How to Buy BlockDag in 2026: A Beginner’s Step-by-Step Guide to BDAG Token

How to Buy BlockDag in 2026 is a common question among beginners exploring newer blockchain infrastructure projects. BlockDAG is a standalone Layer-1 blockchain built using a hybrid Proof-of-Work (PoW) and Directed Acyclic Graph (DAG) architecture, designed to improve transaction throughput and scalability. Because of its independent network design, buying BDAG does not follow the same process used for simple token swaps on general-purpose networks and is instead accessed through official BlockDAG distribution channels. For asset management, Bitget Wallet provides secure stablecoin storage, hot memecoin trading, and a seamless cross-chain experience.

You don’t need advanced trading skills to get started with BlockDAG, but it is important to understand where BDAG is officially distributed, how payments are processed, and how to avoid common beginner mistakes. Following a clear, step-by-step process helps reduce risk and uncertainty. In this guide, we explain how to buy BDAG safely and efficiently in 2026, even for users who are new to cryptocurrency.

Key Takeaways

- BlockDAG (BDAG) is a Layer-1 blockchain project with its own network, not a token built on another chain.

- Beginners can acquire BDAG in 2026 through official sales, mining programs, or supported centralized exchanges, depending on availability.

- Verifying official sources, understanding distribution terms, and following basic security practices is essential to buying BlockDAG (BDAG) safely and confidently.

What Is BlockDAG (BDAG)?

BlockDAG (BDAG) is a Layer-1 blockchain that combines Directed Acyclic Graph (DAG) structures with Proof-of-Work (PoW) consensus. Unlike traditional blockchains that process transactions in a strict linear order, BlockDAG is designed to allow parallel transaction processing, improving efficiency under network load.

BDAG is the native token of the BlockDAG network, intended for transaction fees, mining rewards, and ecosystem participation. The project positions itself as infrastructure-focused, with long-term value tied to network adoption and technical execution rather than short-term speculation.

What makes BlockDAG (BDAG) different from basic or narrative-driven tokens?

BlockDAG (BDAG) is designed as an infrastructure-focused asset rather than a token driven primarily by short-term narratives or market attention. Its differentiation comes from how the network is built, how value is created, and how the token is accessed.

-

Technology-driven design:

BlockDAG focuses on scalability and throughput through its DAG-based architecture, aiming to solve performance bottlenecks found in conventional blockchains.

-

Value drivers:

BDAG’s value is influenced by development progress, network stability, mining participation, and ecosystem growth rather than short-term attention cycles.

-

Access model:

BDAG is distributed through official BlockDAG channels, such as presales, mining initiatives, or centralized exchanges when listings are formally announced.

Source: X

Is BlockDAG (BDAG) a scam or just high-risk?

BlockDAG is not automatically a scam, but it should be treated as a high-risk, early-stage blockchain project. As with many developing Layer-1 networks, risks include delayed milestones, evolving token economics, limited transparency during early phases, and market volatility.

What users should do to reduce risk:

Before buying BDAG, users should confirm they are interacting only with official BlockDAG websites, wallets, and sale portals. Fake sites, impersonator accounts, and misleading promotions are common risks in early-stage projects. Always double-check URLs, payment instructions, announcements, and any published BDAG contract address through verified official channels before proceeding.

Latest market signals:

As of 2026, BlockDAG is actively tracked within the crypto infrastructure space and remains in a speculative but legitimate development phase, meaning careful due diligence is essential before participating.

Where to Buy BlockDag (BDAG)?

When users search for how to buy BDAG, they are usually looking for the safest and most direct way to access BlockDAG during its current distribution phase.

In 2026, BDAG is primarily obtained through official BlockDAG sales or mining programs, with centralized exchange listings appearing only when formally announced. Users should not assume continuous exchange liquidity or instant tradability.

Pricing, purchase limits, vesting schedules, and withdrawal rules may vary between phases. Always review the latest official terms before committing funds, and avoid assumptions about future listings or guaranteed liquidity.

Comparison of BDAG Buying Methods

| Buying Method | Custody Model | Execution | Control | Recommended For | Main Risks |

| On-chain Swap (DEX via Wallet) | Non-custodial | User-controlled,on-chain | High | Self-custody, DeFi users | • Contract impersonation • Price slippage • Gas fee volatility |

| On-chain UEX (via Exchange) | Custodial | Platform-managed, on-chain | Medium | Users who want on-chain exposure without wallet management | • Custodial exposure • Withdrawal limits • Platform dependency |

| Centralized exchange (CEX) | Custodial | Platform-managed | Low | Beginners, high-liquidity traders, fiat on-ramps | • Custodial risk • Withdrawal delays • Regional or national regulatory restrictions |

Why Many Users Buy BDAG With Bitget Wallet?

For users evaluating the best wallet to buy BDAG, a non-custodial solution is often preferred, as it allows users to maintain full control of assets while interacting with supported BlockDAG access points. Bitget Wallet also supports cross-chain access and helps reduce common beginner mistakes like interacting with impersonation tokens.

What Bitget Wallet Helps With?

✅ Self-custody and asset control Users retain full ownership of private keys and funds, reducing exposure to custodial and platform-related risks.

✅ On-chain swaps with transparent execution Explore over 1M tokens with real-time in-app rankings—discover trending assets early and stay ahead of the market.

✅ Multi-chain access with cost-efficient execution Bitget Wallet supports 130+ blockchains, including 7 major networks such as Solana, Base, Arbitrum, Polygon, Tron, and more. This allows users to buy, hold, and manage BDAG across different ecosystems without being locked into a single chain environment.

On supported networks, users can also benefit from gas-free transactions or long-term gas discounts, helping reduce execution costs when swapping, transferring, or managing assets across chains—an advantage for users who trade frequently or operate across multiple ecosystems.

✅ Flexible post-purchase asset management After buying BDAG, users can hold, transfer, or manage assets freely across supported chains without withdrawal limits or third-party restrictions, making it easier to adapt to changing liquidity or market conditions.

How to Buy BlockDag (BDAG) on Bitget Wallet?

Trading BlockDAG (BDAG) is easy on Bitget Wallet. Follow these simple steps to get started:

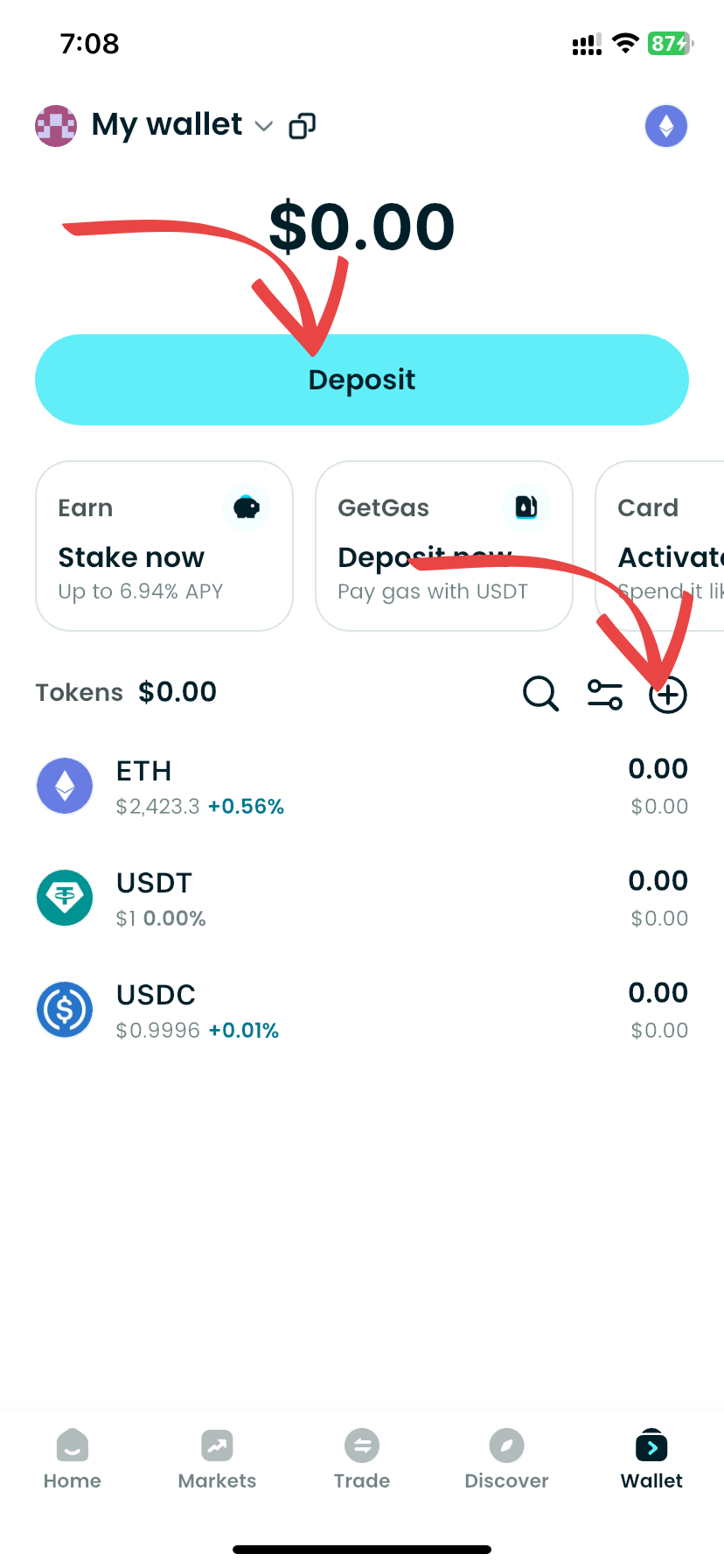

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading BlockDAG (BDAG).

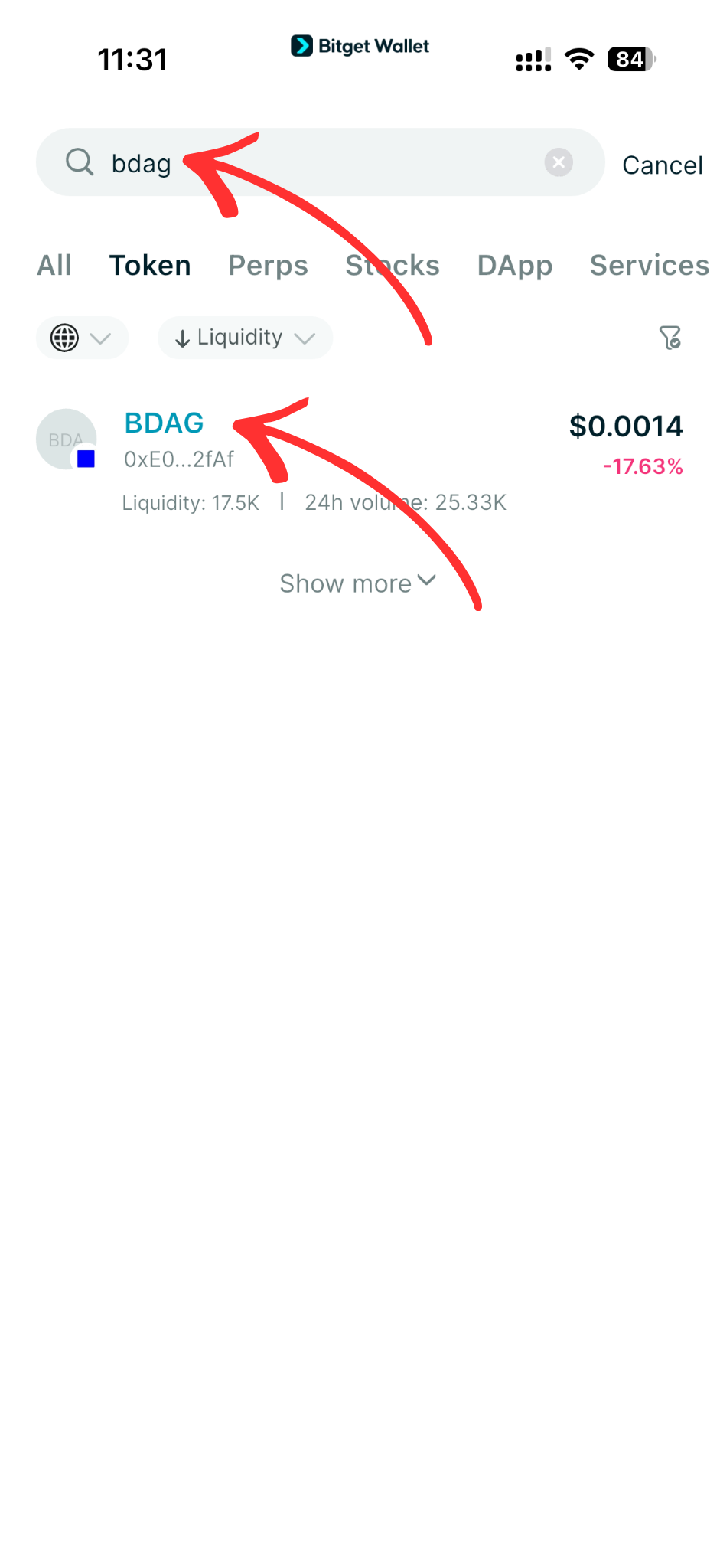

Step 3: Find BlockDAG (BDAG)

On the Bitget Wallet platform, go to the market area. Search for BlockDAG (BDAG) using the search function. Click on the token to access its trading page.

If the token is newly trending or liquidity is moving fast, always verify the latest official contract address on the exact swap page you’re using before trading.

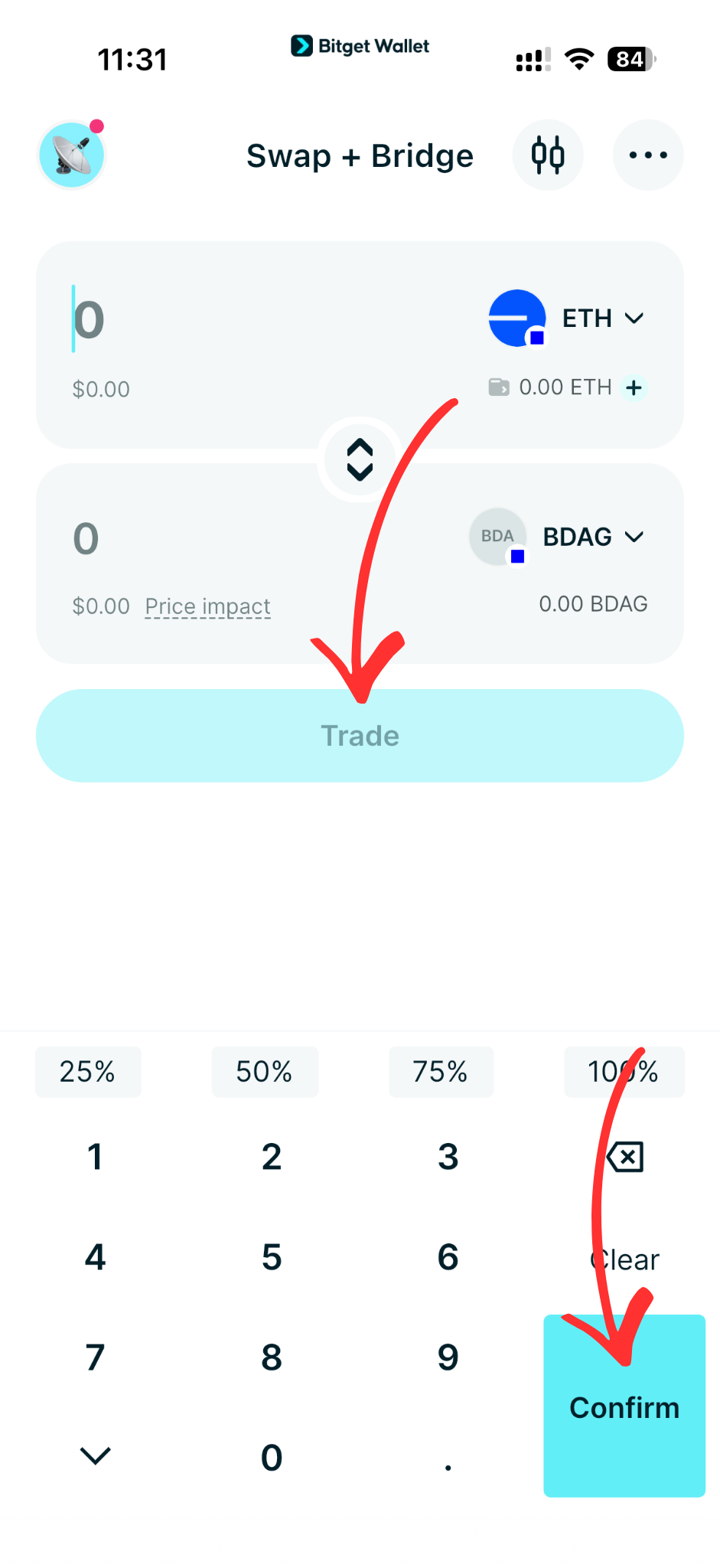

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, BDAG/USDT.

By doing this, you will be able to exchange BlockDAG (BDAG) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of BlockDAG (BDAG) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased BlockDAG (BDAG).

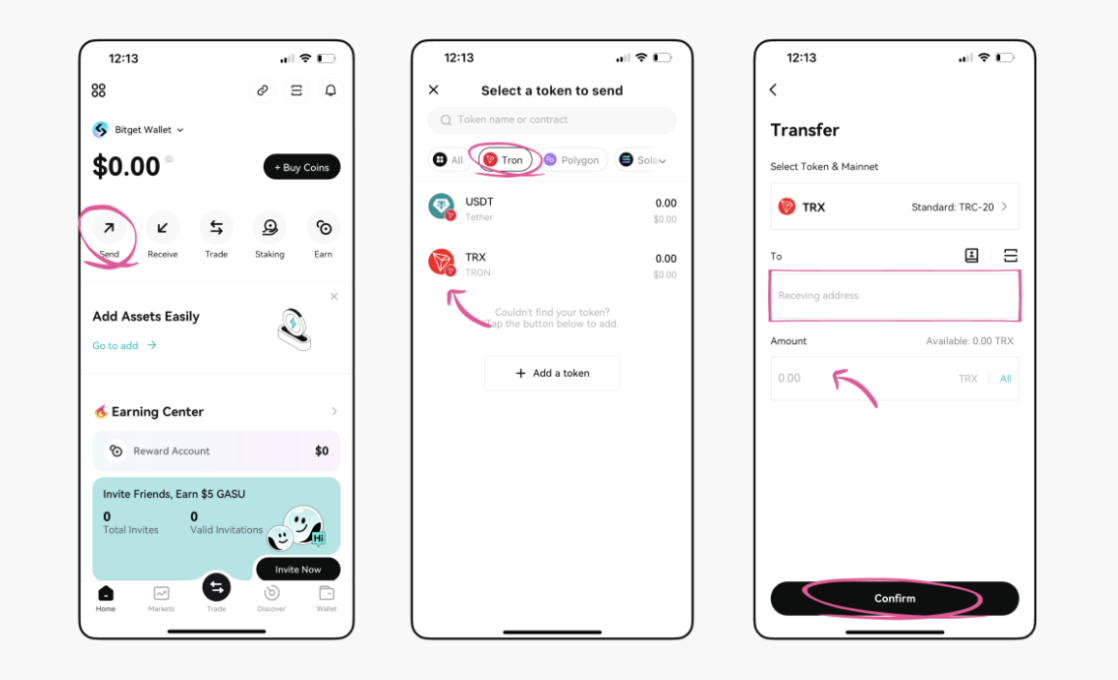

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your BlockDAG (BDAG) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

What Should You Know About BDAG Price Volatility?

BDAG is the native token of a standalone Layer-1 blockchain, and its price volatility is primarily influenced by market sentiment, distribution mechanics, and development-stage expectations, rather than protocol revenue or mature network demand. Changes in attention, fundraising phases, or perceived progress can lead to rapid price movements.

Volatility behavior:

BDAG can experience sharp price fluctuations because the network is still in an early-stage development phase. Price behavior is often reactive—driven by roadmap updates, mining participation, ecosystem announcements, and broader market sentiment. When expectations rise or confidence weakens, price movements may be amplified in either direction.

Distribution and sentiment factors:

Token distribution plays a major role in BDAG’s volatility. Presale rounds, mining emissions, vesting schedules, and exchange availability can all influence short-term price behavior. Uneven token release or limited market liquidity after listings may magnify price swings. For this reason, volatility should be treated as a core risk characteristic of BlockDAG, not as a guaranteed opportunity, and users should factor this behavior into their risk management decisions.

BDAG Price Prediction: How High Can BlockDAG Go?

Predicting the price of any cryptocurrency—especially an early-stage Layer-1 project—depends largely on market conditions, execution progress, and investor confidence rather than traditional valuation models. BlockDAG does not yet have long-term usage metrics or revenue flows to anchor valuation, which means price behavior can be unstable and expectation-driven.

If BlockDAG continues to deliver on development milestones and maintains market interest, BDAG’s price may remain variable within a wide, sentiment-driven range typical of emerging infrastructure projects. Any potential upside or downside is more likely to be influenced by roadmap execution, token release dynamics, and market conditions rather than established adoption. As such, volatility should be viewed strictly as a risk characteristic, not a forecasted outcome.

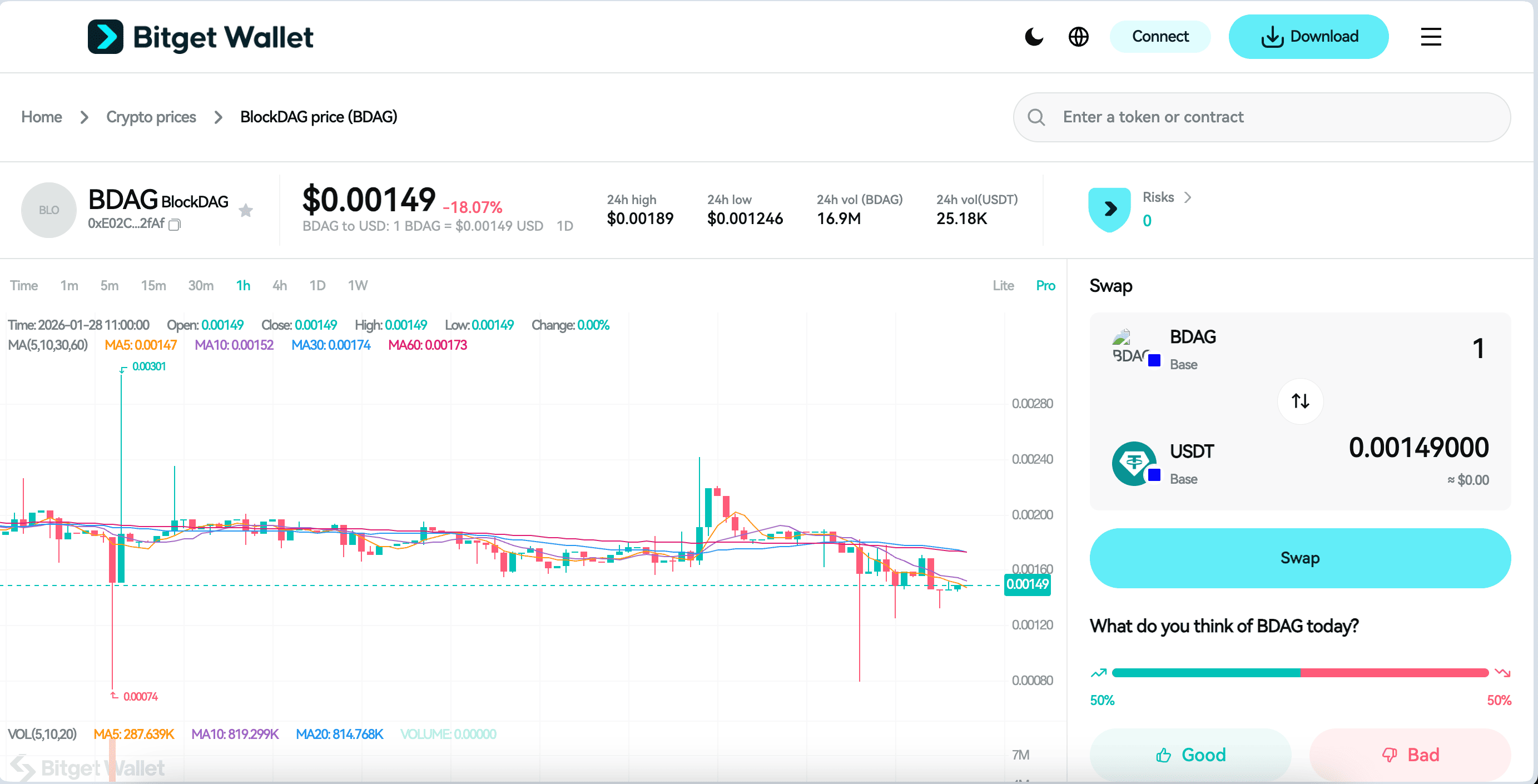

Source: Bitget Wallet

Is BDAG Crypto Safe to Invest In?

Whether BDAG is “safe” to invest in depends largely on how users manage risk and verify information, rather than on the token alone. As a developing Layer-1 project, BDAG carries structural risks common to early-stage blockchain networks, making due diligence and position sizing critical.

Key risks to be aware of:

-

Impersonation or fake sale pages:

Look-alike websites or unofficial presale portals may appear. Interacting with non-official sources can lead to irreversible losses.

-

Token release and vesting risk:

Presale allocations, mining rewards, or vesting schedules may affect circulating supply and price behavior.

-

Liquidity uncertainty:

Early exchange listings may have limited liquidity, increasing slippage and exit risk during volatile periods.

-

Execution and delivery risk:

As with any developing blockchain, delays or changes to the roadmap can impact market confidence.

No early-stage crypto project—including BlockDAG—is risk-free. Users should proceed cautiously, apply disciplined risk management, and only allocate capital they can afford to lose.

How to Approach BlockDag (BDAG) Volatility With a Smarter Strategy?

With volatile early-stage assets like BDAG, discipline matters more than timing. A smarter approach focuses on minimizing avoidable mistakes, controlling exposure, and maintaining realistic expectations—rather than reacting to short-term price movement.

Practical principles to follow:

-

Track distribution mechanics:

Understand presale stages, mining emissions, and vesting schedules before committing capital.

-

Use conservative position sizing:

Keep allocations modest to reduce the impact of unexpected price swings.

-

Set predefined risk limits:

Decide upfront how much capital you are willing to risk and avoid emotional adjustments.

-

Rely on verified sources only:

Follow official BlockDAG announcements and avoid unsolicited messages or unofficial links.

Approaching BlockDAG with an education-first mindset helps turn volatility into a structured learning process, strengthening long-term decision-making and risk control.

Conclusion

Buying BDAG starts with understanding that it is a high-risk, early-stage Layer-1 blockchain project, not a mature protocol or guaranteed long-term investment. Successful participation depends on careful verification, disciplined capital management, and realistic expectations—especially in development-driven markets.

Use reputable, non-custodial wallets and interact only with official BlockDAG channels when acquiring or managing BDAG. Maintaining full control of your assets and understanding token mechanics is essential when engaging with emerging blockchain projects.

Unlock cross-chain DeFi and stablecoin savings easily in Bitget Wallet.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to buy BlockDag (BDAG) safely as a beginner?

Beginners should interact only with official BlockDag (BDAG) sale platforms or announced exchanges, verify URLs carefully, and start with small allocations. Avoid unsolicited links and confirm all payment instructions through verified channels.

2. Where can I buy BlockDag (BDAG)?

BlockDag (BDAG) is primarily distributed through official BlockDAG sales, mining programs, or supported centralized exchanges when listings are announced. Availability depends on the project’s current distribution phase.

3. Do I need KYC to buy BDAG?

Whether KYC is required depends on the purchase method. Centralized exchanges (CEXs) typically require KYC, as users trade through custodial accounts managed by the platform.

In contrast, buying BDAG through on-chain swaps using a non-custodial wallet like Bitget Wallet does not require KYC. Users interact directly with decentralized liquidity from their own wallet, without submitting identity information. However, this also means users are fully responsible for security, contract verification, and transaction execution.

4. Is BlockDag (BDAG) high risk?

Yes. BlockDag (BDAG) should be considered a high-risk asset due to its early-stage status, evolving token distribution, and reliance on future execution and adoption.

5. What should I check before buying BlockDAG (BDAG)?

Before buying, confirm you are using official BlockDAG channels, understand token release mechanics, review any vesting or lock-up terms, and define your maximum risk exposure in advance.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Fabric Airdrop Guide: How to Participate and Claim $ROBO Rewards2026-03-03 | 5mins

- Can I Buy World Cup Ticket with Cryptocurrencies?2026-03-02 | 5mins

- How to Buy CHZ in 2026: A Beginner’s Step-by-Step Guide to Chiliz2026-03-02 | 5mins