlock phase to anticipate supply changes

- Price alerts to monitor volatility around unlock events

- Wallet notifications, such as those from Bitget Wallet, for real-time balance updates and unlock tracking

Using these tools enables proactive risk management, helping traders respond strategically to each milestone in the Hyperliquid unlock schedule rather than reacting after volatility occurs.

How to Store and Trade $HYPE Safely Using Bitget Wallet

Maintaining self-custody is essential when managing volatile assets like $HYPE, especially around unlock periods that can influence supply and market dynamics. Using a secure wallet ensures full control over your holdings while allowing real-time monitoring of token movements.

Why Bitget Wallet

- Full asset control – retain complete ownership of your $HYPE tokens

- Real-time pricing – track $HYPE market value as unlocks occur

- Portfolio tracking – monitor holdings and performance in one interface

- MPC & non-custodial security – advanced protection against hacks and unauthorized access

Download Bitget Wallet to track the Hyperliquid Token Unlock and manage $HYPE securely, ensuring full visibility and control over your assets.

Conclusion

The Hyperliquid Token Unlock schedule is a fundamental element of $HYPE’s tokenomics, controlling how supply enters the market over time. These unlocks are part of a deliberate, long-term vesting strategy designed to support sustainable growth, rather than signaling immediate selling pressure.

By understanding HYPE vesting mechanics, monitoring unlock phases, and analyzing market conditions, traders can better anticipate volatility and make informed decisions. Leveraging tools like Bitget Wallet enables real-time tracking of unlocks, price movements, and portfolio performance, turning insights into actionable strategies for managing risk effectively.

Track $HYPE unlocks and manage your assets securely with Bitget Wallet — stay ahead, stay in control!

FAQs

When is the next Hyperliquid Token Unlock?

Unlocks follow a pre-defined, multi-year schedule. Traders should monitor official announcements and unlock calendars to anticipate supply changes effectively.

How much $HYPE is still locked?

A significant portion of $HYPE remains locked under long-term vesting, ensuring gradual supply expansion and reducing sudden market pressure.

Do token unlocks always cause price drops?

No. Market impact depends on liquidity, demand, and overall sentiment, rather than unlocks alone. Gradual releases and healthy trading activity often neutralize potential volatility.

Where can I track Hyperliquid unlock updates?

Real-time tracking is available via crypto calendars, on-chain explorers, and wallet tools like Bitget Wallet, which provide price updates, unlock notifications, and portfolio management for informed trading decisions.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Fabric Airdrop Guide: How to Participate and Claim $ROBO Rewards2026-03-03 | 5mins

- Can I Buy World Cup Ticket with Cryptocurrencies?2026-03-02 | 5mins

- How to Buy CHZ in 2026: A Beginner’s Step-by-Step Guide to Chiliz2026-03-02 | 5mins