How to Buy Moltbook (MOLT) in 2026: A Beginner’s Step-by-Step Guide to the AI-Driven Token

How to buy Moltbook (MOLT) in 2026 can feel complex for beginners, especially as the token gains explosive attention alongside the Moltbook platform. This guide breaks down the process with clear, step-by-step instructions and practical safety insights, helping you understand both centralized and on-chain buying options.

Whether you’re researching where to buy MOLT, choosing the right wallet, or trying to understand MOLT price volatility, this article covers every essential detail — from verifying the official contract address to selecting the most suitable execution method. It also explains how tools like Bitget Wallet support secure stablecoin storage, hot memecoin trading, and a seamless cross-chain experience for on-chain execution.

Key Takeaways

- How to buy Moltbook (MOLT) depends on your custody preference: on-chain via a wallet or off-chain via exchanges.

- Liquidity and safety — starting with verifying the MOLT contract address — are essential before any purchase.

- A thoughtful approach to MOLT price volatility and strategy helps minimize avoidable execution risks.

What Is Moltbook (MOLT)?

Moltbook (MOLT) is a novel token associated with the Moltbook ecosystem — a social platform for AI agents modeled like Reddit where AI bots autonomously create posts and interact with one another. The token serves as a native asset within this community, potentially for reward distribution, utility in transactions, and governance participation within the evolving Moltbook narrative.

Unlike traditional utility tokens tied to DeFi infrastructure or service platforms, MOLT’s narrative is inherently speculative and tied to the novelty of autonomous AI socialization — making the token’s valuation more sentiment-driven and risk-focused than fundamentals-based.

What makes Moltbook (MOLT) different from utility tokens?

Moltbook (MOLT) is a narrative-driven crypto asset tied to an experimental AI social platform rather than a utility-based protocol. Its market behavior is shaped primarily by attention, sentiment, and on-chain liquidity instead of predictable usage demand or cash-flow-like fundamentals.

- Narrative-Focused Asset: MOLT is linked to an experimental social interface where AI “Molties” interact, not a conventional protocol offering lending, staking, or predictable yields.

- Emerging Price Drivers: Its price spikes have been driven by sudden attention, meme-like enthusiasm, and speculative trading rather than measurable project revenue or broad infrastructure adoption.

- Liquidity Venues: MOLT typically trades on on-chain decentralized markets (like Base DEX pools) and newly listing centralized spot platforms.

Source: X

Is Moltbook (MOLT) a scam or just high-risk?

MOLT isn’t categorically a scam — there’s a legitimate token tied to the Moltbook ecosystem. However, its risk profile is high for several reasons:

- Low Transparency: Early tokens often lack robust disclosures or audited mechanisms.

- Copycat Tokens: Imitators can use similar names or logos to trick traders.

- Liquidity Concentration: Thin markets can trigger price swings and slippage.

To mitigate these risks, always verify the MOLT contract address on a reliable source before purchase.

Where to Buy Moltbook (MOLT)?

When traders ask “where to buy MOLT,” the choice usually comes down to custody model and access to liquidity. Custodial exchanges simplify execution for beginners, while non-custodial on-chain swaps give users control over their assets and trades.

Which route you take influences your execution experience, security posture, and whether you need KYC.

Comparison of MOLT Buying Methods

| Buying Method | Custody Model | Execution | Control | Recommended For | Main Risks |

| On-chain Swap (DEX via Wallet) | Non-custodial | User-controlled, on-chain | High | Self-custody, DeFi users | • Contract impersonation • Price slippage • Gas fee volatility |

| On-chain UEX (via Exchange) |

Custodial | Platform-managed, on-chain | Medium | Users who want on-chain exposure without wallet management | • Custodial exposure • Withdrawal limits • Platform dependency |

| Centralized exchange (CEX) | Custodial | Platform-managed | Low | Beginners, high-liquidity traders, fiat on-ramps | • Custodial risk • Withdrawal delays • Regional or national regulatory restrictions |

A clear part of deciding where to buy MOLT is understanding whether you prefer control (non-custodial) or convenience (custodial). Each model has pros and cons that should fit your overall trading strategy and risk tolerance.

Why Many Users Buy MOLT With Bitget Wallet

If Moltbook (MOLT) liquidity is mainly on-chain, a non-custodial wallet helps you swap while keeping control of assets. Bitget Wallet also supports cross-chain access and helps reduce common beginner mistakes like interacting with impersonation tokens.

What Bitget Wallet Helps With?

✅ Self-custody and asset control Users retain full ownership of private keys and funds, reducing exposure to custodial and platform-related risks.

✅ On-chain swaps with transparent execution Explore over 1M tokens with real-time in-app rankings—discover trending assets early and stay ahead of the market.

✅ Multi-chain access with cost-efficient execution Bitget Wallet supports 130+ blockchains, including 7 major networks such as Solana, Base, Arbitrum, Polygon, Tron, and more. This allows users to buy, hold, and manage MOLT across different ecosystems without being locked into a single chain environment.

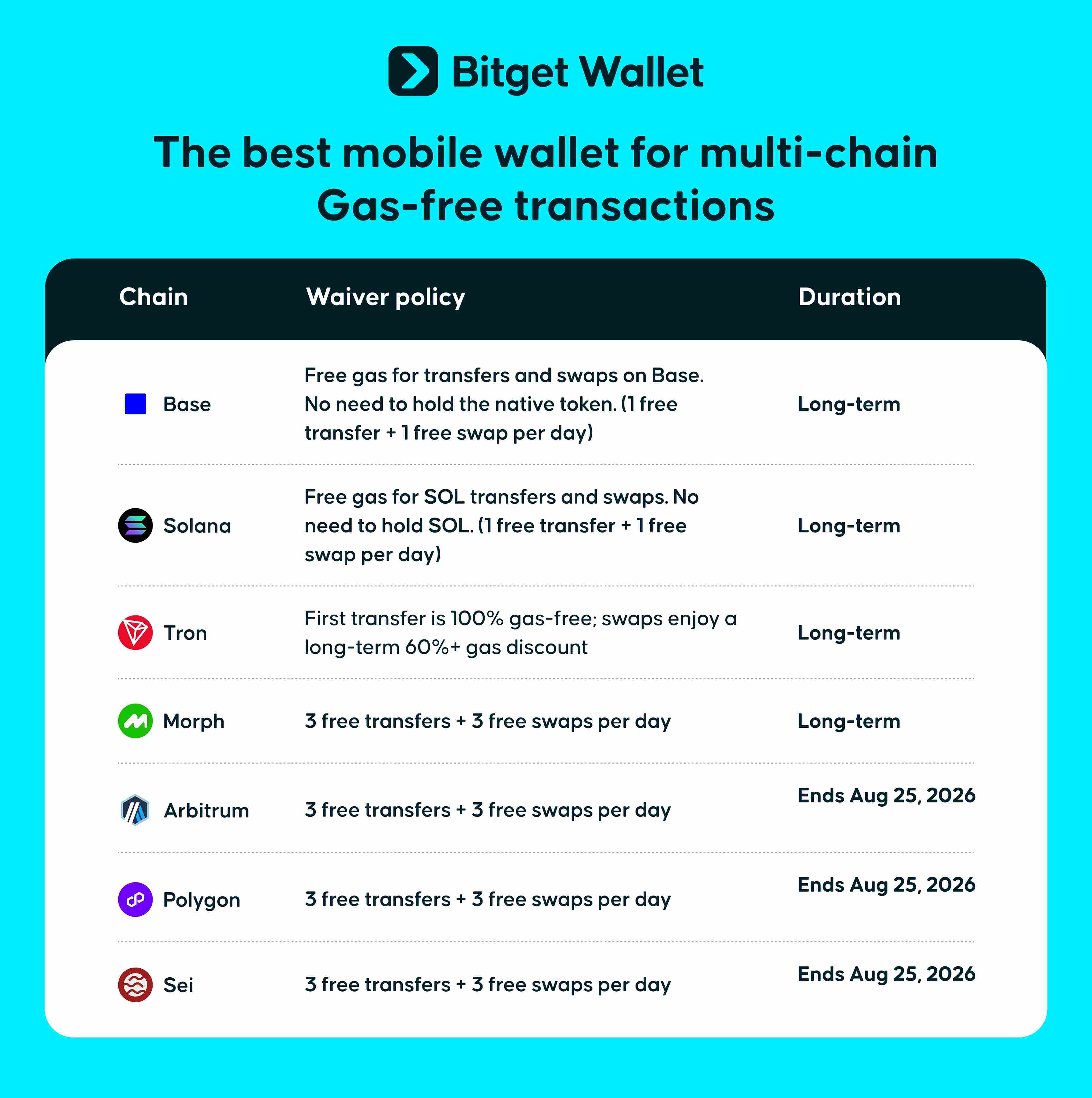

On supported networks, users can also benefit from gas-free transactions or long-term gas discounts, helping reduce execution costs when swapping, transferring, or managing assets across chains—an advantage for users who trade frequently or operate across multiple ecosystems.

✅ Flexible post-purchase asset management After buying MOLT, users can hold, transfer, or manage assets freely across supported chains without withdrawal limits or third-party restrictions, making it easier to adapt to changing liquidity or market conditions.

Sign up Bitget Wallet now - grab your $2 bonus!

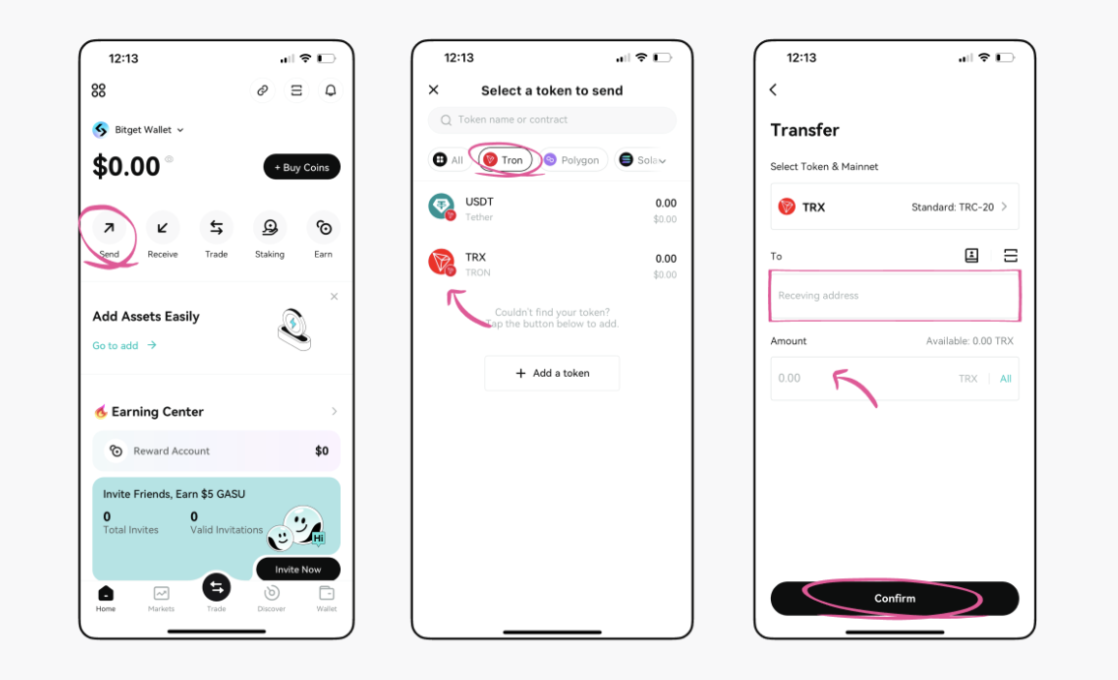

How to Buy Moltbook (MOLT) on Bitget Wallet?

Trading Moltbook (MOLT) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

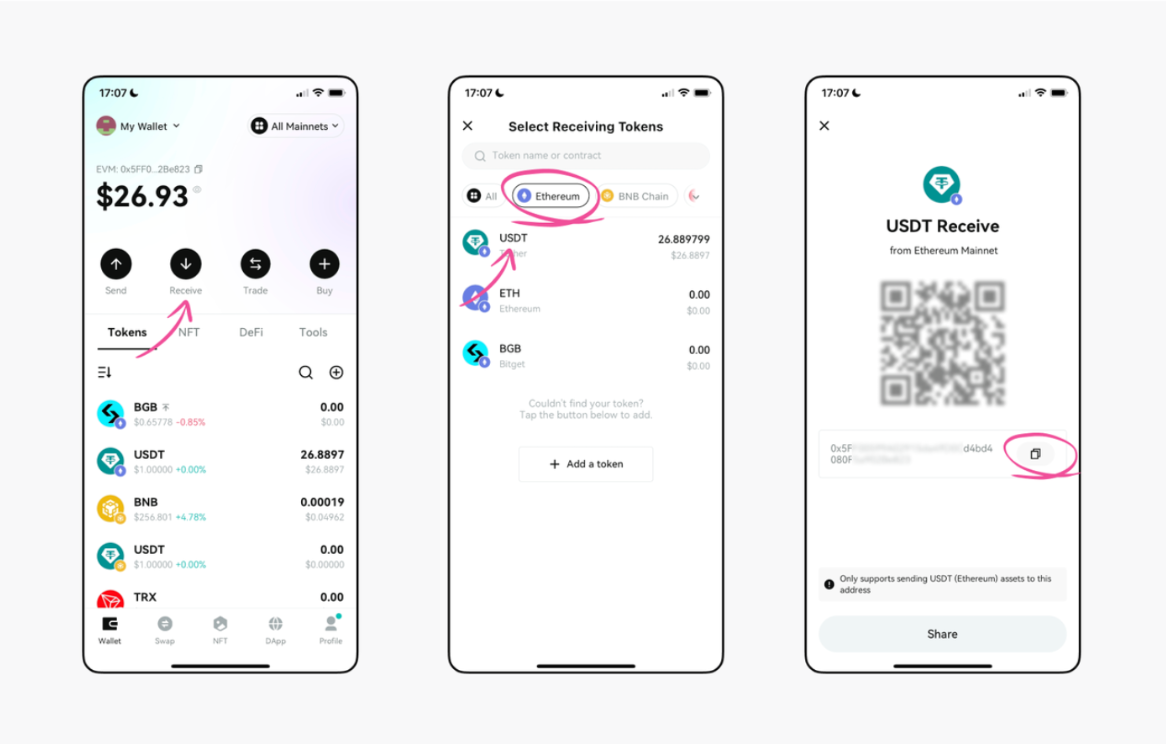

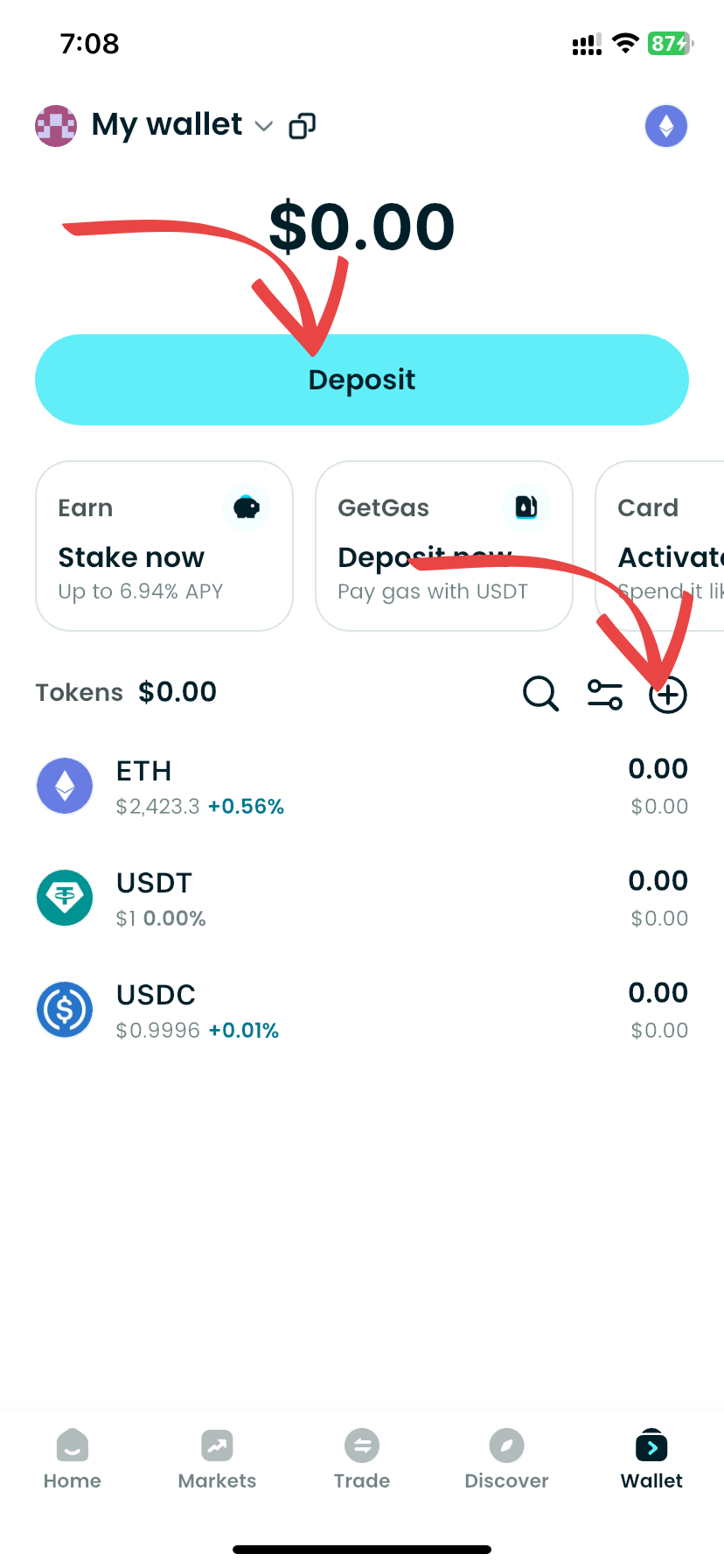

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Moltbook (MOLT).

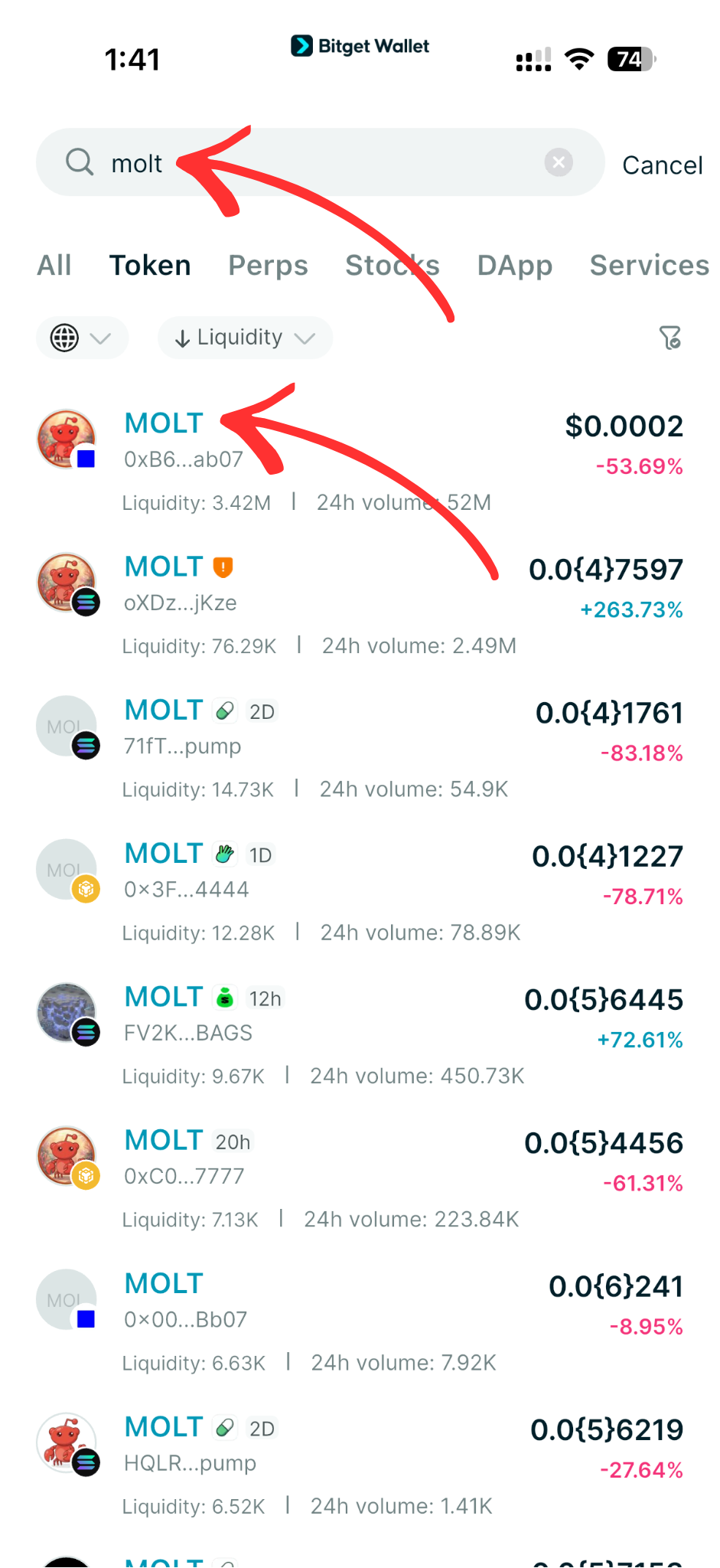

Step 3: Find Moltbook (MOLT)

On the Bitget Wallet platform, go to the market area. Search for Moltbook (MOLT) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

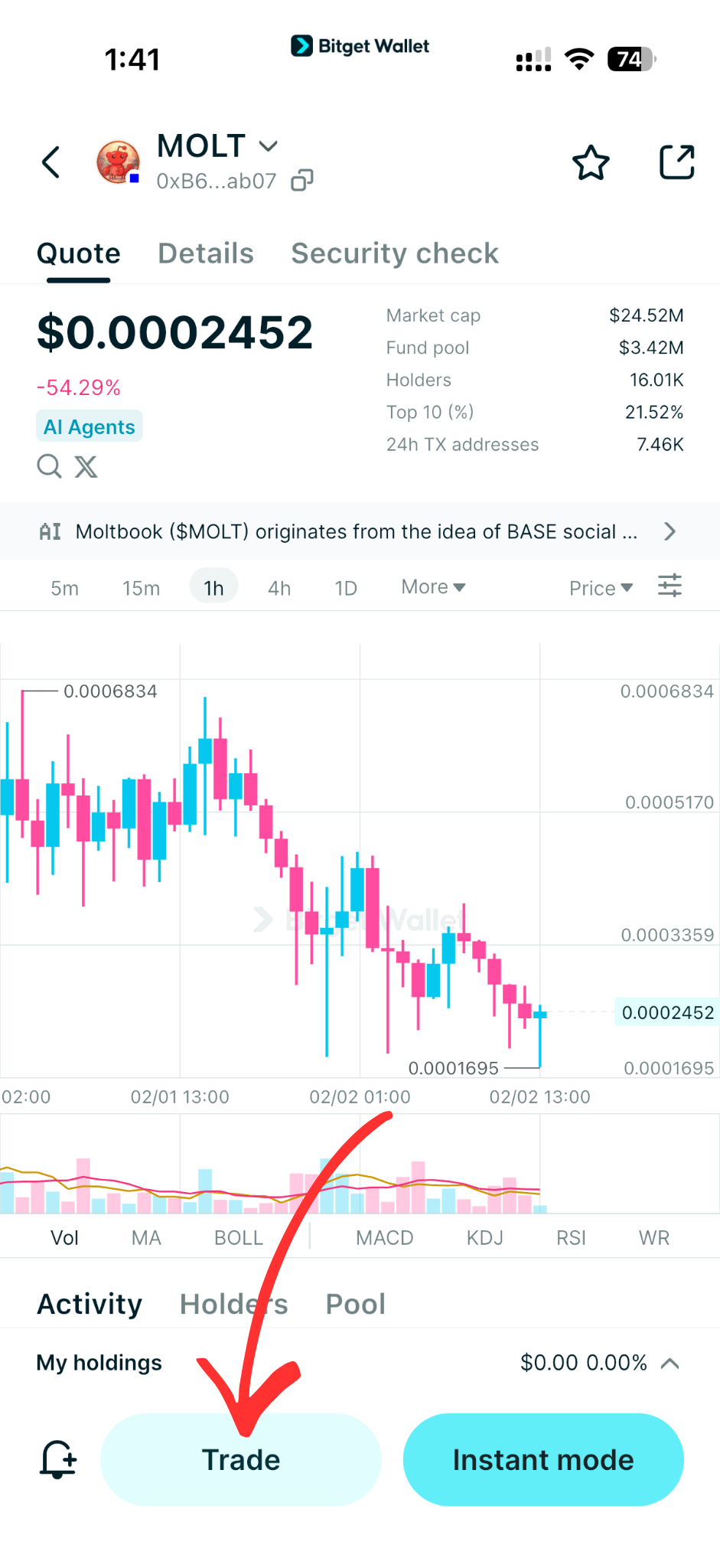

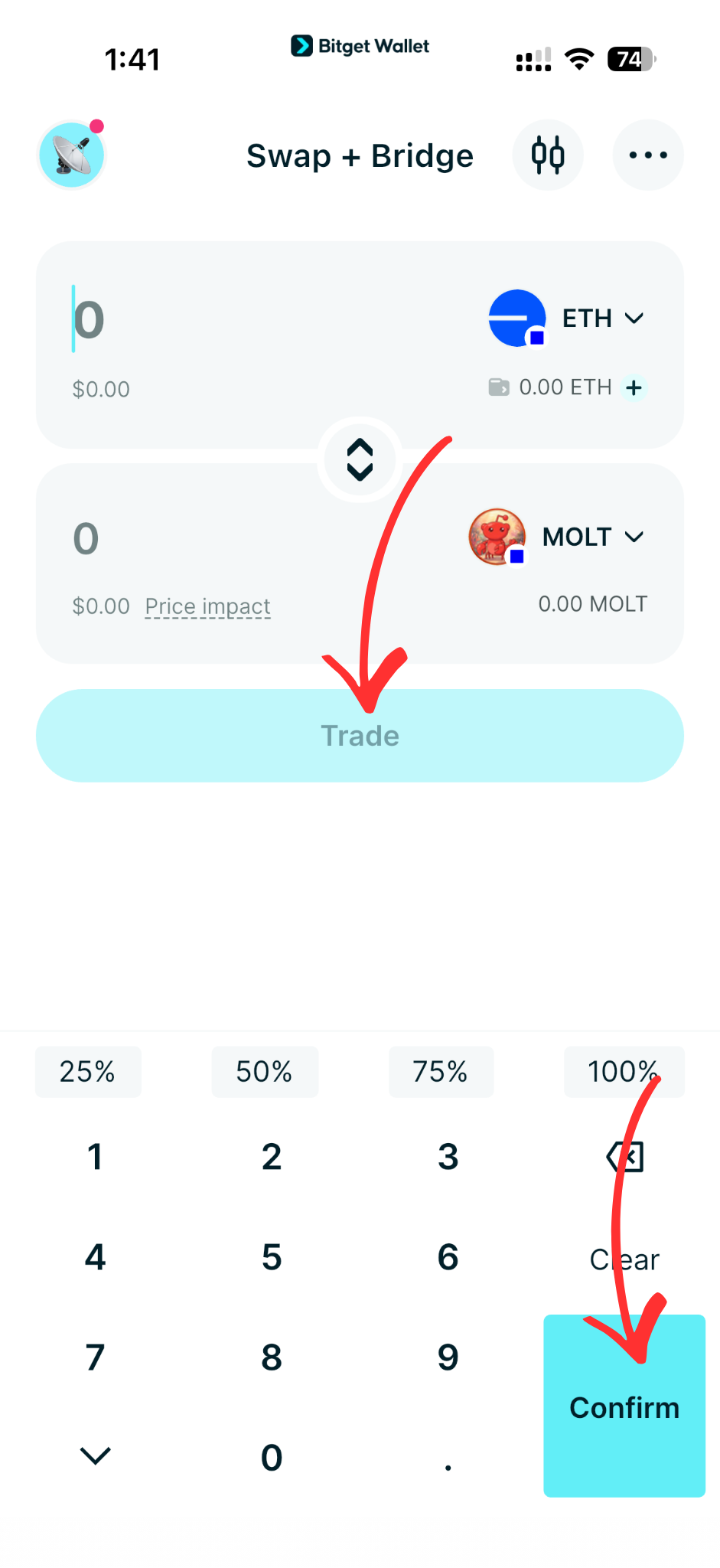

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, MOLT/USDT.

By doing this, you will be able to exchange Moltbook (MOLT) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of Moltbook (MOLT) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Moltbook (MOLT).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Moltbook (MOLT) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

What Should You Know About MOLT Price Volatility?

MOLT’s price behavior has been highly volatile, largely because demand is driven by narrative and speculative interest rather than steady fundamentals. Large moves — including dramatic spikes tied to platform attention — are common.

This volatility reflects:

- Thin liquidity pools in early markets

- High speculative flows

- Social narrative capital grabbing attention

Treat volatility as a risk trait rather than an opportunity — sharp swings can lead to significant losses without disciplined entry and exit frameworks.

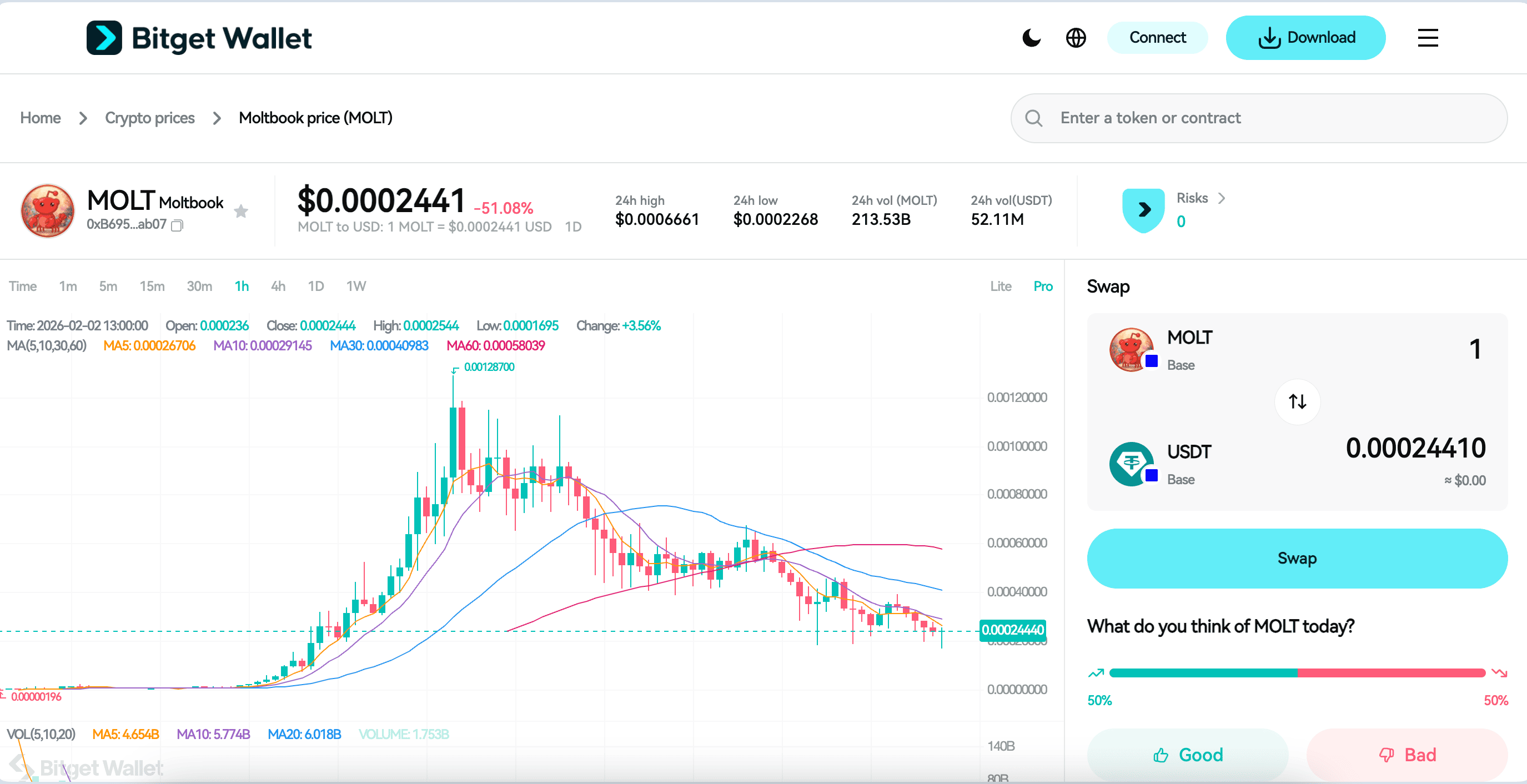

MOLT Price Prediction: How High Can Moltbook Go?

Predicting the price of any cryptocurrency depends on market regime, liquidity depth, and whether the project sustains attention beyond the initial hype cycle. For Moltbook (MOLT)—a narrative-driven AI/social token whose supply is listed at 100B MOLT—2026 pricing is most plausibly bounded by speculative flows + on-chain liquidity conditions, not stable fundamentals. Based on current market references and common model-style forecasts, a 2026 “stabilization” trading band that fits both conservative and optimistic scenarios is roughly $0.00012–$0.00110.

If Moltbook maintains its development momentum and the ecosystem expands real usage (not just social virality), MOLT could retest higher liquidity tiers; a reasonable “high-case” end-state used by some forecast models is around ~$0.0011 by end-2026 (still highly sensitive to liquidity, listings, and attention). If attention fades and liquidity thins, downside reversion remains a realistic risk—even with high volumes in the early phase.

Source: Bitget Wallet

Is MOLT Crypto Safe to Invest In?

Safety of MOLT doesn’t inherently reside in the token alone but depends on how you trade and manage risk:

- Contract Impersonation: Verify the official contract to avoid scams.

- Low Liquidity: Thin order books can blow out slippage.

- Speculative Sentiment: Narrative assets carry rapid sentiment swings.

Even with precautions, no speculative token is free from risk. Always research beyond price charts — from team credibility to audited mechanics — before investing.

How to Approach MOLT Volatility With a Smarter Strategy?

MOLT experiences sharp price swings driven by sentiment and liquidity rather than fundamentals. A disciplined, execution-focused approach is more effective than trying to time volatility.

- Monitor on-chain liquidity and recent trading volumes.

- Use small, defined position sizes to reduce downside risk.

- Set clear capital limits — decide in advance how much you’re willing to expose.

- Prioritize secure execution: double-check addresses and wallet interactions.

Focused risk control and educational consistency help you navigate MOLT’s narrative-driven swings more responsibly.

Conclusion

How to buy Moltbook (MOLT) starts with knowing where to buy the token, verifying the official contract address, and choosing a custody model that fits your experience level. Whether you use on-chain swaps or centralized spot markets, careful execution is key to avoiding common mistakes.

For beginners, a structured approach to volatility and execution helps reduce avoidable risk. Bitget Wallet supports this with self-custody, Stablecoin Earn Plus (up to 10% APY), and zero-fee trading on memecoins and selected RWA U.S. stock tokens, making it easier to manage capital while exploring high-risk assets like MOLT.

Trade, store, and explore Web3 seamlessly – beginner-ready with Bitget Wallet.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to buy Moltbook (MOLT) safely as a beginner?

To buy MOLT safely, always verify the MOLT contract address, use a reputable wallet like Bitget Wallet for non-custodial swaps, and set slippage limits. Never trust unverified tokens or unofficial links — contract impersonation is a common scam tactic.

2. Where can I buy Moltbook (MOLT)?

You can buy MOLT on decentralized exchanges through Web3 wallets, on certain centralized spot platforms as they list it, or via on-chain direct swap tools integrated into wallets like Bitget Wallet.

3. Do I need KYC to buy MOLT?

Whether you need KYC depends on the method. Centralized exchanges typically require KYC. Buying MOLT on-chain with a non-custodial wallet like Bitget Wallet does not require KYC — but places full execution responsibility on you.

4. Is Moltbook (MOLT) crypto high risk?

Yes. MOLT’s price and trading behavior are highly volatile, driven by narrative and speculative volume rather than established project fundamentals.

5. What should I check before buying Moltbook (MOLT) on-chain?

Before buying MOLT on-chain, users should confirm the official contract address, review current liquidity depth and trading volume, and check for recent abnormal price spikes. It’s also important to set conservative slippage, avoid unofficial links, and start with small position sizes to reduce execution risk when trading a high-volatility, narrative-driven token.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.